Do you root for the little guy? I always find myself doing so. Can’t help it…I guess I just tend to view the world from the perspective of the little guy.

And while this is more of an emotional thing in general, when it comes to the stock market…it’s purely rational.

You see, stocks of small companies (small-cap stocks) tend to lead the way as new bull markets get their footing. So, join in with me…let’s go little guys!

But why does this happen? To understand this, it’s important to understand how bull market cycles work.

Normal Stock Market Cycles

A normal stock market cycle is best described by quoting famed investor, Sir John Templeton: “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

The stock market is a collection of humans. And human emotion drives market behavior.

When a new bull market begins, it means a bear market just ended.

And after a bear market, people are afraid to buy stocks. Then, as the market climbs, more people get comfortable buying stocks. Then, as the market continues climbing, even more people want to get in. Then, as the market climbs even higher, the fear of missing out begins to set in.

And eventually, herd mentality gets out of control. Stock prices get too high. And the growth is no longer sustainable.

The market crashes. The FOMO crowd ends up losing their money. And then missing out on most of the next bull market, because they’re scared of losing their money again.

Sophisticated Investors vs Amateur Investors

Early bull market investors are usually pretty sophisticated. Often, the majority of these gains are driven by institutional investors and professional money managers.

The FOMO crowd described above are the amateur investors. They’re the ones that are usually late to the party.

This is an important distinction. Because early in the bull market — when there’s still a lot of pessimism from the recent bear market — the idea of buying small-cap stocks is especially scary.

Stocks of small companies tend to exhibit much more risk than stocks of large, established companies. So when we see small-cap stocks start to pull away, the “smart money” is telling us that good things are ahead.

Let’s take a look at how this has played out in each of the last three universally accepted bull markets.

2009 – 2021: Complete Bull Market Cycle

After the 2008-2009 bear market, dubbed as the Great Financial Crisis, we began a sustained bull market that reached every stage of Templeton’s cycle of human emotions.

Yes, technically the covid downturn in 2020 was a bear market (because the market fell by more than -20%). But in terms of the cycle, nothing changed. The market dropped, government stepped in to fix it, and it was over in a matter of months.

After which, the cycle that began in 2009 was resumed. If anything, the government intervention threw us squarely into the euphoria stage. Maybe even quicker than it would have happened otherwise.

Beginning in late 2020 and continuing through 2021, we saw lots of euphoric bubbles form. It happened in everything from disruptive tech and clean energy stocks to bitcoin and NFTs (non-fungible tokens).

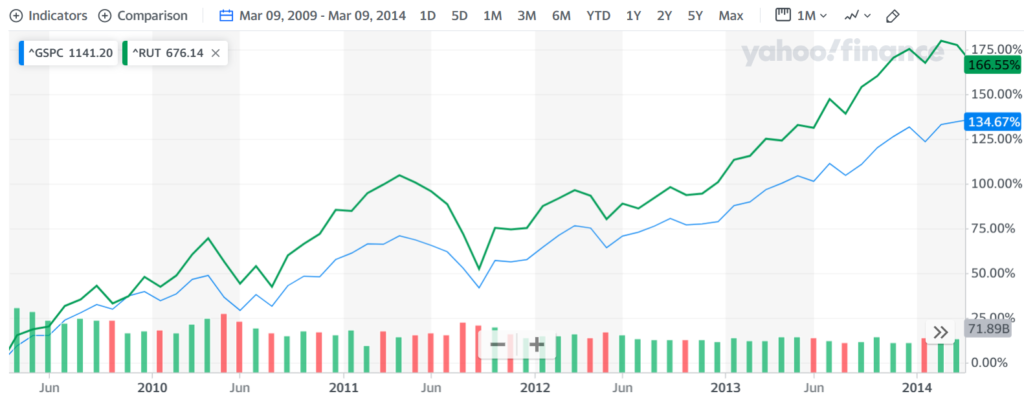

As you can see, small-cap stocks (green line) clearly led the way in the early days of this cycle.

2002 – 2007: Shortened Bull Market Cycle

Sometimes, exogenous events abruptly bring a bull market to an end. Which means an abnormal market cycle — because the full cycle is never actually experienced.

This was the case in 2008, when the subprime mortgage crisis resulted in the collapse of Bear Stearns, Lehman Brothers, and several other systemically important financial institutions.

That stock market never got to the euphoria stage. Nevertheless, small-cap stocks still clearly led the way as this bull market gained its footing.

1991 – 2000: Complete Bull Market Cycle

The bull market run in the 1990’s was also a sustained bull market that reached every stage of Templeton’s cycle.

From March 1990 – July 1991, the US economy was in a recession. This was following another recession just three years prior in 1987, the collapse of the savings-and-loan industry around that time, and the Fed’s interest rate hikes in the late 1980s. Not to mention, Iraq’s invasion of Kuwait in the summer of 1990.

So, this bull cycle began with lots of fear and pessimism. And by the end of the decade, the stock market reached the euphoria stage culminating in the “dot-com” bubble.

It was early days of the internet. Investors started valuing stocks based on “clicks” instead of dollars. The Nasdaq Composite index went parabolic before it all crashed down.

As you can see, once again, small-cap stocks clearly led the way in the early days.

Today: Sustainable Bull Market?

I’m very encouraged to see the recent market trends starting to rotate. Away from big companies dominating, and toward small companies seeing some major upswings.

Technically, we’re in a new bull market that began on October 13, 2022. But despite this, small-cap stocks have been lagging behind significantly. The Russell 2000 is a good representation of small-cap stocks. And as you can see in the chart below, small-caps haven’t fared so well.

This is one of the reasons many people doubt that this new bull market is sustainable. In fact, many have even called it a “bear market rally.” Meaning a temporary uptrend that will eventually collapse again.

I don’t buy this. Now that the Fed has stopped raising interest rates, there is more certainty around what the economic landscape will look like from here. This means businesses are able to make better projections and figure out how to grow their profits.

And whether rates are higher – like they are today – or lower, business leaders and entrepreneurs are generally smart and adaptive people.

Give them some certainty and they can run successful businesses.

Because of this, it makes total sense why small-caps are starting to get more love. As you can see below, the past week was a blowout victory for them.

And as you can see in the next chart, since November 1st, small-cap stocks have been leading the S&P 500 (mostly large-cap). This is important because November 1st was the day the Fed held interest rates steady for the second time in three meetings, signaling to the market that they’re probably done raising.

So, does this mean a new and sustainable bull market is getting its footing?

I can’t give you the answer to that. But I personally think so. Either way, I will be watching small-cap stocks closely as things progress.

Let’s go little guy! Small but mighty!