What is affordable freedom? Well, it can mean different things to different people.

But when working with my clients, we define it as the ability to spend your time however you please, without much financial stress.

Notice, I didn’t say financial independence.

Financial independence means you never have to earn money again. Because you’ve built up enough assets, where you can support yourself for the rest of your life by making withdrawals from these assets.

Freedom, on the other hand, means that you are free to do whatever kind of work is joyful for you. Even if it means making less money.

Sure, financial independence is the ultimate goal. But why wait until you’re 60 years old to have financial freedom?

I view the path to financial independence in three distinct phases:

- Financial Security: you know you’ll be ok if you lost your job and had to find a new one

- Financial Freedom: you have freedom to do work you love, on your time schedule

- Financial Independence: you can do whatever you want, whenever you want, with whoever you want, without earning an income

The following video will provide an overview of how I help my clients tackle this process:

For most people, getting all the way to phase-3 financial independence requires amassing significant wealth. Even if you only need $50,000 per year of income to support your needs, you’d still need over $1,000,000 to be financially independent.

However, getting to phase-2 financial freedom doesn’t necessarily require massive wealth. When you throw in the extra variable of earning income doing something you love, it becomes much more attainable for most people.

Affordable Freedom Case Study

To illustrate what affordable financial freedom can look like, consider the scenario of a family that I work with. I think their story provides a very practical example of achieving phase-2 financial freedom.

For privacy reasons, I’ll change their names to John and Amanda.

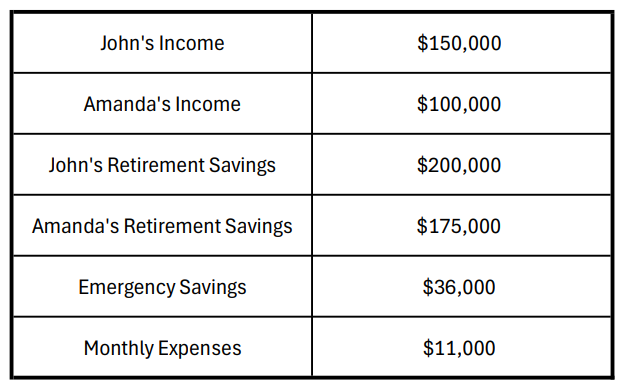

When we started working together two years ago, John was 38 and Amanda was 40. And they were a typical dual-income household. They had a great combined income of around $250,000 / year.

When we met, this is what their extremely-high-level-rounded-for simplicity’s-sake finances looked like:

After going through my 4-step financial decision-making process, they were able to immediately drop their monthly expenses by $1,000.

This is because two things became clear.

- There were expenses that were unaccounted for. In other words, they were spending more money than they thought.

- Some of the money they were spending was on things that didn’t really improve their quality of their life.

After building out a more intentional family budget of around $10,000 / month, they had an extra $1,000 / month to increase debt payments so they could pay off their loans sooner. And getting rid of those debt payments has been a nice boost to their monthly cash flows.

Furthermore, after the debt was fully paid off, that additional $1,000 / month started going into a high-yield savings account to build up their emergency fund.

And looking out two years, we knew their expenses would fall even more. Because starting this school year, their kids are all at the neighborhood schools.

Which means no more monthly daycare expenses. The daycare raise is a beautiful thing!

These very basic planning steps paved the way for them to be in the position they’re in today.

Amanda will be leaving her stressful job and moving to part-time work that she thinks she’ll enjoy a lot more. And it will also allow her to work around the family’s hectic schedule (school, activities, etc).

Thankfully for their family, John actually enjoys his work. So he’ll keep his job.

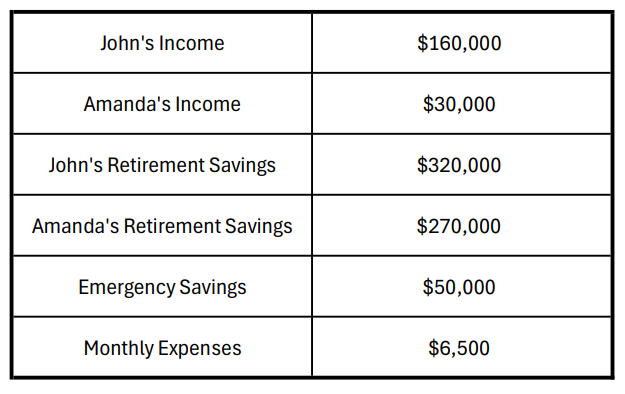

Going forward, here’s what John and Amanda’s extremely-high-level-rounded-for-simplicity’s-sake finances will look like:

Despite Amanda’s income falling by more than $70,000 per year, their annual gross income is still more than $100,000 more than their annual expenses.

And they’re in a lower tax bracket, too. Which helps their cash flows even more.

Amanda is no longer contributing to her 401(k), but she’s now maxing out a Roth IRA. And between 20 more years of compounding investment returns on her current retirement savings, the growth of her new Roth IRA, and John’s retirement savings — they will still have plenty of money in retirement.

Not to mention, the ability to access funds sooner. Because Roth IRA contributions can be withdrawn before 59 1/2, tax and penalty free, in 5 years.

Our expectation is that Amanda’s newfound freedom and happiness will have a ripple effect, improving the wellbeing and happiness of the entire family. Heck, just planning for it has improved their spirits over the past couple of years.

Affordable Freedom Framework

When I first started working with clients, I didn’t really have a framework for what I’m describing. It was just ongoing conversations about aligning time and money around values and life goals.

But as I started having these conversations on a regular basis, I decided to start having them with my wife on a more regular basis.

It’s funny — back when I was in college, I worked for a home improvement contractor during semester and summer breaks. And I remember going to his house and seeing a mess of unfinished home improvement projects.

And sure enough, I found myself in the same boat in my career as a financial planner. Helping others with their financial lives, while not fully addressing my own.

Out of this realization, I decided to put together a framework for how my wife and I can work better as a team in life. And now I’m sharing this with clients as well.

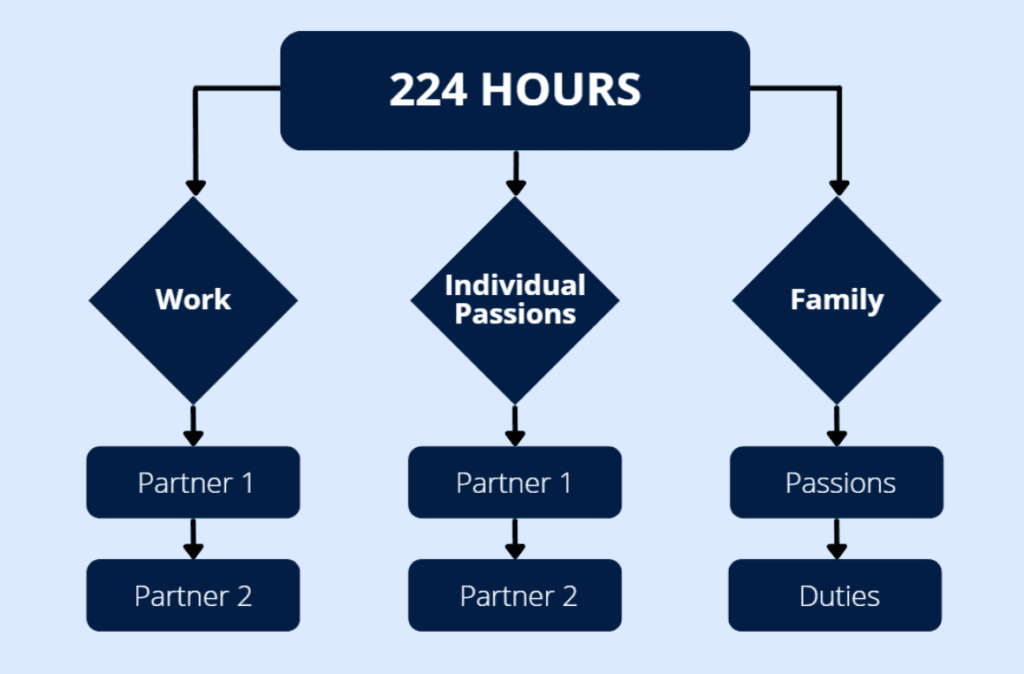

The idea here is that — assuming we sleep 8 hours per day — we have 112 waking hours in a week. So together, we have 224 waking hours in the week.

This framework allows us to measure how we’re spending that time. And by shining a light on how we’re currently spending our time, we can identify any gap — if any — between that and how we would like to spend our time.

If we determine there is a discrepancy between the two, we can then assess our financial needs with a little more intention — using the 4-step financial decision-making process I referenced above.

This allows us to determine if there might be any room to sacrifice some of the money we’re earning, in exchange for a little more time. Which can be applied to get us closer to the ideal allocation we’ve identified.

For my wife and I, we’re financially set right now. Despite the fact that my income is about 1/4 of what it used to be when I was in my corporate career. Because we have enough between our two incomes.

And that extra time is incredibly valuable. And how I spend that time is bringing us closer together as a family unit.

Eventually, I plan to earn enough that — if she wants — she can quit her job. But for now, we know we’re good.