First things first: is there a bubble?

According to Investopedia, during a bubble, “assets typically trade at a price, or within a price range, that greatly exceeds the asset’s intrinsic value.” In other words, it’s when investor expectations get too far ahead of reality. Which pushes the price of an asset (a stock) higher than it’s actually worth.

Consider the “dotcom” bubble of the late nineties. There was excessive hype around the internet and how it would change the world as we knew it. As a result, they poured money into any and every internet (dot com) stock. And as you probably know, the more money that gets invested in stocks, the higher their prices go.

Looking back today, we know that they were right! The internet changed everything. But unfortunately, it took a little longer than most of them had anticipated.

Investor expectations got too far ahead of reality. As a result — beginning in 2000 — the S&P 500 crashed by nearly 50%. And it didn’t fully recover for seven years. Ouch!

I believe a bubble is potentially brewing today. Only today, it’s being driven primarily by AI hype. Just like the internet some twenty years ago, AI is also poised to change the world as we know it. But expectations might be getting a little ahead of reality.

To be fair, I don’t believe today’s market will lead to a spectacular pop like the dotcom bubble. Things are much different today.

Perhaps it’s better to think of it as a heavily inflated balloon instead. If you keep pumping air into that balloon, it will eventually pop. Similarly, if investors keep pumping massive amounts of cash into AI-related stocks, we could potentially see a dramatic pop.

But considering current circumstances, I think it’s more likely that the AI “balloon” will simply deflate to a smaller size. Of course, nobody knows when this will happen. And I could be wrong.

There’s a famous saying in the investment world that the market can stay irrational longer than you can stay solvent. In other words, investors who “short” — or bet against — a bubble can run out of money before it actually pops.

So, I’m certainly not advocating any drastic investment decisions. But it’s prudent to be prepared, just in case. If the bubble keeps inflating, my clients’ portfolios are designed to keep climbing. But if it pops, I believe they will be able to withstand it better.

Fundamentals versus Sentiment

When investing, it’s important to understand the difference between fundamentals and sentiment. Above — when I say “expectations got ahead of reality” — reality refers to the fundamentals of the investment and expectations refer to investor sentiment.

For example, the “fundamentals” of a stock are determined by looking at the current financial health of the business. Whereas “sentiment” is simply how optimistic or pessimistic investors are about the future of that business.

In the long term, fundamentals tend to win out. And today, market fundamentals look a lot healthier than they did during the dotcom bubble.

In the dotcom era, there were a lot of businesses with poor fundamentals and really high stock prices, driven by sentiment.

Today, many of the hyped-up AI stocks have very strong fundamentals. When you look at companies that are associated with the “AI trade,” you see some of the most successful companies in the world (Nvidia, Google, Microsoft, etc). These companies — along with their outsized representation within the overall stock market — have great fundamentals.

But just because a company has great fundamentals doesn’t mean that sentiment can’t still get too high. And today, I believe sentiment around many of these top stocks is being driven by more than just AI-hype. I believe they are also being driven by fears about high interest rates.

As you’re probably aware, the Federal Reserve recently raised interest rates at the fastest clip in more than 40 years and interest rates have stayed at this elevated level. When interest rates are high, investors prioritize current earnings more than future earnings.

When you can put money in a high yield savings account — earning around 5% risk free — there’s less incentive to invest in riskier things based on future potential. As a result, more stock market money gets concentrated into stocks that are viewed as safer bets in the short-term.

Additionally, many of these top companies are sitting on enormous cash balances. Why does this matter? For one, higher interest rates mean they’re also earning an enormous amount of money on this cash. On top of this, companies with mountains of cash don’t have to borrow as much money. Therefore, high interest rates don’t affect them as much as smaller companies.

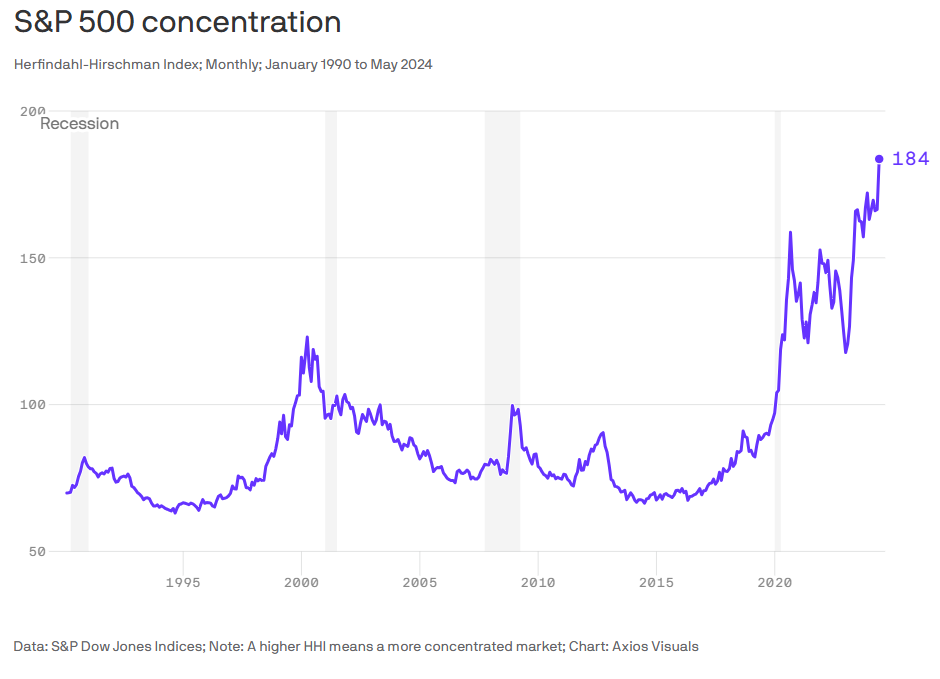

Despite strong fundamentals — between AI hype and interest rate fears — I believe investors are putting a huge premium on big tech stocks. And as a result, the market is significantly more concentrated today than it was during the dotcom bubble.

What happens if/when the AI excitement fades a little bit? What happens if/when the Fed starts cutting interest rates again?

We got a preview of the latter question just this week, when the Fed signaled rate cuts. The mere suggestion of it has resulted in a sharp decline in big tech stocks.

Nobody can predict the future. But I don’t need to predict the future to know that a prudent investment portfolio should be diversified away from just the overly concentrated S&P 500.

So what’s an investor to do?

Diversification is always important when it comes to successful long-term investing. And this is especially the case today. So, we need to look for other parts of the stock market that aren’t as hot as the AI / Big Tech part of the market.

To do this, we can start by looking at PE ratios. A PE ratio is simply the price of a stock divided by that company’s earnings. A high PE ratio can potentially indicate that a stock is overvalued. A low PE can potentially indicate that a stock is undervalued.

Let’s take a look at the current PE ratios of various parts of the stock market to compare:

As you can see above, the S&P 500 is very expensive relative to other areas of the market. The S&P 600 index measures small US companies. And the MSCI Emerging Markets index measures stocks that are located in emerging international markets.

Berkshire Hathaway is an investment conglomerate run by and built on the “deep value” investing philosophy of Warren Buffet. Deep value means they invest in businesses only if they believe sentiment (and the resulting stock price) is low, relative to fundamentals.

And while past performance is never an indicator of future results — and there’s no way to know if things will pan out the same way they did back in the dotcom era — I still think it’s helpful to take a look at how these different areas of the market performed back when that bubble popped.

The following chart is an illustration of this. As you can see, in the seven years it took for the S&P 500 (purple line) to recover, these other areas of the market did much better. This illustrates the critical importance of diversification. Especially when the market gets as concentrated as it is today.

Of course, depending on your circumstances, you may not want to have all of your investments in stocks. Bonds and cash are also great ways to diversify away from the concentration in the S&P 500.

Earning around 5% on cash-like investments is pretty attractive today. And if interest rates end up coming down, bonds would perform well. Their prices move inversely with interest rates, meaning your bonds would go up in value.

Most importantly, you want to make sure that your investment strategy is held within an overall financial plan that can tolerate all potential risks. In other words, your financial plan should ensure that your financial security and wellbeing is preserved regardless of what happens in the stock market.