Santa Claus Rally?

There are some pretty funny adages that have been used by stock market traders over time. And one that seems to come up every year? The Santa Claus rally.

I always laugh when I hear this. I mean, how can Santa possibly deliver gifts to every little boy and girl in the world, while ALSO delivering good stock market returns?

But then, year after year, I always seem to be amazed that he does it! Jolly old Saint Nick simply defies logic. As all the greats do.

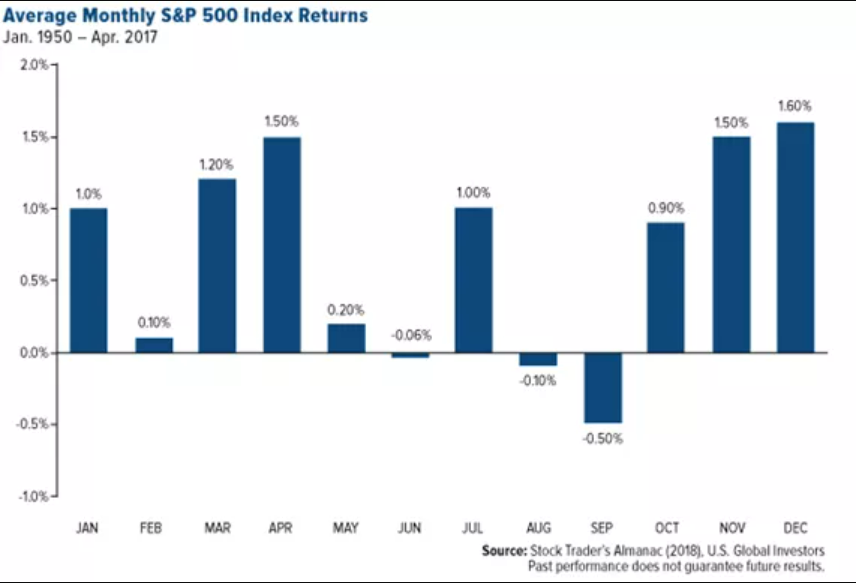

As you can see in the chart below, December has historically been the best month for stocks. And furthermore, the months leading up to December tend to be pretty good, as well.

Looks like the littles aren’t the only ones on their best behavior during the latter part of the year!

Whatever the case may be as to why the stock market tends to perform well this time of year….sure enough, it’s happening again this year. Let’s take a minute to review what’s been going on lately.

It’s been all about the Fed

As I’ve discussed previously, the bear market that occurred in 2022 was almost entirely due to sentiment around inflation and the Federal Reserve’s response to inflation, which is raising interest rates.

Let’s briefly recap how the Fed uses interest rates to fight inflation and influence the economy:

When inflation is high, the Fed raises interest rates in an effort to slow it down. The idea is that higher interest rates make it more expensive to borrow. And if it’s more expensive to borrow, consumers and businesses will spend less money. And if consumers and businesses spend less money, the economy will slow down. And if the economy slows down, demand for goods and services (and their prices) should fall.

This fear of a slowing economy created a perfect storm for a bear market in stocks. Companies were fearful of slowing revenues, so we’ve seen large swaths of layoffs across the workforce during the past year-plus.

This created lots of negative headlines around a looming recession. And the R-word always injects fear into the stock market. When stock investors are fearful, they tend to sell stocks more often than they buy them. And when selling outnumbers buying, stocks go down.

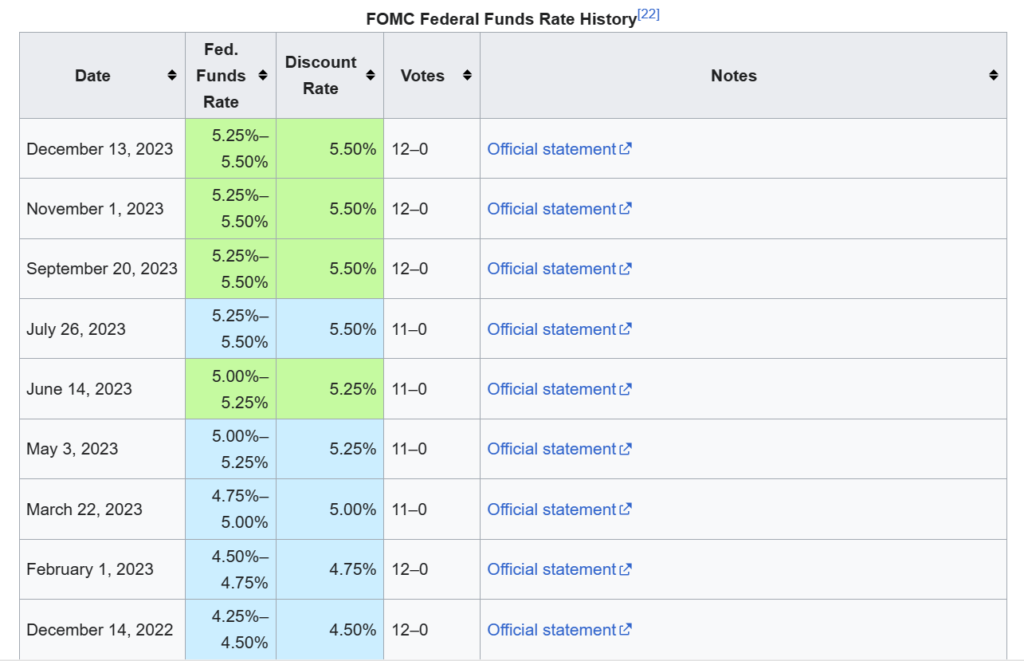

Now we’re seeing the flip side of this. The Fed has signaled to the market that they are done raising interest rates. As you can see in the chart below, they have now held steady in 4 out of their last 5 meetings.

And this week, in addition to their decision to hold steady on interest rates, Fed Chair Jerome Powell also indicated that they are anticipating three rate CUTS next year. And the stock market is loving this turnabout! This is what’s been driving the great returns we’ve seen recently.

But this is a delicate balancing act.

Because on one hand lower interest rates are good news for stocks. If investors are getting lower interest rates on things like bank accounts and bonds, it’s only natural that demand for stocks (and therefore, their prices) would increase.

On the other hand, when the Fed cuts interest rates, it signifies that economic growth isn’t that strong. Just like raising interest rates is a tool to fight inflation. Lowering interest rates is a tool to fight deflation (a slowing economy). So, is the Fed expecting an economic slowdown?

The short answer is yes. But…

A bit of a slowdown in the economy would be fine, as far as the stock market is concerned. As I’ve stated before, we don’t need a rip-roaring economy for the stock market to perform well. We simply need an economy that’s performing “as expected” or “better than expected.”

And even if the economy slowed down more than expected — now that interest rates are so much higher than they were a couple years ago — the Fed can cut rates even further. And just like raising interest rates slows down the economy, cutting them stimulates it.

So, with apologies to Santa Claus, this year-end stock market rally is courtesy of the Fed.

The secret to successful stock market investing

So, with all this being said, what’s the secret? Do we buy stocks toward the end of each year, so we can benefit from seasonal trends? Do we follow what the Fed is doing and make our decisions accordingly?

No. Not at all.

The secret to successful investing is simply disregarding everything I just talked about and having patience and discipline.

Because the truth is the stock market is a reflection of the economy and companies’ ability to grow their earnings. And humans are really smart. No matter what problems we’ve been faced with, we create solutions to those problems, businesses adapt, and the economy moves onward and upward.

As legendary stock market investor Ben Graham once said, “in the short-run, the stock market is a voting machine…but in the long-run it’s a weighing machine.”

In the short-term, investors hang onto every headline and trade with their emotions. That’s why the stock market is so volatile. And this volatility makes it appear that stocks are risky investments.

But in the long-term, the economy — and the businesses within it — have always moved higher. And if you think human ingenuity will continue to make this happen, stocks are a pretty safe bet.

With the caveat that you own a well-diversified portfolio. An index fund is a great way to do this. Because it can give you exposure to the entire economy, rather than making bets on individual companies.

Of course, if you think you can do the research required to achieve higher returns on your stock investments, you can try. But just know that the vast majority of “traders” lose money. And if you’re not willing to dedicate the majority of your time studying your investments, you’ll probably lose money too.

*Important to Note*

Time horizon is very important when investing in stocks. If you need to use the money within a shorter period of time (ie 5 years or less), you probably don’t want that money in the stock market. A significant short-term decline could be devastating to you.