Our obsession with past performance

I’m not sure there’s an industry that’s been tainted by deception and fraud as much as the investment industry has.

And because of this, we as a society have become obsessed with past performance. If an investment manager has a good track record, we tend to view this as a sign of expertise and trustworthiness.

Think about it for a second. If I asked you to choose between two investment managers. One of them had a return of 30% last year and the other one only had a return of 10%. Which one would you think is more competent?

The 10% manager could have a very good reason why his or her strategy underperformed. In fact, it might even be an expected part of the long-term strategy.

Doesn’t matter. Fraudsters tell stories. We want data!

And the investment industry has put a lot of money and resources into exploiting this human tendency. Because doing so leads to a lot of revenue for a lot of companies.

Investment fund companies all compete for awards from the likes of ratings firms like Lipper and Morningstar.

You may be familiar with the phrase “compared to its Lipper average” — which has been repeated ad nauseum in television commercials. Or you may be familiar with the coveted 5-Star Morningstar rating.

But there’s a big problem baked into this performance obsession.

Past performance is not indicative of future results

Speaking of phrases that you’ve probably heard ad nauseum! This one takes the cake.

And for good reason.

If the investment industry is going to sell performance as hard as they do, they have to have an out. Because all too often, things don’t turn out the way investors expected them to.

And they don’t want to lose all their profits to a bunch of lawsuits.

There have been many studies done to find out if — and to what extent — a high fund rating is predictive of good future returns. And most of them conclude that these ratings should not be used to project future returns.

In this report from Vanguard, the authors found that “a given rating offers little information about expected future relative performance; in fact, our analysis reveals that higher-rated funds are no more likely to outperform a given benchmark than lower-rated funds.”

Personally, I’ve seen countless times in my career where someone buys a 5-star fund, only to see that drop to a 2 or 3-star fund in a few years.

And it’s not just mutual funds. This phenomenon extends to big, bad hedge fund managers too.

For example, in 2008-09, hedge fund manager John Paulsen became one of the brightest stars of the investment industry. He was hailed on Wall Street after he successfully predicted the subprime mortgage meltdown.

Since then, he has made several losing bets. His hedge fund and personal fortune steadily declined. And in 2020, he announced that he would be returning money to investors and converting his hedge fund to a family office.

As annoying as the phrase may be, it bears repeating: past performance is not indicative of future results. Don’t fall for it.

An intelligent long-term strategy is far more important

Investment performance is about what’s happened in the past. And building wealth is about preparing for the future.

Whether we’re talking about future earnings of a business or future returns of a strategy that invests in businesses, success hinges on an intelligent long-term strategy. One that is positioned to benefit from future trends.

And evolving this strategy over time, as needed.

To illustrate this, let’s look at the incredible growth trajectory of three businesses: Netflix, Amazon, and Tesla.

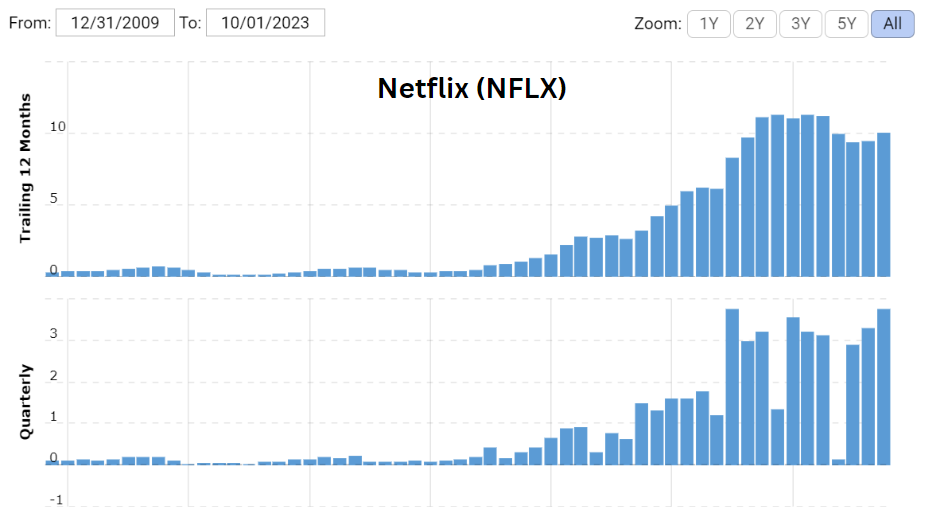

Below are three charts that show the earnings growth for each company, which are courtesy of macrotrends.net and can be found using the following links: Netflix | Amazon | Tesla. Clearly, the success of these businesses took a lot of patience and a lot of forward thinking.

As you can see, each of these businesses struggled to make money for a long time.

If you viewed these businesses the way the investment industry wants us to view funds, you’d have thought they were 1 or 2-star businesses. Certainly not a 5-star business that has a “track record” of making a lot of money.

And you’d have missed out on some incredible wealth-building opportunities.

Since 2010, Netflix stock price has increased around +7,000%, Amazon stock price has increased around +2,400%, and Tesla stock has increased around +14,900%.

Since 2015, Netflix stock price has increased around +1,000%, Amazon stock price has increased around +1,000%, and Tesla stock price has increased around +1,200%.

*performance data are estimates and calculating using data from finance.yahoo.com

Using thematic investing to capture future trends

Everybody wants to find the next Netflix, Amazon, or Tesla.

But very few people are able to do it. In order to have any confidence to invest early in companies like this, you would have to check a number of boxes.

First, you’d need to know each company’s business model inside-out. Additionally, you’d have to understand the leadership strategy and culture inside-out. And you’d also need a good understanding of the underlying economic trends that the businesses are designed to capitalize on.

Not even the best professional money managers can do all of these things consistently.

More often than not, when anyone — professional or amateur — hits it big on one of these stocks, it’s mostly luck.

And this is where thematic investing comes in.

This will be the topic of next week’s newsletter. And I will explain how I use thematic investing for myself and my clients.

But until then, here’s a little preview from the good folks over at Global X ETFs (an industry leader in thematic investing):

“It is a forward-looking investment approach that seeks to embrace the changes we anticipate happening in the world. When conducted properly, we believe thematic investing can help position a portfolio for an uncharted era of new technologies disrupting existing paradigms, demographics reshaping the needs of the world’s population, and shifting consumer behaviors forcing changes to existing business models.”