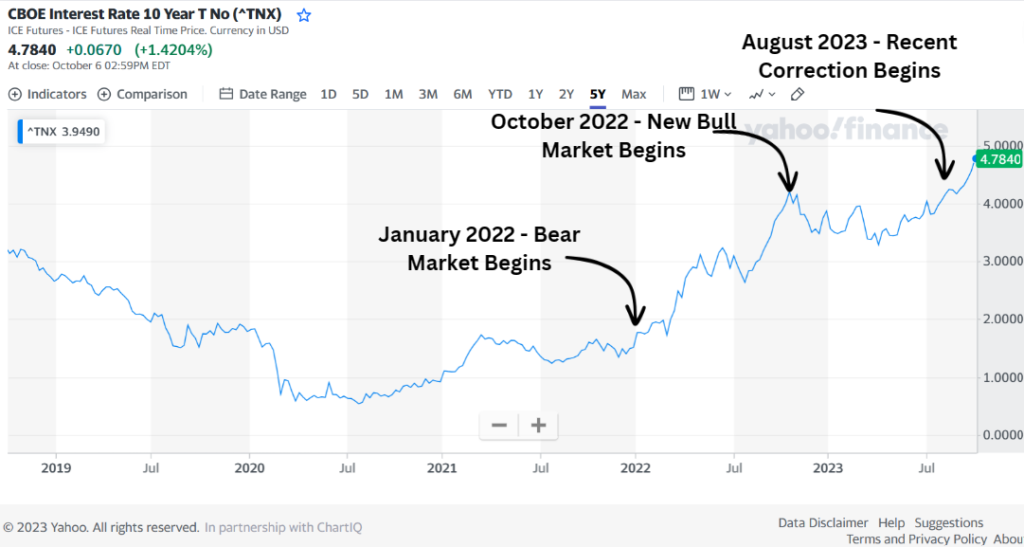

Hey there, friend. As I’ve said several times before, the best way to build wealth — and ultimately gain financial freedom — is to either own a business or own part of someone else’s business (own stocks). On that note, it’s time for another stock market update. As I talked about last week, the last couple months have been a rocky stretch for the market. And when this happens, it’s important to understand what’s going on. Not necessarily to make any changes to your investments. But more often, it simply helps us stay the course. When our investments fall and we don’t understand why, it breeds fear. Which can result in bad investment decisions. And there are mountains of research showing that most people make terrible investment decisions, thanks to emotions. On the other hand, when we have a full understanding of what’s happening, it breeds confidence. Which typically results in better investment decisions. That’s what I want for you. Higher interest rates have been the “boogeyman” for the past two years The decline in stocks that we’ve seen since the S&P 500 peaked on July 31 has been primarily driven by rising interest rates. In particular, the decline — and the accompanying media narrative — has centered around the rising rate on the 10-year Treasury Bond. The chart below shows us the “yield” (or interest rate) on the 10-year Treasury Bond. As you can see, there are three points I’ve highlighted: 1) January 2022 — The recent bear market (sustained decline in the stock market) began. This is when rates began accelerating significantly higher than pre-covid levels. 2) October 2022 — The new bull market (sustained climb in the stock market) began. This is when rates began falling / leveling off. 3) August 2023 — This represents the start of the current two-month decline we’ve seen in the stock market. As you can see, it coincides with rates breaking higher than the previous high that marked the start of the new bull market.

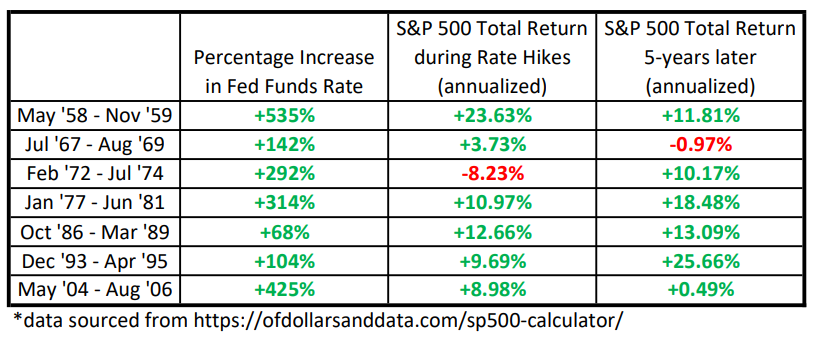

But higher interest rates are not inherently bad for the stock market On the surface, the fear of rising rates makes sense. Since the 2008-2009 Great Financial Crisis, the economy has become addicted to low interest rates. This once-in-a-lifetime event derailed the global economy. And over the next decade, economic growth was very low relative to long-term averages. So the Federal Reserve kept interest rates low. Low interest rates serve as a stimulus to the economy. Because low borrowing costs leads to more borrowing. More borrowing leads to more spending and investment. More spending and investment leads to economic growth. Additionally, very low interest rates on Treasuries and other bonds means more money flows into the stock market. Because this provides a much better return than 0% or 1% on bonds. Because of this, many believe the economy and stock market NEED low interest rates to keep climbing. But history shows this is absolutely not true. Let’s look at some examples. Below is a chart that shows the historical Fed Funds Rate. It clearly shows historical periods where the Fed was raising interest rates. And below this, is a table that details those periods, along with the correlating stock market returns.

How can this be? Well, it’s important to remember that the opposite of inflation is deflation. And deflation usually means the economy is in the crapper. So — often times — inflation just means we have a strong economy. And a strong economy means higher corporate earnings. And higher corporate earnings means higher stock prices. Maybe we are just getting back to a gold old fashioned stock market. Where strong economic growth matters more than interest rates. Furthermore, when you look at the stock market today, it has really been driven by a small handful of companies. The below graphic illustrates this. While the S&P is up solidly for the year, the EQUAL WEIGHT S&P has gone nowhere. Why is this important? Because equal weight shows the performance of all 500 stocks equally. While the standard S&P 500 is very heavily weighted to only the largest companies. And the largest companies — Big Tech companies listed below — by and large, have stronger balance sheets than most countries. They are sitting on mountains upon mountains of cash. Which means they don’t have to borrow. Which means higher interest rates are pretty much irrelevant to them. So, even if higher interest rates drag down the majority of companies in the S&P 500, these leaders will most likely continue driving overall stock market returns.