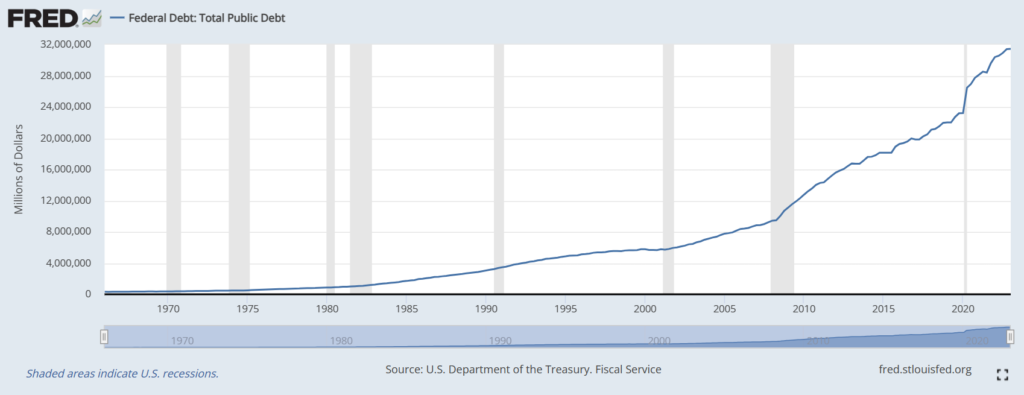

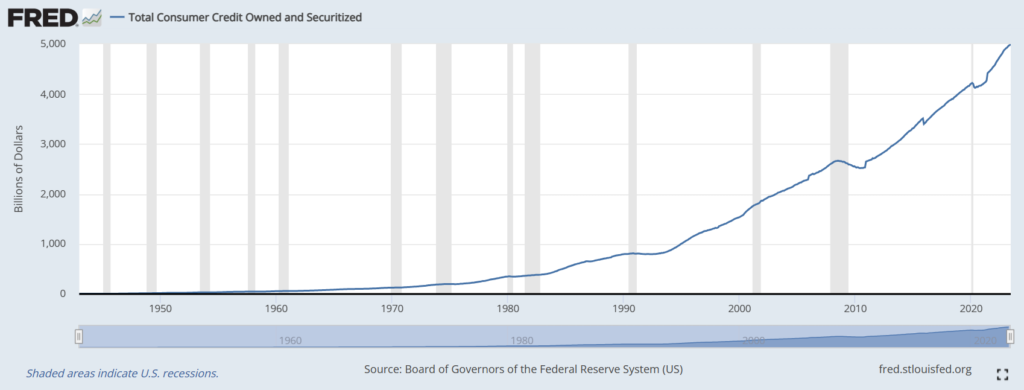

Debt is at all-time highs This probably isn’t news to you. The media has been talking about this for years. And recently, it’s getting even more coverage. And when you look at the amount of debt in the US economy, the total numbers are staggering. Take a look at the following charts from the St. Louis Federal Reserve. These illustrate the total amount of US government debt (nearly $32 trillion!) and the total amount of consumer debt (nearly $5 trillion!).

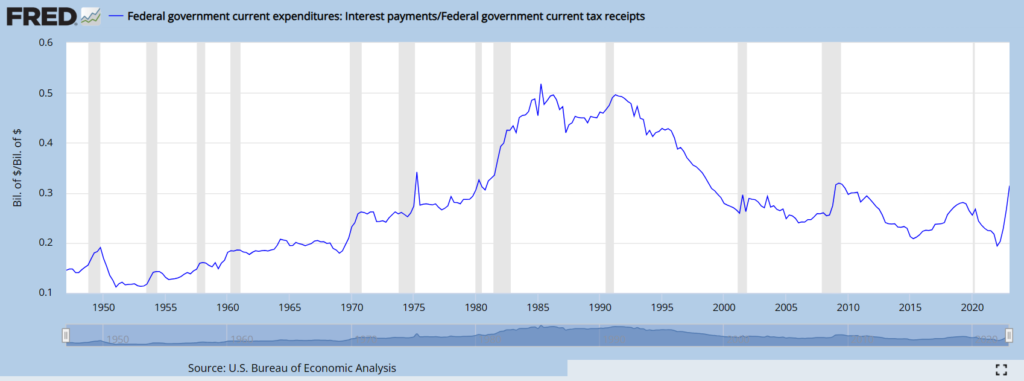

Total debt doesn’t really matter though As I learned a while back in my career, the amount of debt doesn’t matter as much as the ability to service the debt. Said differently, it doesn’t matter how much debt someone has if it’s easy for them to pay it off. The current narrative around the massive debt problem actually makes intuitive sense. Interest rates have risen significantly over the past year. So, the pundits claim that higher interest rates are going to make it much more expensive to pay off debt. This is true, but only on new debt. Previous debt — for the most part — was issued at lower interest rates that are fixed. As long as we don’t have massive defaults — inability to make payments — debt poses very little economic risk. Can the Federal Government service their debt? The best way to determine if the government can service their debt is by looking at the amount of interest they are required to pay on that debt. And compare this to the amount of tax revenue they receive. As you can see in the following chart, this ratio is actually much lower than it was during the 1980’s and 1990’s. And if you recall, in the 80’s and 90’s, the United States enjoyed the best economy and stock market most of us have ever seen. So, yes, I’d say the US government should be able to service their debt without much problem.

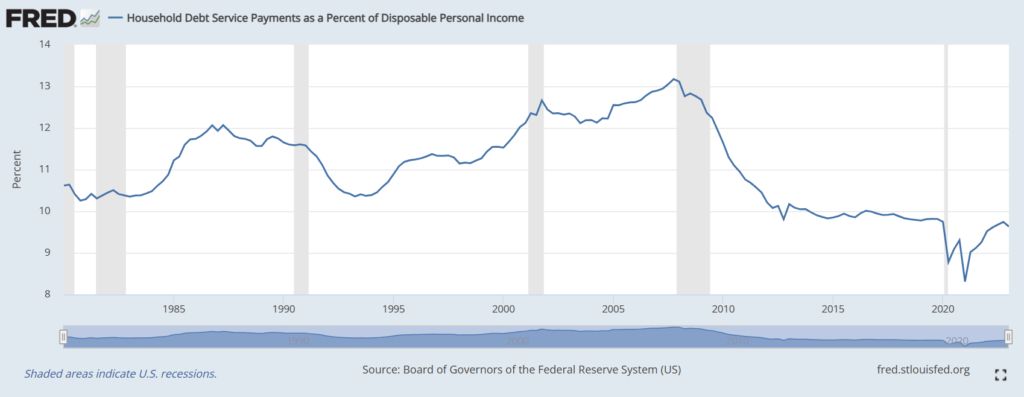

Can US consumers service their debt? The best way to determine if consumers can service their debt is to look at the amount debt payments they are required to make. And compare this to the amount of disposable income they have. As you can see in the following chart, this ratio is at historic lows. Just like federal debt, it is much lower than it was during the booming 80’s and 90’s. But more importantly, it is not even in the same ballpark as where it was prior to the 2008-2009 Great Financial Crisis. So the next time someone tells you our consumer debt problem will lead to another financial crisis, show them this chart!

Bottom Line Debt is not inherently bad. It is a tool. And when used properly, it can be an amazing tool to create value and build wealth. The US government and consumer look like they are both in solid shape to use this powerful tool in the way it was intended. And, as always, when things turn out better than feared, the stock market usually goes up. Keep calm. Own assets that are likely to go up over time. And build wealth so you can buy your freedom.