This week, I thought I would share my thoughts on the future of college education. For many of you, financially planning for your kids to attend college is top of mind. For others, perhaps this will help in understanding how our economy is shifting – which is always important for a long-term investor.

In my opinion, the college tuition “bubble” is primed to burst in the coming years. I don’t know how long this will take. And – as is always the case with future projections – I could be wrong. But to me, the writing is on the wall.

A college education is an asset. From this perspective, it’s not all that different from a stock. We invest in the cost of college tuition, hoping it will bring future financial rewards. Just like we invest in shares of a stock, hoping it will bring future financial rewards.

And assets – when they become overvalued – can turn into asset bubbles. When the bubble pops, prices come crashing down. Now, I’m not sure if college tuition costs will come crashing down. But I do believe they will – at the very least – level off from the insane rate of inflation we’ve seen over the past few decades.

Typically, there are 5 stages of a bubble:

Stage 1 – Displacement

Displacement occurs when there is a paradigm shift. When we move from an old way of doing something to a new way of doing something. As you are probably aware, there once was a time when college was only for the elites. Then it became more accessible to the masses. This was a paradigm shift.

It occurred after World War II, when the GI Bill was passed in 1944. In addition to establishing hospitals and making low-interest mortgages available to veterans, it also granted stipends covering tuition and expenses for veterans attending college or trade schools.

Stage 2 – Boom

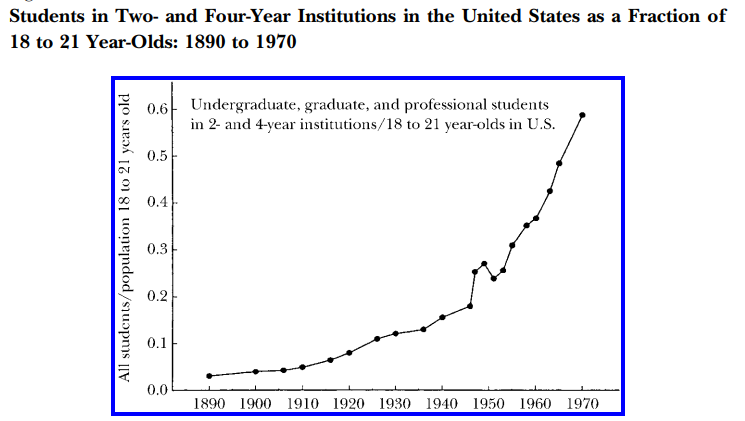

After an initial period of slow growth, displacement is followed by a boom. For college enrollment, this was primarily driven by the GI Bill and the Higher Education Act of 1965. College became a normal part of life for the mass majority.

The following chart is from a 1999 research piece from Harvard University:

Rather than simply being a way to educate the elites, college was now a means of getting ahead in life for the masses.

Stage 3 – Euphoria

Euphoria is the stage where there is a whole lot of FOMO (fear of missing out). Since the evolution in college enrollment – and tuition costs (greater demand = higher prices) – occurred over such a long period of time, it’s hard to pinpoint exactly when we reached this stage.

But we have been at this level for quite some time now. Anxiety and FOMO are highly prevalent in the college admissions process these days. College went from a way of getting ahead, to a prerequisite of even competing in the job market. Complete with several high profile college admissions scandals.

With stocks, euphoria is a much shorter process. Because there are always thousands of ways to invest one’s money. So, when things become overvalued, it’s easy to find an alternative way to invest.

On the other hand, students didn’t have much of an alternative to traditional college until recently.

Stage 4 – Profit Taking

With stocks, this is when the “smart money” starts taking profits – and moving their money elsewhere – in anticipation of a bursting bubble.

There is obviously no “profit taking” from the standpoint of college enrollment and tuition. However, there are certainly plenty of opportunities for students to move their money elsewhere today.

For less than the price of an iPhone, one can now take online courses from some of the most prestigious universities in the world. Additionally, for-profit education companies are popping up like spring weeds in my backyard currently. This trend is not stopping. Students now have plenty of ways to increase their knowledge and value to the world, without the exorbitant costs of traditional college.

Stage 5 – Panic

With stocks, this is when a watershed moment initiates panic and the bubble bursts. In 2008, for example, it was the failure of Lehman Brothers. This caused mass uncertainty and panic.

When it comes to college, the only panic will be that of colleges and universities whose enrollment rates are dropping significantly. I believe many of these institutions will end up going out of business.

And the watershed moment is the advent of the “creator economy.” The creator economy is also known as the “influencer economy” and has been discussed since as early as 1997, by Stanford University’s Paul Saffo.

Basically, it is the ability to use social media as a way to create value for others. Today, students are able to share all their knowledge and insights with the world. And if people find value in these insights, they will build a large audience.

Say goodbye to the days of submitting a resume to a company to apply for a job. Say hello to the days of displaying your talents in the open market and 1) operating your own business or 2) working for the highest bidding employer.

Implications for Financial Planning

There is still a tremendous amount of value in attending a traditional university, in my opinion. And that is the human experience. The social development that occurs when a child goes away to school will still be incredibly valuable in a world dominated by social media.

So, I would still plan and invest in education savings vehicles – such as a 529 plan, for example. But I would err on the side of having too little saved up, versus having too much.

From an investment standpoint, for-profit education companies represent a potentially lucrative long-term investment. I am keeping my eyes open for ways to benefit from this trend.