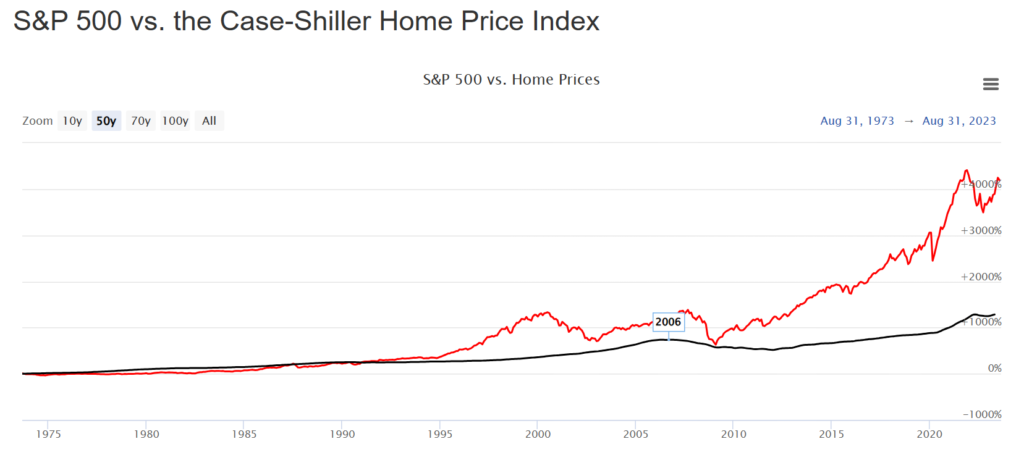

“Return on Hassle” One of my favorite finance writers, Nick Maggiulli, recently wrote a blog post about this concept. It’s something I’ve thought about often in regard to real estate investing, but never put into words like he does in this article. I’ve often told people, “my index fund never calls me to say the furnace broke or I’m going to lose a couple months of rent thanks to a gap in tenants.” This is the “return on hassle” concept in a nutshell. If an investment requires me to invest more of my time or emotional capacity, this must be taken into consideration on top of the expected financial returns. And — as a former landlord of a condominium unit — I can attest that real estate investing absolutely stressed me out from time to time. I might be able to overlook this if it weren’t for the fact that my stock portfolio significantly outperformed my real estate investment. To be fair, my anecdotal experience isn’t always the case. But to get some more reliable context, let’s look at historical returns for real estate versus the stock market. Historical Financial Returns When it comes to historical performance, the stock market has obliterated real estate from a price standpoint. Said differently, the stock market has gone up way more than home values over time. As you can see in the following chart (courtesy of longtermtrends.net), the S&P 500 (red line) has outperformed the Case-Shiller Home Price Index (black line) by a whopping 3,000% over the past 50 years!

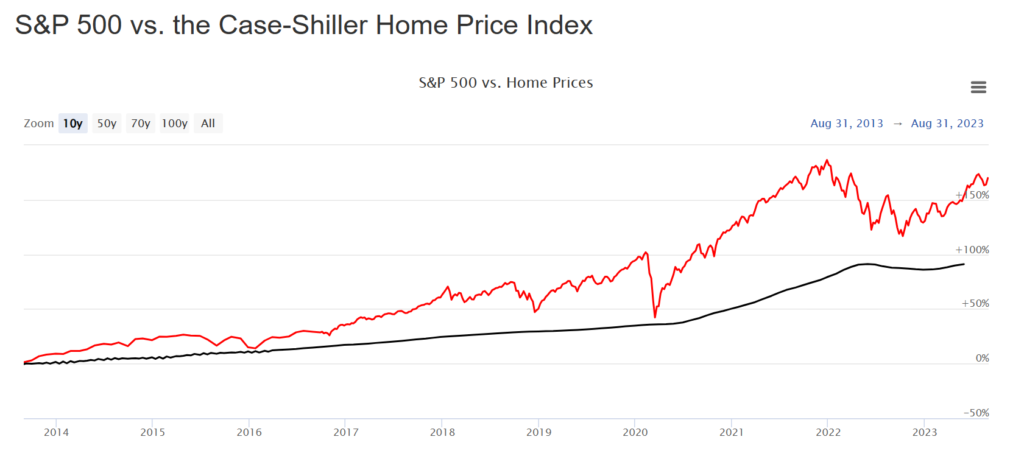

And if you look at just the last 10 years, this gap has narrowed quite a bit.

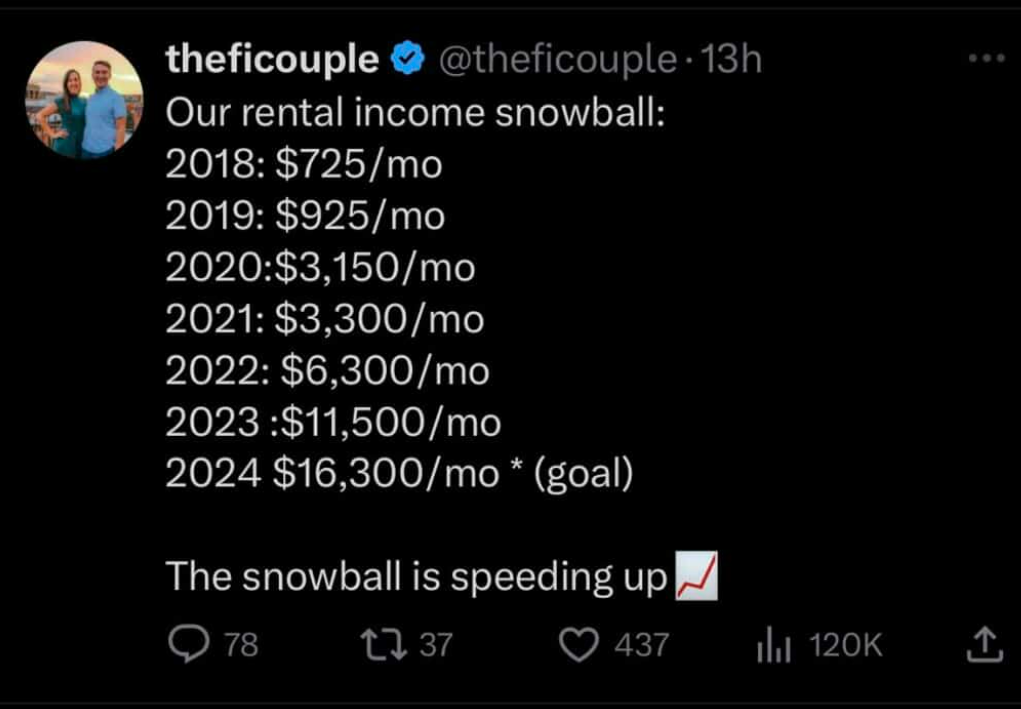

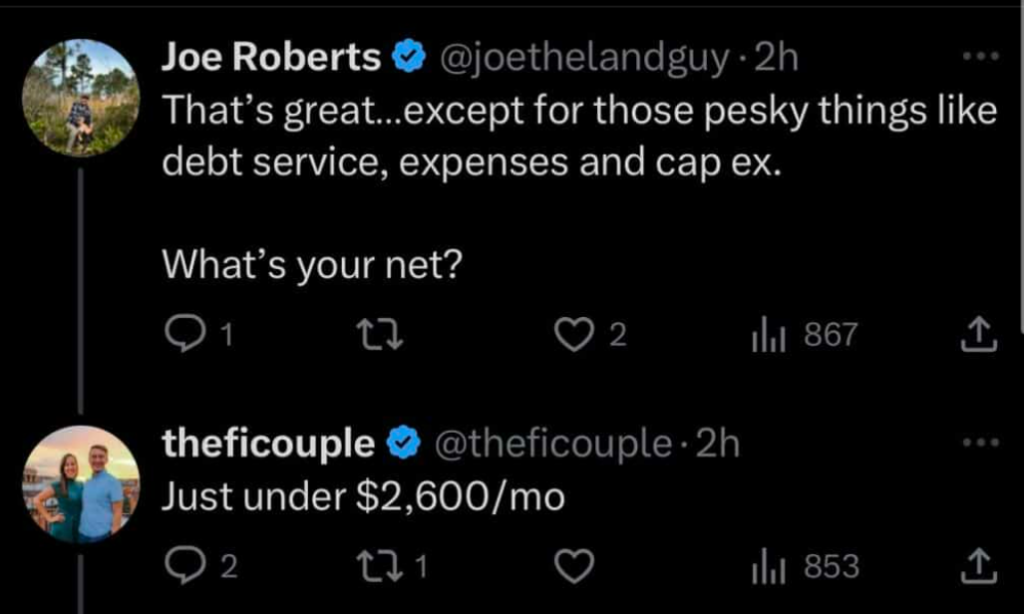

My best guess as to why real estate has done so well to close the gap over the past decade? Historically low interest rates. For most of the past decade, we’ve been at near-zero interest rates. Low borrowing costs allows more people to purchase real estate, which drives up prices. My best prediction as to what will happen going forward? We likely won’t go back to near-zero interest rates. Today’s higher interest rates could be here to stay. Which points toward mean reversion. In other words, the stock market should start running away from real estate again, just as it has historically over long periods of time. Total Return Matters Though… The above charts only show “price return” for the stock and real estate markets. But stocks pay dividends and real estate investments generate rental income. These must be factored in when determining the expected financial returns on investment. Total return is easy to calculate for the S&P 500. Over the past 50 years (July 1973 – July 2023), the total return for the S&P 500 was 16,570%. Total return is much more difficult to calculate for real estate. So, we have to do a little reverse engineering. As the chart above illustrates, the Case-Shiller Home Price Index increased by almost 1,300% over the past 50 years. Therefore, in order to beat the S&P 500 total return of 16,570%, rental income would have had to add another 15,270% over that period. Rental income can vary widely. Two homes in two different regions can collect very different levels of rent. Additionally, rental income — as a percentage of money invested — can vary, depending on how much of one’s own money is invested in the property versus mortgaged. But at the end of the day, it’s often good to look at possibilities versus probabilities. Is it possible rental income could have closed the gap and added another 15,270% to an investor’s total return? Sure. Is it probable? No. This recent Twitter thread illustrates this:

Ethical Concerns Matter (at least, to me they do) As you could probably guess, I’m a big believer that the stock market is the most efficient mechanism on the planet to passively build wealth. But in addition to financial considerations, I have no interest in real estate investing because it’s just a greedy thing to do (even if unintentional). We are currently in the midst of a housing affordability crisis. All across our country people are getting screwed by investors that are driving up real estate prices. Most people either can’t afford to buy a home or have no money left to enjoy their life after their housing costs are paid. This isn’t cool! And besides, you can get better returns in the stock market. Why screw people who are less fortunate, in the name of your investments? Clearly, this is my biased opinion. But I wouldn’t be surprised if the housing affordability crisis plays into the Fed’s rationale for keeping interest rates higher. Higher rates means less borrowing, which means less real estate investing, which means lower housing prices. Time will tell.