For the week, the S&P 500 was up +1.13%. On the surface, that seems like a pretty tame week. But there were some fireworks sprinkled in. There was some important news that came out on Wednesday and turned things around for the week. Leading up to this news, the S&P 500 had been down around -2% in the first half of the week.

On Wednesday, chairman of the US Federal Reserve, Jerome Powell, said that smaller interest rate hikes could begin this month. As I’ve been saying for a while now, with leading inflation indicators showing signs of inflation abating, the Fed could slow their pace of interest rate hikes. And this would be a positive surprise for the stock market.

As expected, the stock market reacted very positively to this news. The S&P 500 rallied nearly +4% in a matter of hours after the news was released. And for the most part, it hung onto those gains to finish off the week.

More Gains Ahead?

There is still much uncertainty about the stock market going forward. But that is always the case. There has never been a time in history where there were no serious concerns. This is why you often hear people say that the stock market (bull markets) climb a “wall of worry.” There are always plenty of fears. But as long as they don’t turn out quite as bad as everyone expects, the stock market moves on.

Right now, as I mentioned last week, the biggest concern is still a potentially pending recession in the new year. However, if it doesn’t materialize or ends up being milder than anticipated, that would likely be a positive catalyst for the stock market.

And, in my opinion, the news from the Fed this week bolsters the case for both of those outcomes. It’s widely expected that we will end up in a recession thanks to the negative effects of higher inflation on corporate profits, as well as the slowing effect that rising interest rates tends to have on the economy. But now that the Fed is beginning to discuss slower rate hikes, this may not be as bad as feared.

Then, there was some other good news on the economic front that came out on Friday. The jobs report showed that the economy added more jobs than expected and that wages increased more than expected. Assuming inflation isn’t as much of a problem going forward, this is great news for the economy!

Now, there are some that say this report is bad news on inflation. But I disagree.

There’s this argument called “wage price spiral.” Basically, it means that if a company has to pay more workers higher wages, that will create an inflation spiral. Because then, they’ll have to raise their prices to protect their profit margins.

Highly unlikely right now.

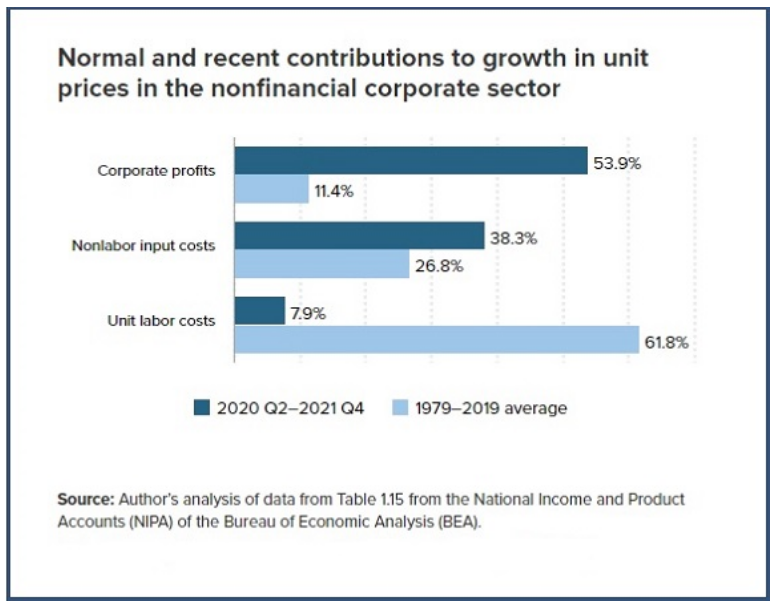

The following chart shows that corporate profit margins are at record levels. They’ve already used inflation as an excuse to fatten their profits. Not sure it would be smart of them to continue doing this after everyone has caught on.

So, I continue to expect inflation to subside more than people expect. And the economy to grow faster than people expect. And let’s not forget that corporate profits are healthier than ever. All together, this looks like a recipe for continued gains in the stock market.