Another rough week in the stock market. I’ve been saying this a lot lately. But that’s the reality we’re in right now.

The S&P 500 finished down nearly 6% for the week. For perspective: a “bear market” is considered a drop of 20% or more, a “correction” is considered a drop of 10-20%, and a “pullback” is considered a drop of 5-10%.

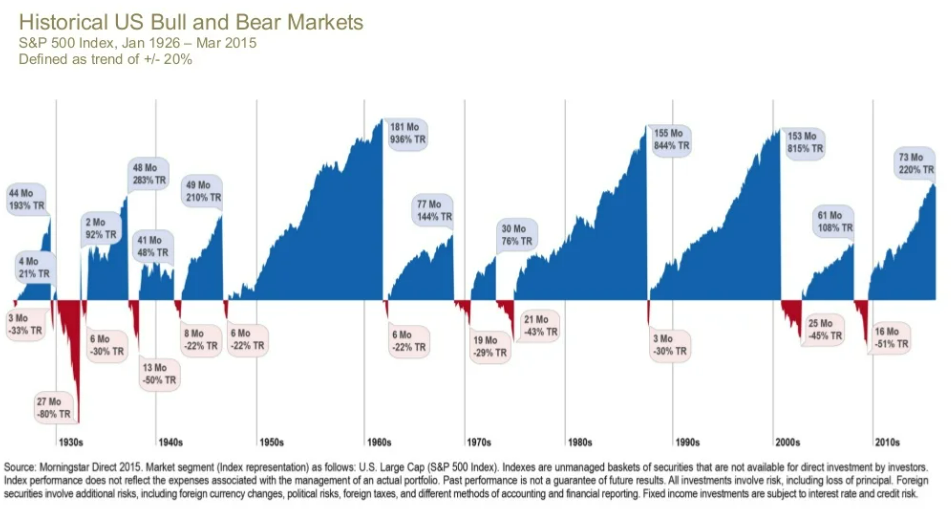

But these are the times that separate great investors from everyone else. As tough as it is to see the value of my portfolio go down, I always remind myself that missing out on bull markets is far more detrimental to my long term returns than going through the occasional bear market. The picture below illustrates this (months and total return of bull/bear markets).

And often, new bull markets begin with a bang. So I want to make sure I am staying invested so I don’t miss out on those big returns. At the risk of sounding cliche, this too shall pass.

The big news this week was – surprise, surprise – inflation and Federal Reserve interest rate hikes.

The fact that this is the most widely talked about issue in the economy for the past year, in and of itself, reduces my worry. Because typically, big crashes are the result of two things: {1} an unknown event that takes everyone by surprise (“black swan” event – like COVID in 2020 and the government allowing Lehman Brothers to collapse in 2008) or {2} market euphoria – like the dot com bubble in 2000 – much different from the widespread pessimism currently.

But this is another conversation altogether, so let’s talk about the news this week. On Tuesday, inflation data came in “hotter than expected.” This spurred worries that we’ll get another big interest rate hike by the Fed. Higher interest rates are viewed as a net negative for the economy (and stocks). This resulted in the biggest daily stock market decline since June 2020.

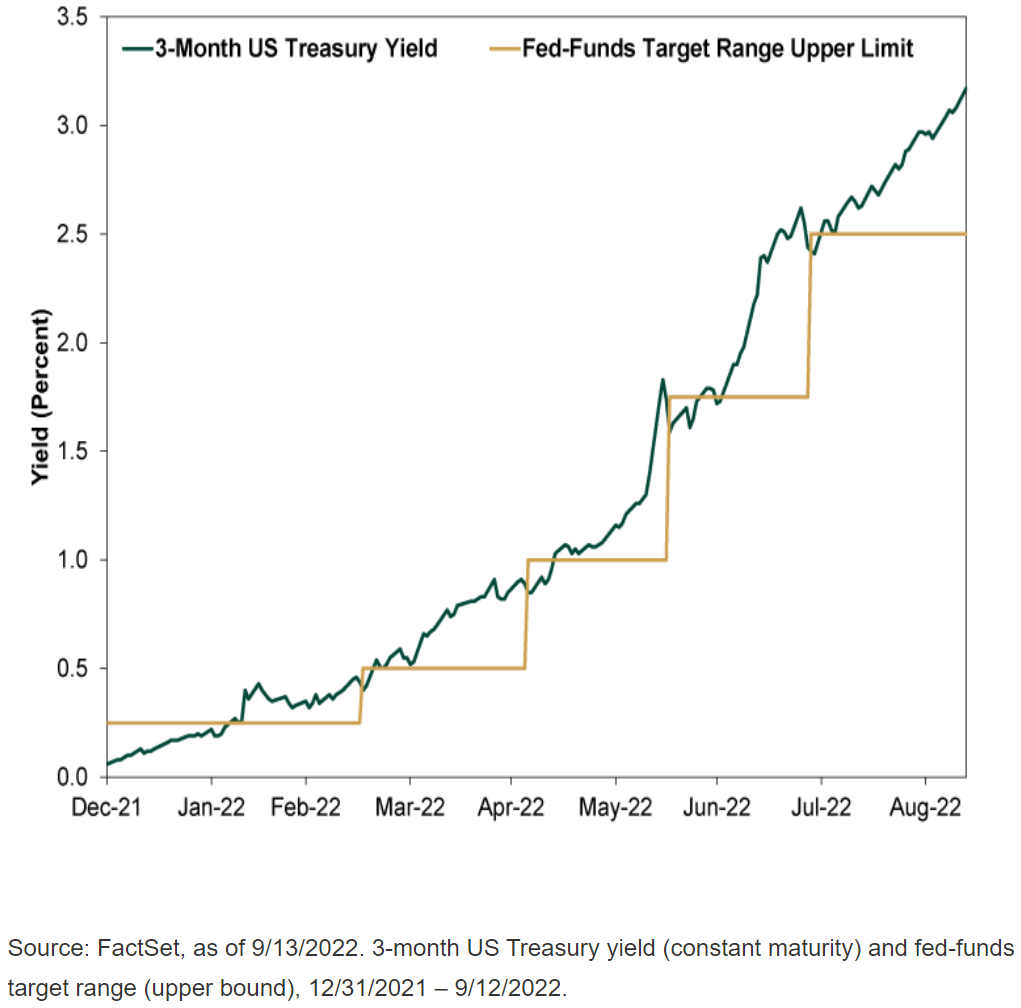

But this doesn’t make much sense. Another big Fed rate hike is already a foregone conclusion. Take a look at the visual below, from research report I read this week.

This shows 3-month Treasury rates (market expectations) versus the Federal Reserve interest rate. Each step up in the gold line is a Fed rate hike. As you can see the market already expects another big rate hike. It currently sits roughly 0.75% higher than the current Fed rate – which is precisely what is currently considered a “big rate hike.”

We already know the Fed is likely to do this at their next meeting, why did the stock market freak out about it on Tuesday? Well, the stock market is simply a collection of humans, buying and selling stocks. And humans are emotional beings. I’d say Tuesday was an example of how the stock market can be overly emotional – and often irrational – in the short term.

So I’m staying cool and sticking to my long term plan. If you’d like more information on that, you can find it here.

Have a great rest of your weekend! And, as always, reach out if I can help in any way.