Please note this is an oversimplification and is simply meant to illustrate a concept. If you were to poke holes in this analysis, I would likely agree with you. It’s a hypothetical scenario that should not be relied upon to make any planning decisions of your own. I realize there are other factors that could cause significant variance. There is also a “Rule of 55” that sometimes applies to your employer-sponsored retirement plan. It rarely comes up as a viable option, but it allows you to begin taking penalty-free withdrawals from the plan at age 55. The following scenario is more common for people that work for many different employers throughout their careers.

_________________________

We’ve all heard conventional wisdom: contribute as much as we can to our 401(k)’s until we retire in our 60’s.

Additionally, we are told we better have enough saved by the time we retire. Because at retirement, our investment portfolio shifts from the “accumulation” phase to the “distribution” phase. Meaning we are no longer growing the size of our savings, but rather spending it down until we die. Running out of money becomes a big risk.

I reject this kind of conventional wisdom. I’ve worked with many clients who – with good planning and counseling – have been able to retire sooner than expected. This is what I want to talk about in today’s newsletter.

Meet the Smiths

The Smiths are a typical (hypothetical) middle class family. They make a decent living and need two incomes to support their family.

- 40 years old

- Married and filing jointly

- $150,000 annual household income

- 2 kids

- Contribute 10% of their salaries to their 401(k)

- Combined 401(k) balance of $250,000

Based on this information, we can estimate their monthly “take-home” pay to be $8,565. Which comes out to an annual take-home pay of $102,780.

The average annual expenses per household in the US is $66,928. But let’s say the Smith’s spend a little more. They don’t like pinching pennies. They prefer to enjoy life. They spend $2,000 per month more than the average US household. Which comes out to an extra $24,000 each year. So, all in, their annual expenses are $90,928. Subtract their annual expenses ($90,928) from their annual take-home pay ($102,780) – and they have a small cushion of $11,852 each year.

Since all their retirement savings are going into their 401(k)’s, they cannot retire any sooner than 59 ½ – otherwise they will have to pay hefty early withdrawal penalties. And this is based on today’s rules. With life expectancies expected to continue climbing, is it possible the withdrawal age is raised in the future? I don’t know, but I wouldn’t completely rule it out.

Meet the (early retiree) Smiths

After the Smiths met with a financial planner, they realized they had more options than they thought. Their financial planner explained that they could potentially retire early.

If they stopped contributing to their 401(k)’s – and instead began contributing to a “taxable” investment account (non-retirement account) – early retirement becomes a possibility. And with more mindfulness and intention around how they spend their money, they could increase the probability of realizing this dream.

Assuming the same data as above – if they eliminated their 401(k) contributions – we can estimate their monthly “take-home” pay to be $9,540. Which comes out to an annual take-home pay of $114,480. If we assume their annual expenses stay the same ($90,928), this leaves them with a cushion of $23,552 each year.

Now, let’s say they use that cushion to contribute $20,000 annually to an S&P 500 index fund within a non-retirement account. If we assume an average annual return of 10% (which is reasonable, considering the average annual return of the S&P 500 has been 11.82% since inception in 1928 and 11.88% since 1957) here is what they could potentially have when they are 55:

And since there is no age limit on when you can withdraw money from a non-retirement account, they can immediately begin to use this money to fund an early retirement.

At this point, their kids are grown and on their own. And they no longer have to commute to and from work every day. So their expenses have dropped by about 25% – from $90,928 down to $68,196. Which comes out to $5,683 in monthly retirement expenses.

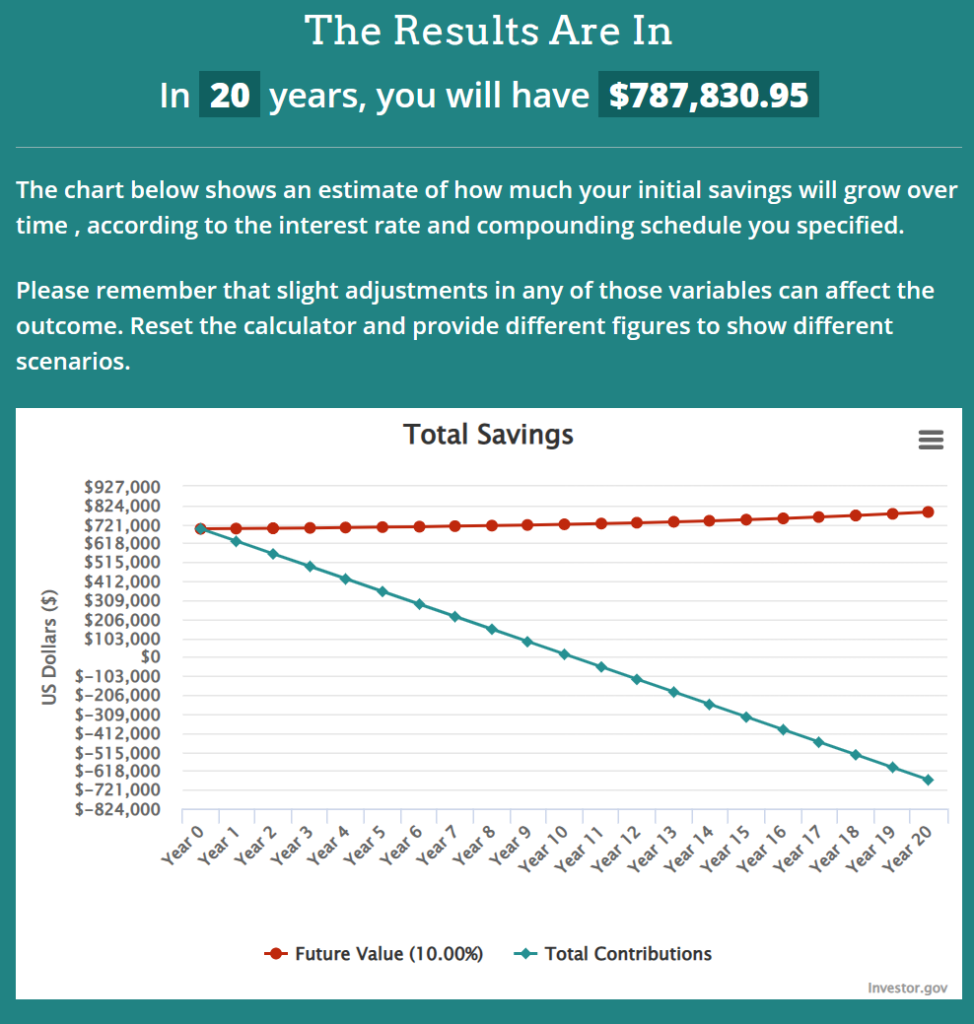

Assuming the same 10% annual growth rate, here is what the value of their non-retirement account could potentially look like if they withdrew this amount each year for the next 20 years (until they turn 75 and will be required to take distributions out of their 401(k) assets).

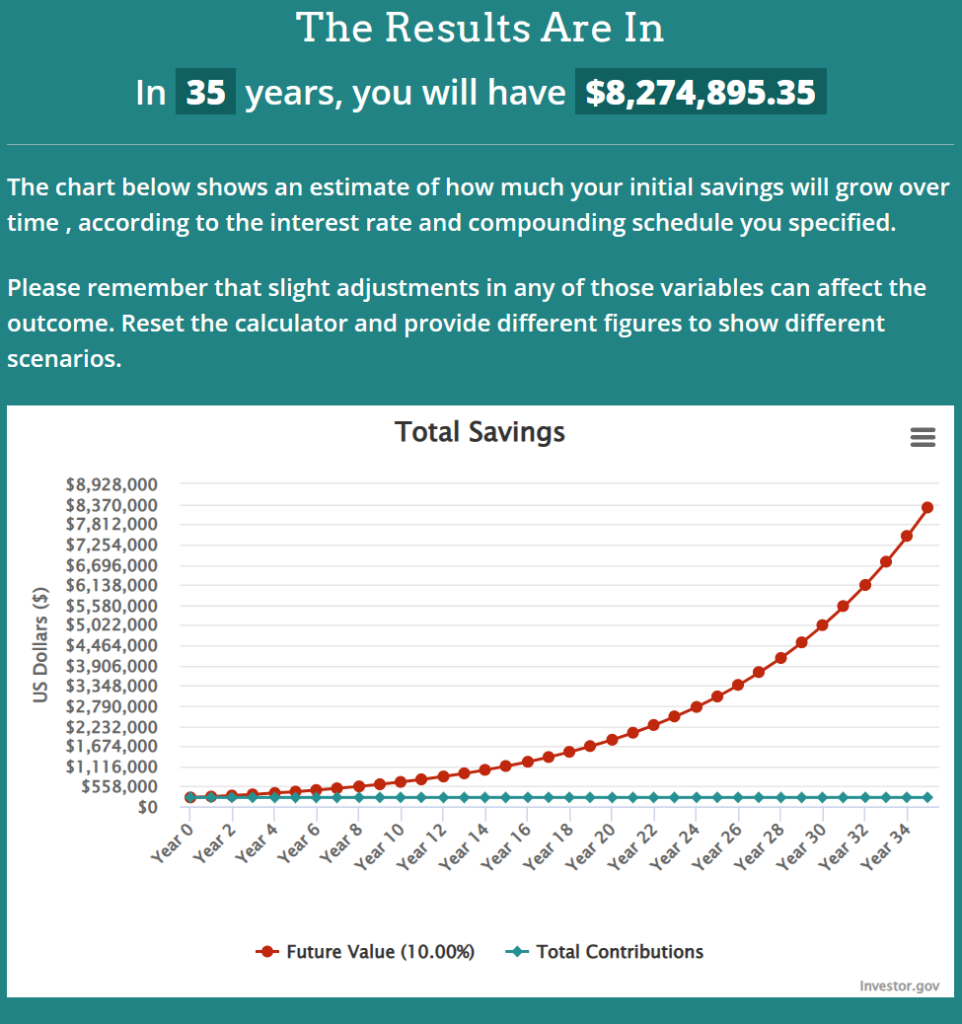

But let’s not forget about those 401(k) assets. You know — the ones they stopped contributing to back at age 40. Remember, they originally had $250,000 saved at that time. Here’s what that could potentially look like at age 75 (again assuming a 10% annual return):

And this doesn’t even factor in social security, which would kick in at 70 or sooner. Which would alleviate some of the strain on their invested assets.

And they don’t HAVE to wait until 75 to take money out of the 401(k) assets. Clearly, they could use this pool as a buffer prior to this – if needed.

There are several variables that would vary in a real-life scenario. Most importantly, a 10% return every year will NOT happen. The stock market varies significantly from year to year. And if they withdrew money during a deep stock market decline, this plan would likely break apart pretty quickly.

Anyone using a strategy like this would want to make sure they have sufficient cash savings set aside, which can be used for withdrawals (instead of the investment portfolio) when they go through inevitable bear markets in stocks.

Once again, this isn’t meant to serve as advice of any sort. It is purely for informational purposes. Like I said earlier, to illustrate a concept. And that concept is that careful planning can help many people retire sooner than they think. If you ever have any questions about how this might apply to your situation, I’m happy to discuss.

_________________________

*hypothetical growth scenarios are calculated using the following Compound Interest Calculator