The US labor shortage that isn’t going away

I believe the most pressing economic issue our country faces today is the anticipated labor shortage. In other words – by and large – US businesses cannot find people to fill the jobs that are available.

And in this week’s post, I’m going to discuss how this can potentially impact your investment accounts.

As you can see in this chart from the Congressional Budget Office (courtesy of Business Insider), the growth rate in the US workforce has been falling significantly for quite some time. And it’s expected to continue falling for the foreseeable future.

Why is this happening?

According to the US Chamber of Commerce, there are four main drivers of this trend:

1) Early Retirements / Aging Workforce: The covid pandemic drove more than 3 million adults into early retirement. And on top of this, younger generations are having fewer children than previous generations. Which means fewer future workers as well.

2) Low Immigration: Net international migration to the US is at its lowest level in decades. The impact of immigration on the US population dropped by 76% between 2016 and 2021.

3) Childcare: The pandemic decimated the childcare industry. And it still hasn’t recovered. Fewer options forced many parents to stay at home with their children. Between this and general inflation, childcare costs have soared. Which makes it harder to justify going to a job and paying for childcare.

4) New Business Starts: As I talked about a few weeks ago, we’ve seen a massive boom in new businesses since the pandemic. And that’s probably not going to stop. In 2020, 2 million individuals made six figures on social media. When you can do that from the comfort of your own home, why would you go back to work for someone else?

Whatever the case, US workers appear to be less dependent on companies these days.

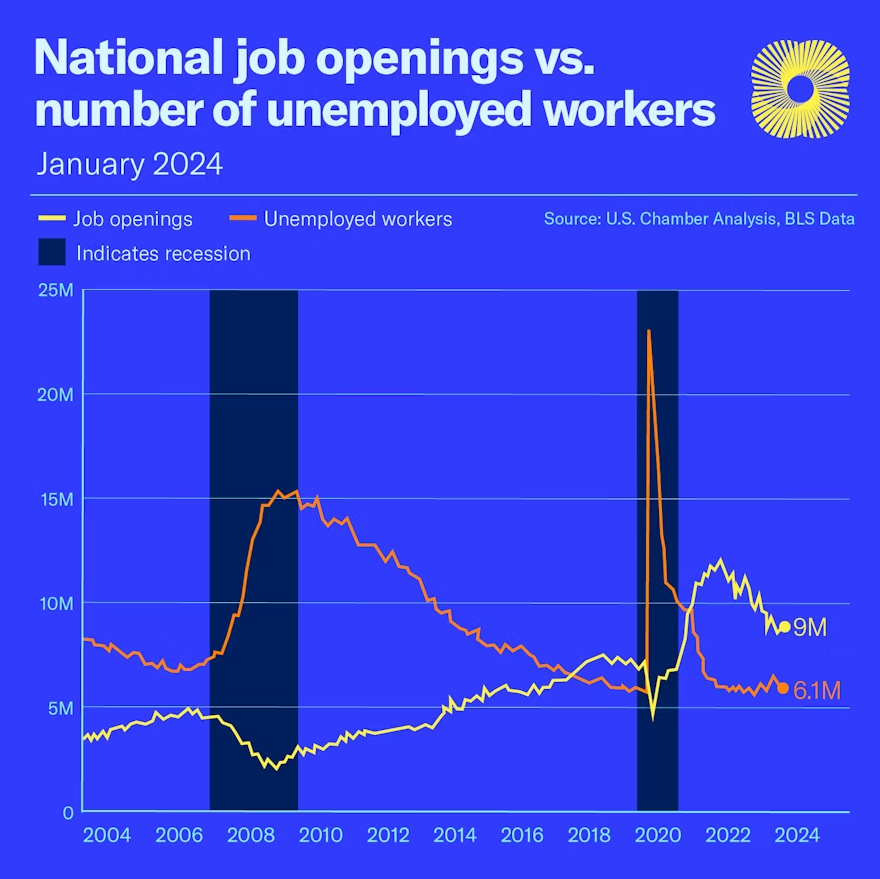

The chart below from the US Chamber of Commerce illustrates that – other than a brief interruption during the covid recession – we’ve seen an increasing trend of more job openings than unemployed workers, since 2017.

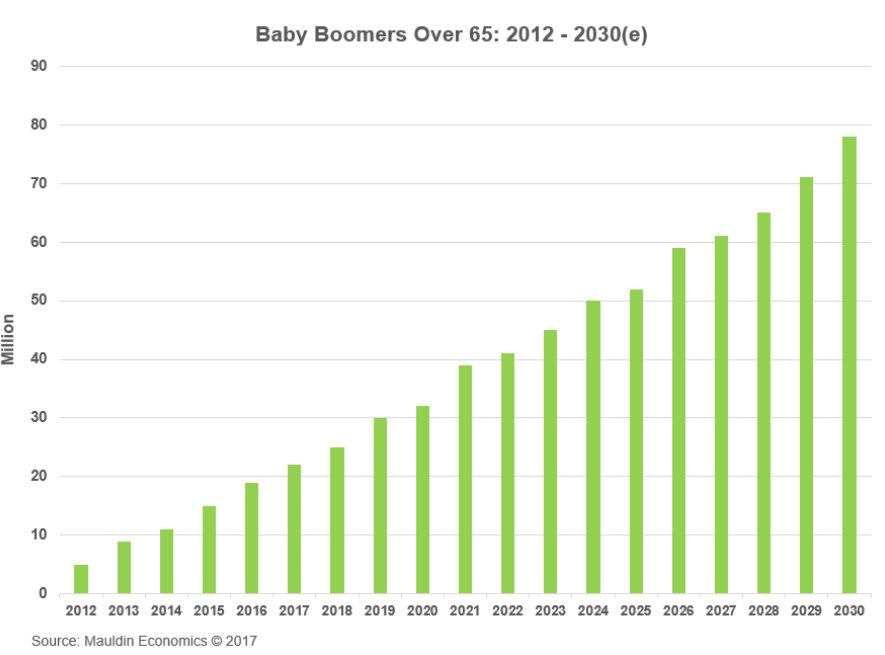

And I think the next chart from Maulden Economics illustrates the biggest driver of this trend.

In 2011, the first group of baby boomers turned the traditional retirement age of 65. And since then, this has accelerated rapidly.

Once again, this helps explain why companies are struggling to find workers. And as you can see, the trend is only going to continue.

To be clear, there are certainly plenty of people in the US that could potentially replace retiring baby boomers. After all, millennials and gen z are now the largest segments of the population.

But – given the other factors listed above – it appears the aging workforce will be too much to overcome. And that’s why the labor shortage is probably here to stay.

Healthy inflation seems inevitable

Fewer workers means higher wages. This is simple economics. If there are fewer workers, companies are forced into a bidding war for those services. And that will drive up the level of wages they must pay.

This will likely lead to elevated inflation, due to an economic phenomenon called “wage push inflation.”

However, this kind of inflation isn’t necessarily a bad thing for the economy.

For one, slightly elevated inflation means people and businesses are continuing to buy stuff at a consistent or increasing rate. If they weren’t, then prices would need to fall in order to incentivize more purchasing.

As I’ve stated before, some inflation is actually a sign of a healthy economy.

Furthermore, as long as wages are rising in an amount that is comparable to prices, inflation doesn’t hurt the consumer.

If the price of a loaf of bread goes up by 10% and my income also goes up by 10%, they cancel each other out. My contributions to the economy continue, uninterrupted. And if this happens at scale, it means overall economic growth continues, uninterrupted.

But there’s a more dangerous inflation lurking

Despite the recent trend of “reshoring” – or bringing production and manufacturing operations back to America – macroeconomic conditions around the world tell us that this trend may not be sustainable.

No matter how much our politicians or business leaders want to do this, it seems increasingly likely that they’ll be forced to pivot.

The labor shortage puts the US economy in too precarious of a position.

Unless we start letting a lot more people into our country in a short period of time, US companies will probably be forced to – once again – ramp up their outsourcing efforts.

If we can’t even fill the job openings we have now, how are we going to fill more job openings by bringing overseas operations back home?

And unlike in the past, it appears the US could be the weaker party in these negotiations.

In the past, we outsourced in an opportunistic manner. By sending jobs overseas, US companies exploited cheap labor. This lowered their costs dramatically. And lower costs increased their profit margins.

Going forward, it looks like we’ll be outsourcing out of necessity. And that puts more leverage in the hands of emerging market economies.

We may actually need them more than they need us.

For one, we’ve spent decades enriching emerging economies and their workers. They now have more job opportunities and wealth than ever before. So, it’s becoming harder to find workers that are willing to work long hours for table scraps.

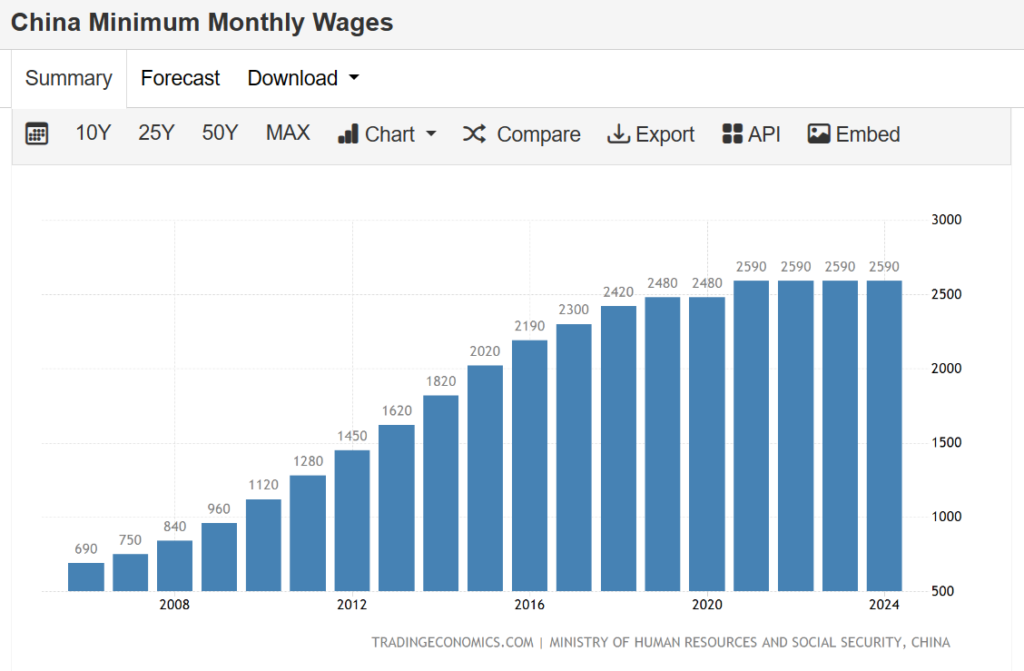

The following chart from tradingeconomics.com shows the rise in wages for Chinese workers over the last couple of decades. As you can see, labor isn’t nearly as cheap as it used to be.

And more recently – after major supply chain disruptions from covid shutdowns – US businesses began a trend called “near-shoring.” Which meant moving operations to Mexico instead of China.

Because of Mexico’s close proximity to the US, delivery of goods is much faster and easier – which creates more resiliency against future supply chain disruptions.

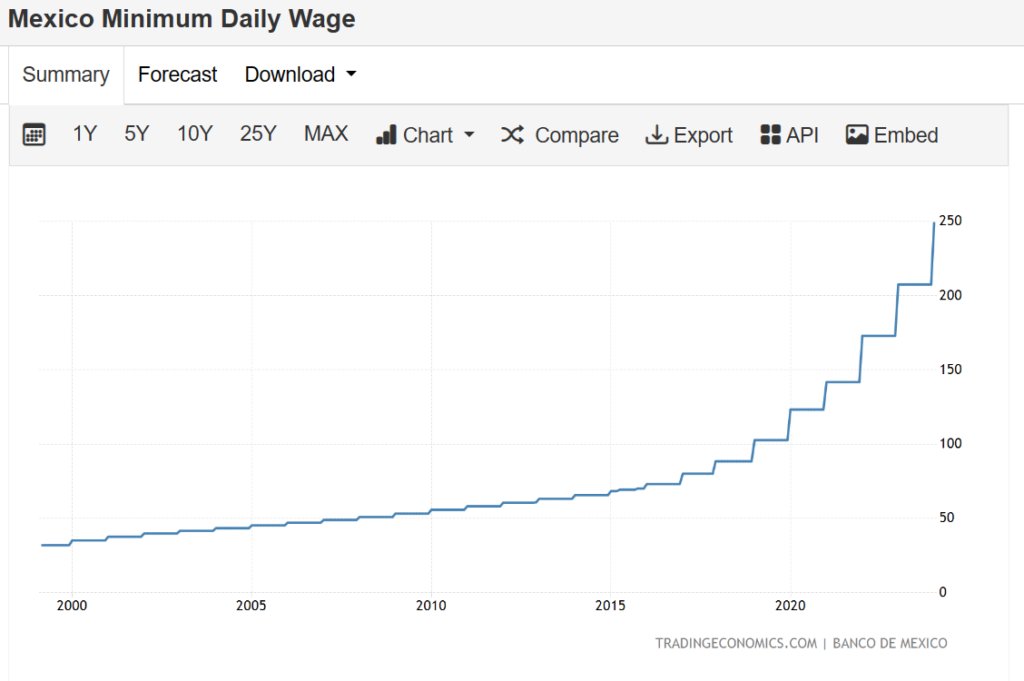

But as you can see in the following chart from tradingeconomics.com, wages in Mexico have spiked significantly since this trend began. Wages there have more than doubled in just four short years, after taking more than a decade to double previously.

So – as it stands today – outsourcing jobs abroad is a lot more expensive than it used to be. If the US labor shortage forces businesses to ramp up these efforts, those costs will only continue rising.

Once again, this is basic economics. If there’s more demand for foreign workers, then US businesses will end up in a bidding war for those services.

Because of all this, there’s a very real risk that:

- The cost of manufacturing overseas will continue to rise

- Those higher prices will then be passed on to the US consumer (higher prices)

And unfortunately – unlike the inflation I talked about earlier, this type will not be offset by higher salaries for US consumers. Because the higher salaries will be earned and spent by foreign workers in their home countries.

What this means for your investment portfolio

This all sounds like terrible news for our investments, doesn’t it?

Well, it’s not great. But it’s also not necessarily bad.

Assuming labor costs – be it here in the United States or abroad – continue to rise, US businesses will probably look for ways to reduce the amount of workers they need to hire. And one way to reduce the amount of required workers is to invest in technology.

We’ll probably see corporate America continue to make big investments in things like artificial intelligence, robotics, digital infrastructure, and other methods of automating business operations.

I’m guessing that the US stock market will continue to be driven by the technology sector for the foreseeable future.

Additionally – as an aging population drives more demand for healthcare services – I expect healthcare costs to continue rising from their already exorbitant levels, here in the US. And this should incentivize more innovation within the healthcare sector.

And finally, I think international stocks are attractive at the moment. Particularly the emerging market economies that will benefit from the macroeconomic issues outlined above.

If you don’t have international stocks in your portfolio, it is my opinion that you don’t have a properly diversified portfolio.