Part 1: How We Got Here

In order to understand why I think the residential housing market will crash in the coming years, we need to establish the cause of this bubble in the first place.

Here’s how I think of this chain of events:

- Supply shortage

- Natural price boom

- Gold rush of new investors

- Artificial price bubble

Supply Shortage

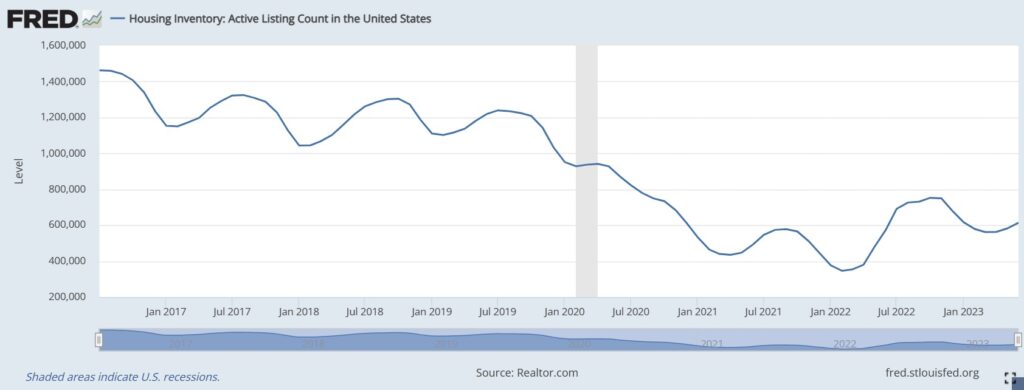

The US economy was already experiencing a major deterioration in housing inventory, which began after the 2008 Financial Crisis. Then, when the covid pandemic shut down the entire global economy – causing major disruptions in new housing construction – inventory took a big dive.

Here’s a chart that illustrates the decline in housing inventory:

Natural Price Boom

Economics 101 teaches us that lower supply (inventory) leads to higher prices. Said differently: if there’s less of something, it’s worth more.

So, real estate began experiencing a price boom that was primarily fueled by a supply shortage.

Gold Rush of New Investors

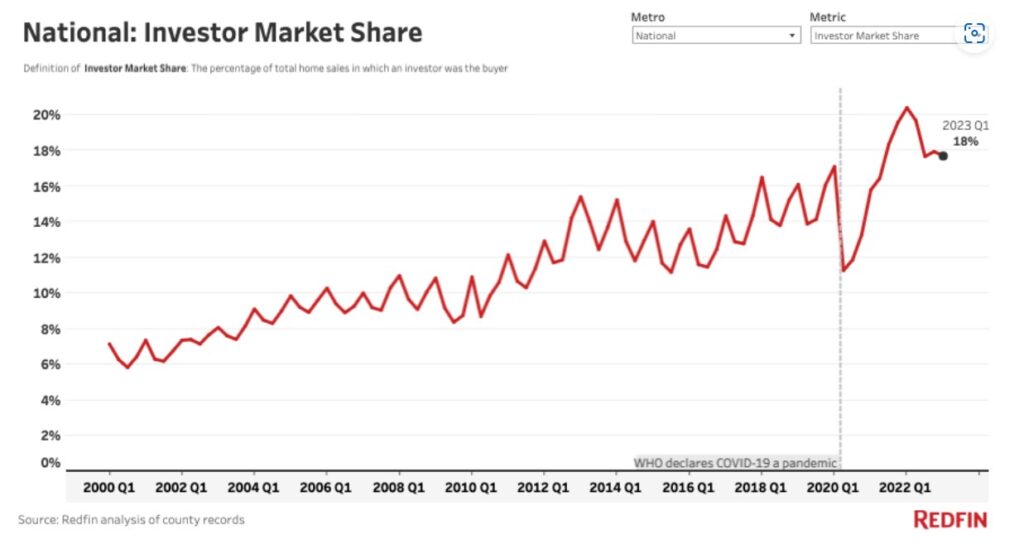

As real estate prices went up, it caught the attention of investors. As you can see below, the percentage of total home sales in which an investor was the buyer has skyrocketed to its highest level in the last 23 years.

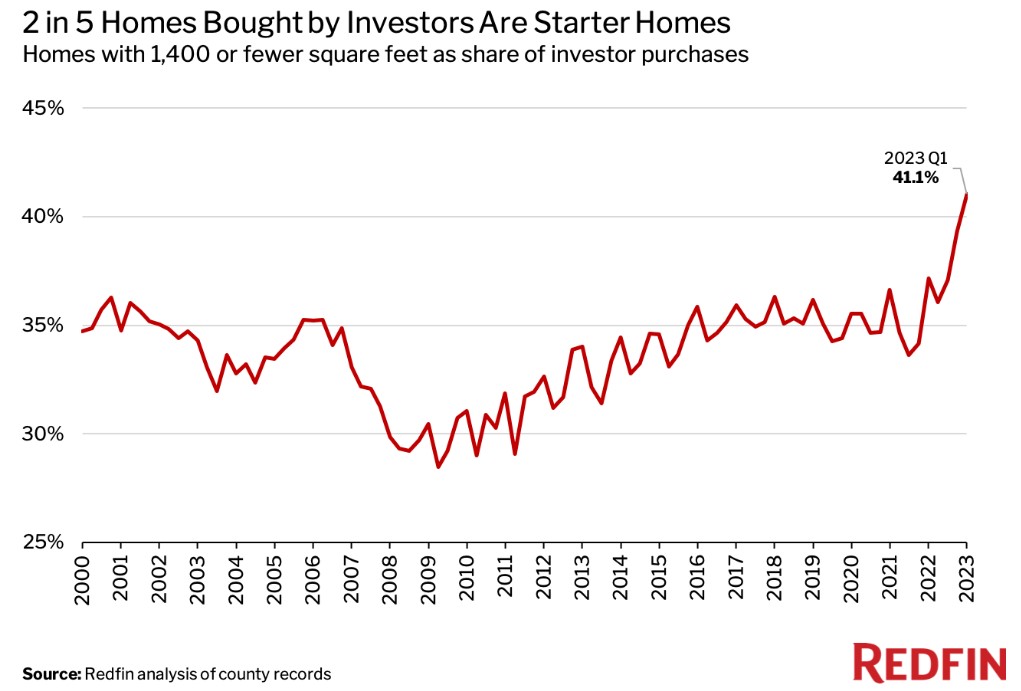

And – wouldn’t you know it – those investors have been especially keen on scooping up starter homes. This has also skyrocketed to its highest level in more than two decades.

Artificial Price Bubble

So – what started as a natural economic outcome – has now reached bubble territory, thanks to hungry investors.

And if you look on social media, you see as many “real estate hustlers” today as you saw “crypto hustlers” back in 2020-21. When everyone on the planet thinks something is a great investment, it’s probably not.

If somehow you still don’t agree with me about this, take a look at the following chart.

Rentals on Airbnb / VRBO have increased nearly +400% in just six years!

And there’s now nearly 70% more short-term rentals on the market than there are homes for sale!

To me, this smacks of investor euphoria. The same kind of investor euphoria that resulted in the collapse of cryptocurrencies and growth stocks in 2021-2022.

And – finally – here’s an illustration of the current price bubble in residential housing. As you can see, it started in the immediate wake of covid shutdowns and has continued until very recently. Which I believe is the beginning of the collapse.

Part 2: Where We’re Headed

I believe we are in the early stages of a negative feedback loop that will ultimately cause the residential real estate market to crash. Or – at least – not perform very well in the coming years.

Here’s how I think about this chain of events:

- Rents will continue falling

- Investors will continue exiting the market

- Buyers will exit the market, in favor or more affordable rents

- Liquidity panic (fewer investors, fewer buyers, falling ROIs)

Falling Rents

By looking at the year-over-year growth rate in median rents, we get a pretty clear picture of how the rental market is softening. And it’s been softening for over a year now.

This is significant because “The housing market tends to be ‘downside sticky,’ which means rents don’t typically fall much even when renter demand pulls back,” Redfin Deputy Chief Economist Taylor Marr said recently. “Instead of lowering rents when business is slow, many landlords offer perks like a free month’s rent or discounted parking, which tends to be less of a hit to profits.”

Said differently, rents don’t need to fall in order to indicate a slowdown in the rental market. They just need to level off. The simple fact that rental growth has slowed so significantly, is indicative of leverage shifting away from landlords and back to renters.

The question then becomes – will this continue? And I think it will.

The two primary reasons I believe this to be the case are:

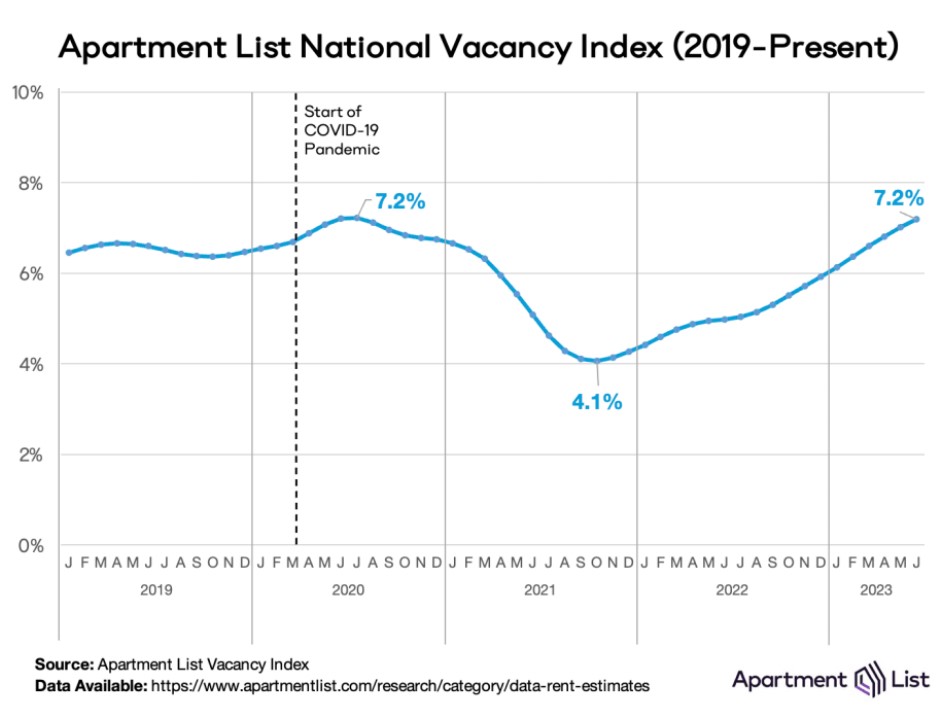

1) Rent vacancies are rising to levels not seen since pre-covid:

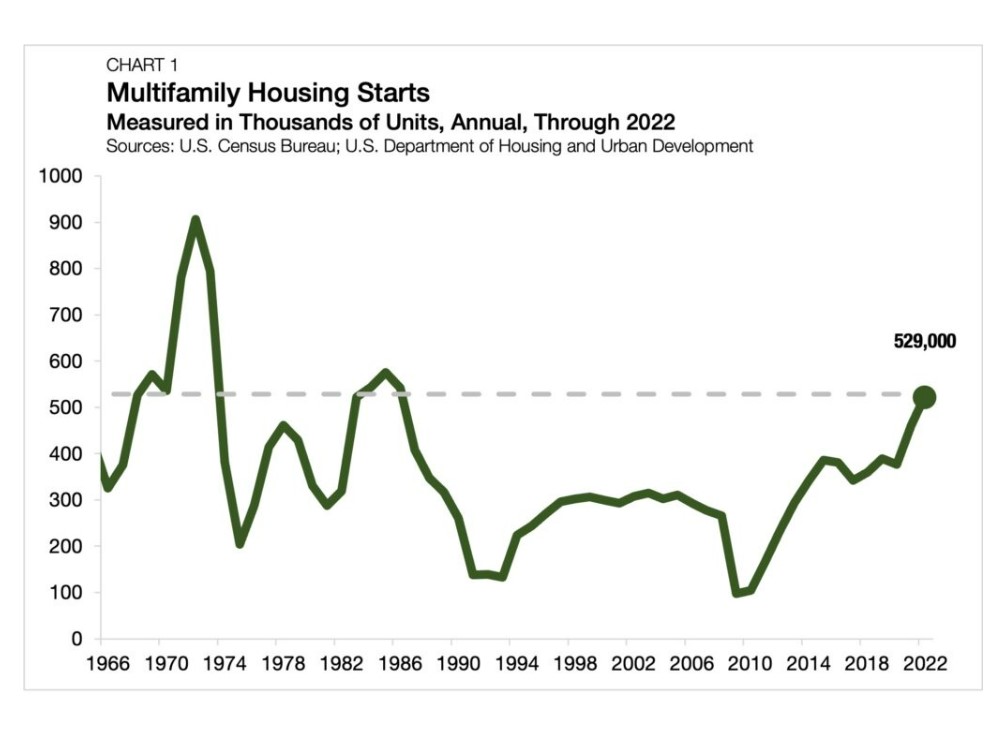

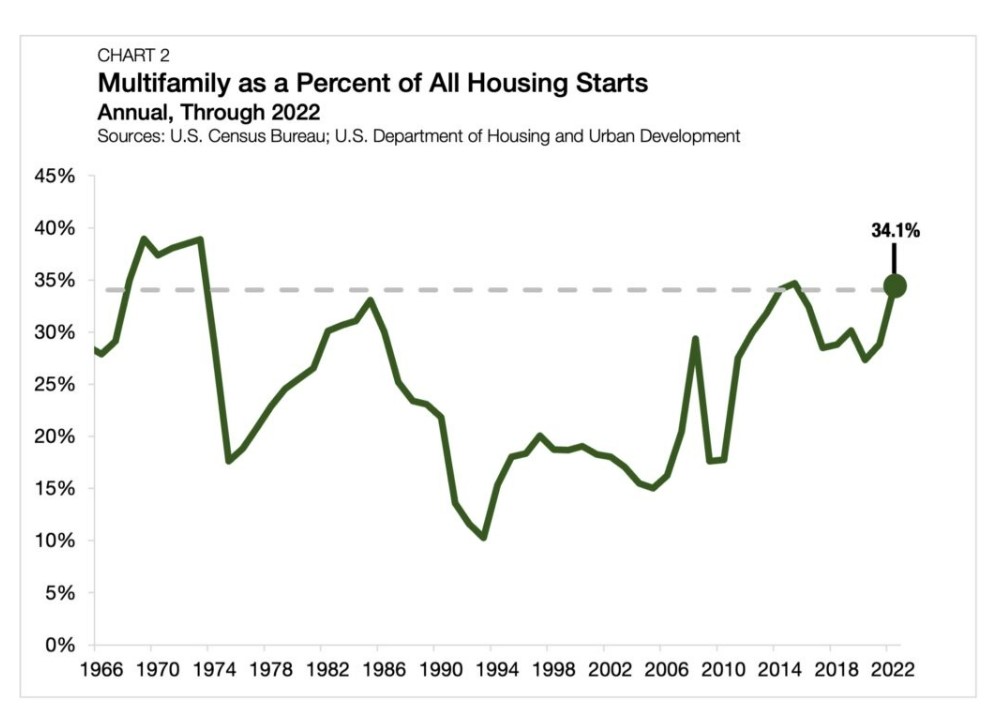

2) Multifamily housing construction is reaching historically high levels:

*the following charts are courtesy of Arbor Realty Trust

Both of these things — more vacancies and more multifamily construction — will drive up supply. And when there’s more of something, the price comes down.

In particular, I don’t see multifamily construction slowing down. The housing affordability crisis is starting to become front and center in cultural debates. And the most efficient way of creating more supply is by building new multifamily properties.

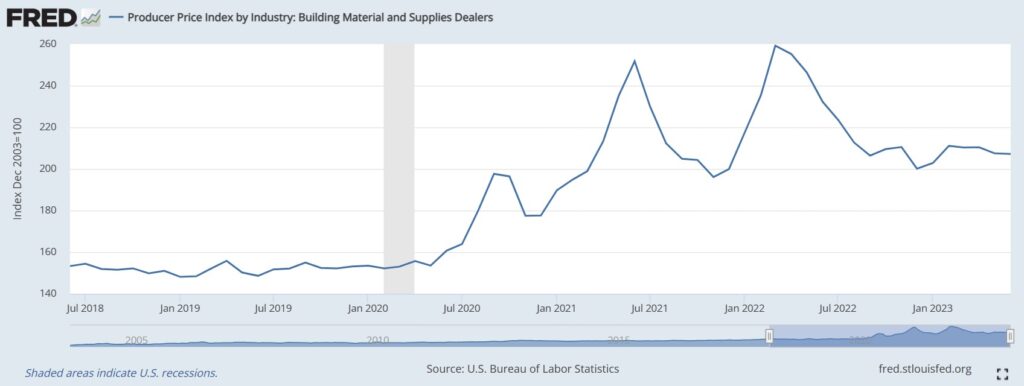

Additionally, it costs a lot less to build today. As you can see in the following chart, the price of building materials has fallen by more than -20% from its peak back in March.

If this continues – and many economists are expecting inflation to continue falling – this would incentivize more construction of multifamily properties.

Investor Exodus

Rental income is like a dividend on a stock. Just like demand for a dividend stock tends to go down when a company cuts its dividend, so too does demand for real estate when rental income declines.

As we’ve already discussed, rents haven’t necessarily declined yet. However, they have leveled off and show signs that a reversal could be in store.

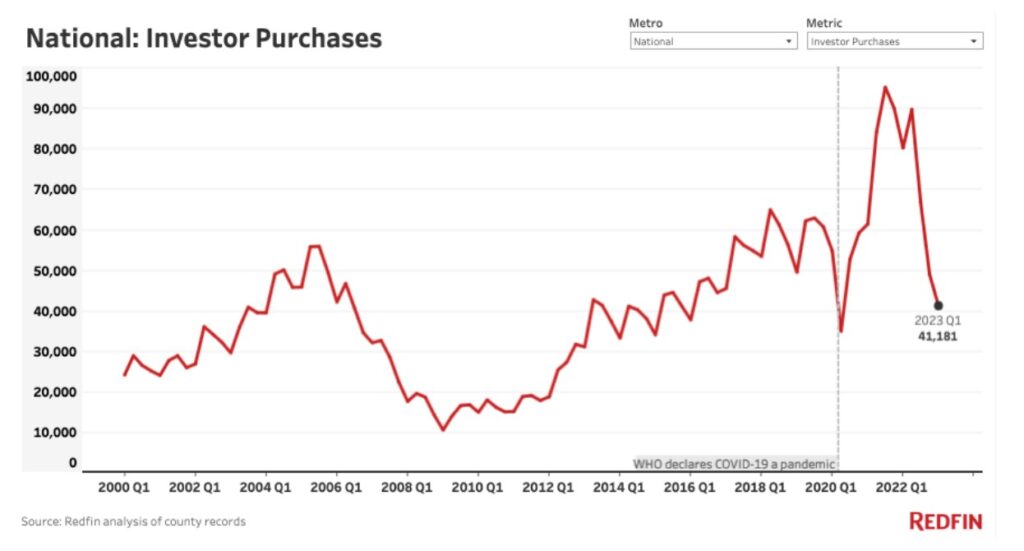

Investors certainly appear to be worried about this. Just look at the following chart, which shows real estate purchases made by investors:

If rents actually start declining, I would expect this trend to accelerate. But either way, the massive influx of new real estate investors appears to have been a temporary post-covid phenomenon.

I just don’t see another investor boom happening – given significantly higher borrowing costs and potentially declining rents. Fewer investors means fewer buyers. Fewer buyers means lower demand. Lower demand means lower prices.

Buyer Exodus

The recent residential real estate boom was never driven by demand. As we noted at the beginning of this article, it was driven primarily by supply shortages.

Therefore, there was never an excess of individual homebuyers in the market to begin with. This is reflected in the historic increase of investors as a percentage of overall purchases, which we talked about before.

Without investors, who will make up that additional demand? Should we expect an influx of individual homebuyers to come to the rescue?

Given the fact that mortgage rates and home prices are now at generational highs. And given the fact that the cost of renting appears likely to fall in the near future…

I have a hard time believing this will happen. High purchasing costs and lower rents should sway a lot more people into renting versus buying. Especially when you consider the abnormal levels to which investors have driven up the cost of starter homes.

Liquidity Panic

All of this sets the stage for a potential liquidity panic. In other words, sellers will have a tough time finding buyers.

During the 2008-09 financial crisis, we saw the damage that a liquidity panic can create. Remember all the write-downs on mortgage backed securities? When there aren’t any buyers, prices plummet.

If you’re an owner of an investment property and the following scenario plays out:

- Fewer investors to sell to

- Fewer individuals to sell to

- Falling rental income (falling ROIs)

What would you do? Hang on and hope your rental income doesn’t go down too much? Sell at whatever price you can get, so you can invest in something else? These questions are certainly enough to spark fear. And thanks to investor “herd mentality,” fear can spread quickly.

Part 3: A Better Alternative

Just as the real estate boom appears to be getting long in the tooth, the stock market appears to be in the early stages of a new bull market. Should this continue – and I believe it will – this will create some stiff competition for real estate in an investor’s portfolio.

If you’d like to dive deeper into how this bull market began, here is an article I published in October of last year, forecasting that a new bull market would begin.

While there’s no guarantee that this will continue, my forecast (and basis for it) turned out to be correct. A week after I made it, the S&P 500 bottomed and has gone up by over +25% since then.

Basically, my rationale was that investor sentiment (around inflation and interest rates) had gotten too pessimistic, and things would start turning out better than expected.

You see – when it comes to the stock market – the economy doesn’t have to do well to get good performance. It just has to be better than expected.

And “better than expected” inflation data has been a staple in the stock market for all of 2023 so far.

If you’re skeptical that the new bull market will continue, consider Sir John Templeton’s famous quote: “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

Right now, it’s safe to say we’ve moved past pessimism. One could argue that sentiment has even reached the optimism stage at this point. But I think there is a long way to go before we reach any meaningful level of euphoria in the stock market. And historically, even when we reach optimism, that phase can last quite a long time.

This is why – since 1877 – the average bull market has lasted about 42 months on average. Considering this one began just 9 months ago, we could have a ways to go.

But didn’t the housing collapse cause a stock market crash in 2008?

Yes, but this time is quite different. I don’t see a housing downturn spilling over into the broad stock market this time around.

Back then, the housing bust resulted in waves of defaults on subprime mortgages (thanks to years of shady lending practices). This led to defaults in mortgage-backed securities — which had been packaged and sold for several years leading up to the crash, putting the whole financial system at risk.

This time, around, lending standards are significantly higher. So we aren’t likely to see another wave of defaults on mortgages. It would simply be a wave of investors selling and taking their equity elsewhere.

Summary

In the aftermath of covid economic shutdowns, we saw a significant acceleration in the decline of housing inventory that began after the 2008-09 financial crisis. This led to a natural price boom because when there’s less of something, prices go up.

This price boom lured in lots of new investors, causing prices to inflate even further. And I believe we have reached bubble territory, meaning prices will fall significantly.

Rental vacancies and multifamily construction have both gone up significantly – a trend that I believe will continue. And when there’s more of something, prices go down. So I think rents will continue to level off and eventually decline.

Real estate investors seem to agree. Over the past year, we’ve seen them flocking to the exits. Should rents continue their downward momentum, this would likely accelerate.

And individual buyers – especially first-time buyers – will likely opt for cheaper rents versus expensive purchases.

Between a lack of investors, a lack of individual buyers, and declining investor ROI – this could potentially lead to a liquidity panic.

Even if there is no panic and subsequent crash, there now appears to be a better alternative. The stock market has recently entered a new bull market. And if this trend continues, this would offer stiff competition to real estate in an investor’s portfolio.

At the very least, I think real estate will underperform the stock market in the coming years.

_________________________

Nothing in this article should be taken as advice or recommendation. If I haven’t done any planning for you, I am not qualified to give you specific advice. Nor would you want to take advice from someone who doesn’t know anything about you. Forward looking statements are opinions I’ve formed, based on available information. They could turn out to be wrong. This is why I prioritize long-term financial planning over short-term investment management.