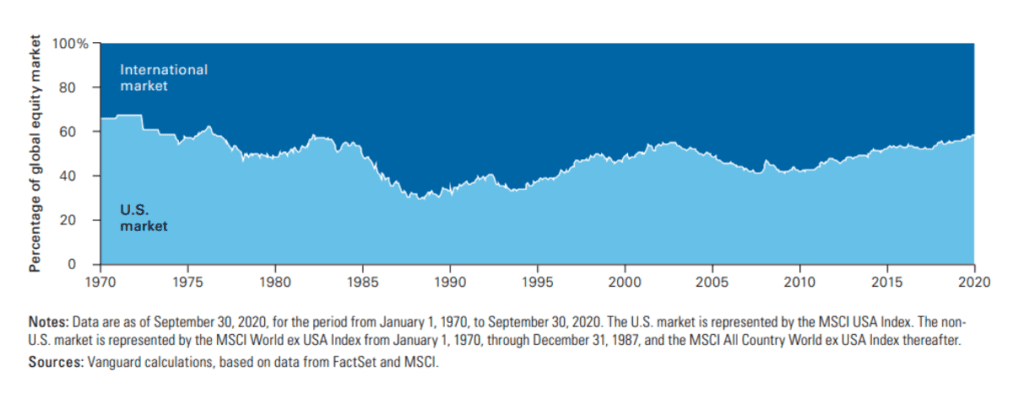

Do you invest internationally or only in US stocks? Hint: if you own a S&P 500 Index fund, you don’t own any international stocks. Also, if you own mutual funds that don’t explicitly say “global” or “international,” you don’t own international stocks. Home country bias is prevalent everywhere across the world, but nowhere is it more pronounced than in the US. We tend to think of US stocks as “safer” and international stocks as “riskier.” This is a myth. The truth is that a blended allocation of the two is the best option. For one, it provides better diversification and a potentially smoother ride. We’ve been in a cycle of US outperformance since the 2008 Financial Crisis. Frankly, it’s unhealthy for one market to get the majority of global market inflows for too long. It’s likely that this reverts back to the mean. And this is exactly how it’s played out historically. Just look at this chart below. I pulled this from a great article from Vanguard, which you can find here. Currently, US stocks make up around 60% of the global stock market. Historically, any time US stocks approached this level, we experienced a mean reversion. US representation decreased, while International representation increased. Said differently, international stocks provided much better returns than US stocks. I don’t see any reason why the future will be any different.

So having a global allocation provides better strength and reliability. And if that’s not enough, we are living in an age where the world enjoys more connectivity across borders than ever before. While manufacturing may be experience some deglobalization, services (the vast majority of the modern economy) are experiencing accelerating globalization. I want my portfolio structured based on what is going on in the world today. I hope you found this helpful and I hope you have the best weekend!