Changing of the Guard?

Historically, market leadership tends to change when we go through a bear market. This means the type of stocks that led the way before the bear market are not the stocks that lead the way after it.

And this transition often begins to accelerate as we enter into the early stages of a new bull market. As you know, I’ve been saying for a while now that I believe a new bull market has begun.

So, this week, I wanted to dig a little deeper and get a sense for what market leadership has looked like in the past versus what it looks like today.

Where We Have Been – Mega-Cap Tech Leadership

For over a decade – since the 2008 Financial Crisis all the way up until the current bear market – technology stocks have been the darlings of Wall Street. More specifically, “mega-cap” tech stocks. Mega-Cap means the largest companies in the market.

You may have heard of the “FAANG” stocks: Facebook, Apple, Amazon, Netflix, Google. And you can throw Microsoft in there, as well.

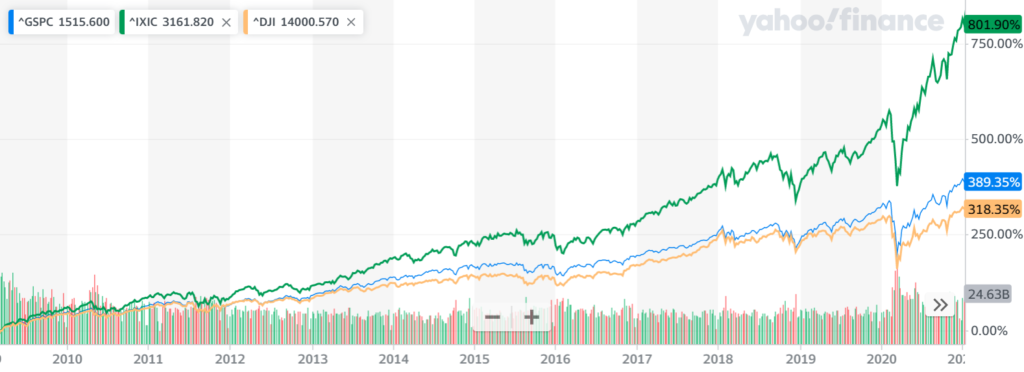

There were times over the past decade-plus where these stocks carried the entire US stock market. And – as is often the case – a rising tide tends to lift all boats. To see this, all we have to do is look at how the tech-heavy / mega-cap-heavy Nasdaq Index performed versus the broader US stock market indices.

The chart below illustrates this. The green line represents the Nasdaq index. The blue line represents the S&P 500 Index. And the orange line represents the Dow Jones Industrial Average. That is some pretty staggering outperformance.

Where we Are – Rotation away from Mega-Cap Tech

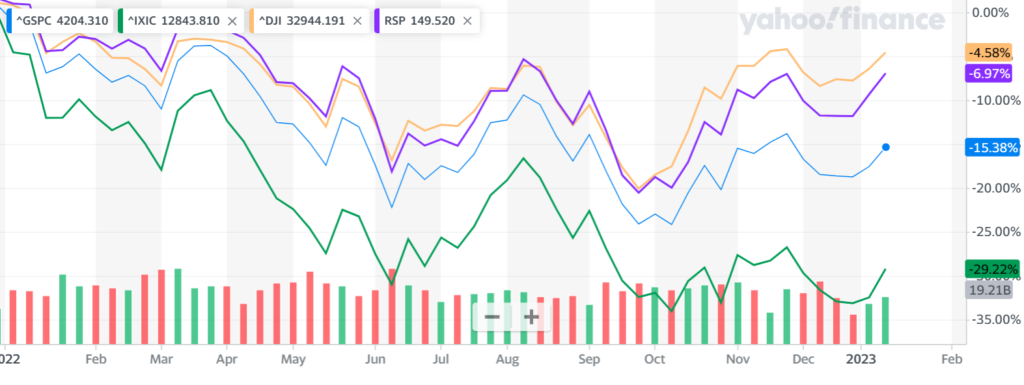

Since this bear market began about a year ago, we have seen a classic rotation away from the previous leaders. The chart below illustrates this.

The green line is once again the Nasdaq index. The blue line is the S&P 500. The orange line is the Dow Jones Industrial Average. And, with this chart I threw in an “equal-weight” S&P 500 index (purple line).

I included this equal-weight index because it gives better representation to smaller companies within the S&P 500. The standard S&P 500 is “market weighted” – which means the largest companies make up a larger percentage of the index. On the other hand, equal-weight means all 500 companies are equally represented. So you get equal exposure to the smallest out of those 500 stocks.

As you can see, that is some pretty significant underperformance for the tech-heavy / mega-cap-heavy Nasdaq index. Exactly the opposite of what we saw leading up to the bear market.

Where We Are Headed – Small Cap Leadership?

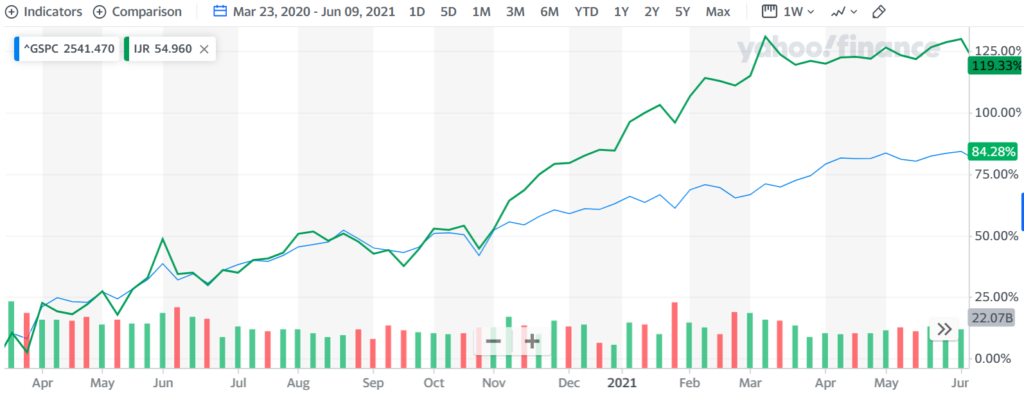

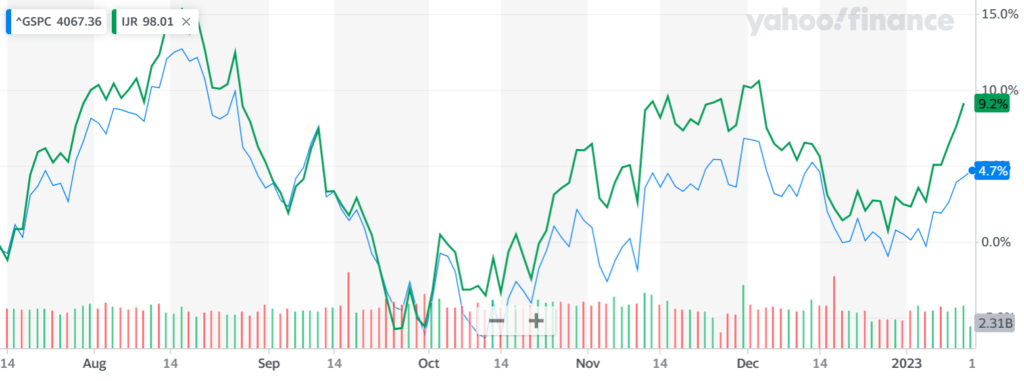

Ultimately, nobody knows for sure where we are headed. But I am keeping a close eye on small-cap stocks. These are smaller companies within the market. And historically, they have led the way during the early stages of a new bull market.

Sometimes it can last a long time. Sometimes it’s a little shorter-lived. But either way, their leadership has a tendency to mark the beginning of a good run for the overall stock market.

The following charts illustrate this for the last three bull markets:

- After the Covid market collapse

- After the 2008 financial crisis

- After the 2000 collapse of the “dot-com” bubble

In all three scenarios, the green line represents the S&P Small Cap index. While the blue line represents the S&P 500 index. As you can see, pretty significant and consistent outperformance for smaller companies.

So far, we have yet to see this fully materialize today. Although, it appears as though it may be starting. If this continues, it would be another sign to me that we are likely in a new bull market and more good returns lie ahead.

Too Long, Didn’t Read

We have seen a clear shift away from the market leaders prior to this bear market. This is a classic reversal that happens during bear markets and accelerate as new bull markets begin. We are also starting to see some outperformance by small-cap stocks, which typically lead new bull markets. I’ll be keeping a close eye on this as we move forward.

This should not be taken as advice. If I haven’t done any planning for you, I am not qualified to give you specific advice. Nor would you want to take advice from someone who doesn’t know anything about you.

Any forward-looking statements could be wrong. In fact, the majority of stock market forecasts end up being wrong. But, in my opinion, forecasts are useful because they help me have a better understanding of what is going on. Which helps me stick to my long-term investment plan. And this discipline should help me benefit from the long term compounding benefits of stocks over time.

It is important to have a comprehensive plan that accounts for all possible risks to any forecast. Please consult a trusted advisor that can help you make the right projections for your situation.

Learn more about my processes here: Free Guides