The Maginficent Seven

If you’ve followed the stock market at all over the past year or two, you know about the so-called “magnificent seven” stocks. For those who may not know about them, let me provide a quick review.

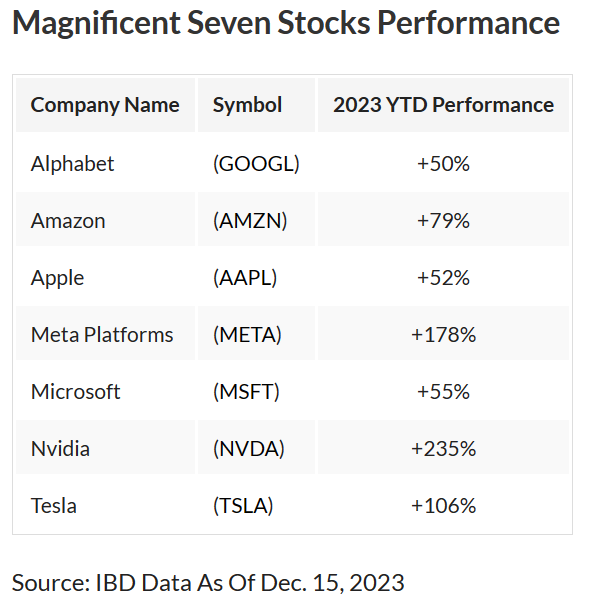

The current bull market in stocks began back in October of 2022. Ever since then, seven stocks have been on fire. Here’s a chart (pulled from this article from Investor’s Business Daily) that illustrates 2023 performance of these seven stocks through mid-December of last year.

Clearly, the stocks of these companies grew at a much higher rate than the overall S&P 500, which finished at around +24% for all of last year.

Don’t get me wrong, +24% is a fantastic year for the stock market. However, if you strip out these seven stocks, the other 493 had a pretty average year.

Here’s a chart from a Wall Street Journal article that illustrates this:

The Hidden Danger of Overconcentration

If seven stocks can drive the entire stock market up, then they can also bring it down.

If you own a mutual fund or ETF that tracks the S&P 500, these seven stocks make up a much larger portion of your portfolio than they probably should. This is called concentration risk.

The S&P 500 is a “market-cap weighted” index. Which essentially means that the larger the company, the heavier their weight within the index.

Currently (as of 1/27/2024), these seven stocks — Microsoft (7.32%), Apple (6.95%), Alphabet/Google (3.98%), Nvidia (3.71%), Amazon (3.49%), Meta/Facebook (2.12%), and Tesla (1.40%) — make up almost 30% of the total index.

And this is the hidden danger that may exist within your portfolio.

Potential Solution: plan for phase 3 of the current interest rate cycle

As I’ve talked about before, interest rates have been the biggest influence on the stock market over the last couple of years.

The action in the stock market can be summed up as follows:

- market expects higher interest rates –> stock market goes down

- market expects same or lower interest rates –> stock market goes up.

Why have interest rates and stocks been moving in the opposite direction? Because higher interest rates are meant to slow the economy (lower stock prices). And lower interest rates tend to accelerate economic activity (higher stock prices).

Yes — on an individual company basis — things like company earnings, product advancements, and industry sentiment have driven stock prices. But on the whole, interest rates have really been the driving force behind investor sentiment, which is ultimately what moves the market in the short term.

Phase 1: Oh No! The Fed is going to “hike us into a recession”

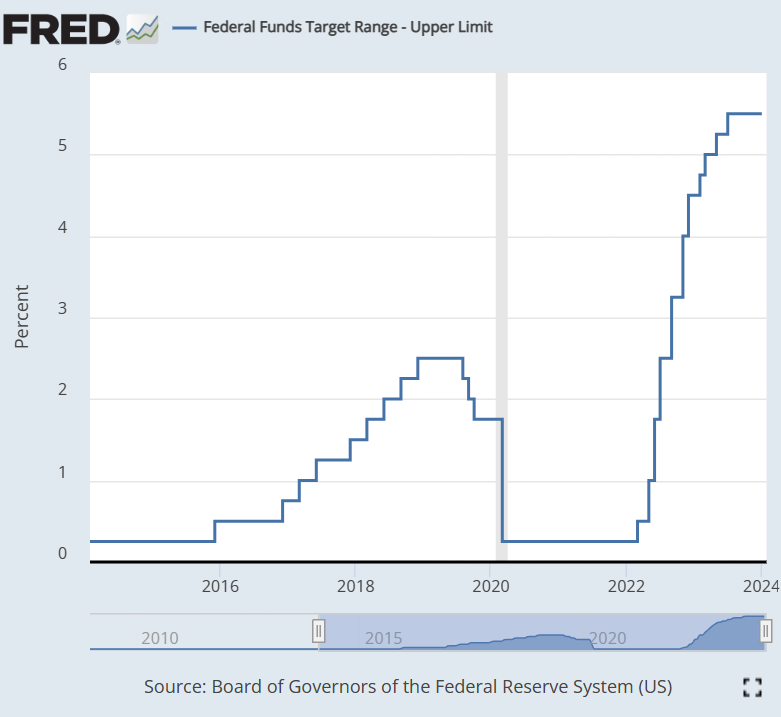

As you can see, the US Federal Reserve began raising (hiking) interest rates in March of 2022. This was the most aggressive rate-hiking cycle since the late 70s / early 80s.

The stock market’s reaction to this was a collective fear that they were hiking too aggressively, which would ultimately throw us into a recession.

And since investor sentiment is what moves markets in the short-term, we entered into a bear market that lasted for almost all of 2022 — ending in October of that year.

In addition to stocks going down, US Treasury bonds also went down. Why? Because when the Fed hikes rates, that means they pay a higher interest rate on new bonds that they issue.

So, the old bonds that had already been issued at lower rates? Their values drop.

This inverse relationship between bond prices and interest rates is a very important rule to understand.

As all of this was unfolding, the interest rate (or “yield”) on Treasury bonds began ticking up significantly.

And ever since then, the overall stock market has become very much tied to the yield on the 10-year US Treasury bond.

Below is a chart that compares the yield on the 10-year Treasury (blue line), mega cap stocks which represent the largest stocks in the market (green line), and small cap stocks which represent the smallest stocks in the market (red line).

As you can see, phase 1 is a clear inverse relationship between stocks and interest rates. The 10-year yield spiked and an all stocks — small and large — dropped.

Phase 2: Despite Fed rate hikes, the economy is still doing pretty well

As I already mentioned, this Fed rate-hiking cycle was one of the most aggressive in history. And it created a lot of fear. But then, those fears turned out to be largely false fears. And when things turn out better than expected, stocks tend to go up.

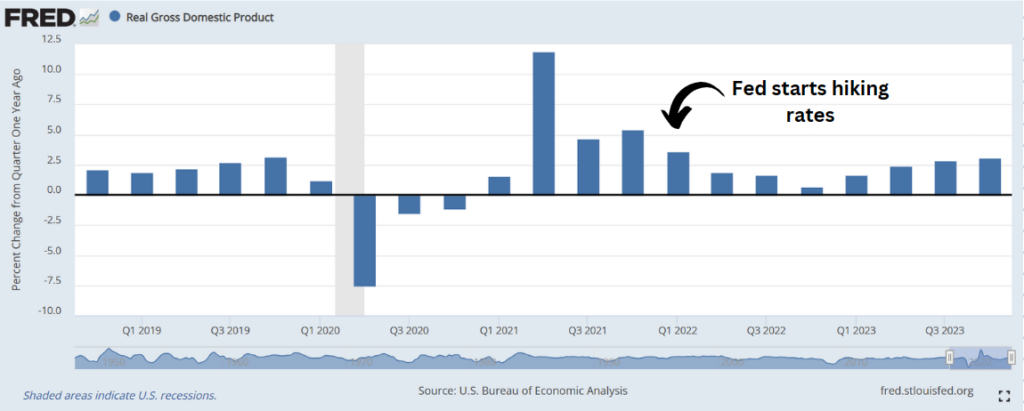

As you can see below, despite rate hikes — not only did we avoid a recession, but the economy continued growing (albeit at a slower pace). And even began accelerating again throughout 2023.

Thanks to the resilience of our US economy, the Fed began to change their verbiage a bit.

I’m taking some liberties with my paraphrasing here, but their sentiment went from “inflation is an immediate threat and we must commit to aggressive rate hikes to defeat it” to “the threat of inflation is abating, so we can start slowing the rate and frequency of hikes.”

And their sentiment shifted over to the stock market. We saw a reversal of investor sentiment from heavy fear to cautiously optimistic.

I think this reversal of sentiment has driven the stock market ever since. As you can see below — as interest rates (blue line) have leveled off — big companies (green line) began a sustained upward move. However, small companies (red line) have only muddled along.

This speaks to the “cautiously optimistic” sentiment in the market right now.

There’s still fear around interest rates. We’re still seeing periods where stocks fall in response to a rising 10-year treasury yield.

Furthermore, the lack of gains in small stocks speaks to these lingering fears. Small companies are thought to be much more sensitive to rising rates.

This is because small companies tend to have more debt on their balance sheet. Unlike mega companies (like the magnificent seven), they do not have mountains of cash they can use to grow their businesses. Small companies need to borrow money to fund their growth.

And this is why the mega caps have recovered and moved on to new highs, while small caps have largely sat on the sideline.

Phase 3: Interest rates come down and the economic expansion continues

Let me be clear on this. This is my opinion of what we’ll see in the coming months and years. It’s always possible that this phase does not materialize the way I think it will.

I’m pretty sure we’ll see some periods of slower economic growth, going forward. This is because rising interest rates can have a delayed effect on the economy. And once again, we just went through one of the most aggressive rate-hiking initiatives in history.

Virtually every economist agrees on this.

Where there’s some debate, is on how much it will slow down. And will we see a recession at some point?

I don’t think we will.

And I think it’s very possible — maybe even probable — that things turn out better than expected. For one, humans are always overly pessimistic about the economy.

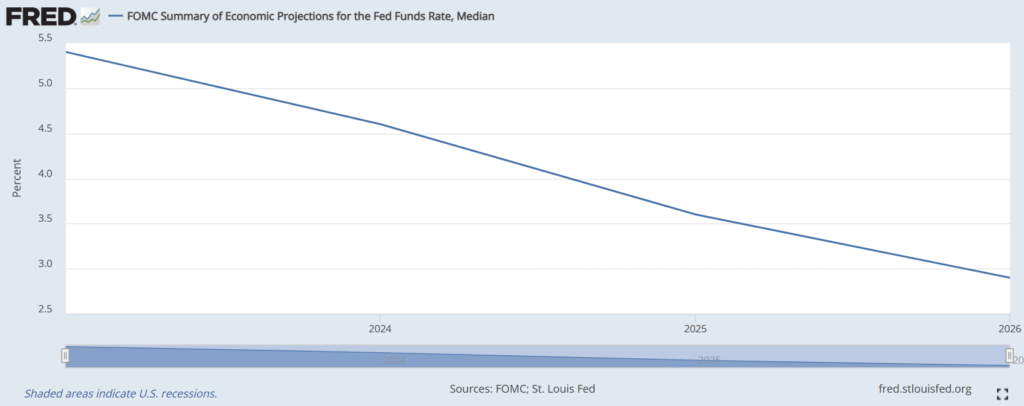

But also, the Fed is now planning a rate-CUTTING cycle. And just like rising rates slows economic growth, falling rates tend to accelerate economic growth.

The Fed is very explicit with their plan. And it’s public knowledge.

Below is a chart that illustrates the median projection for all members of the Federal Open Market Committee (FOMC). The FOMC consists of twelve members–the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis.

And if this leads to sustainable economic growth, we should expect a broadening of strength. It won’t just be the mega companies. Smaller companies should start benefitting as well.

And during the early stages of a sustainable economic growth cycle — when this broadening starts happening — the stocks of small companies tend to experience outsized growth.

This is something I’ve written about in detail, which you can check out here.

Addressing the hidden danger in your index fund

As I mentioned above, holding an index fund that tracks the S&P 500 currently has a lot of concentration risk in the Magnificent Seven companies.

You may be comfortable with this because you believe these companies will continue their outperformance. And that is fine.

But personally, I’m glad I have a strategy that is built out beyond a simple S&P 500 fund. I do this in two ways:

1) Own a global index fund versus US only

2) Invest in emerging themes that inherently consist of smaller, emerging businesses

If you’d like to learn how I invest money for myself and my clients, please visit the following link: