To understand why I think the current bear market is almost over – and why a new bull market will begin soon – we have to understand what caused this bear market in the first place. And it comes down to two things: inflation and Fed interest rate hikes.

These two things have been talked about nonstop all year long. Everyone knows it’s an ongoing problem. Everyone knows this hits corporate earnings. So it’s already priced into the stock market. These expectations are precisely why we are in a bear market right now – having seen the S&P 500 drop as much as 25% from its high back in January.

In order to get further downside in this bear market, I believe we would need to have one of two things happen.

1 – The impact of inflation and rising rates would need to be worse than expected

2 – We would need an unknown and unpredictable negative event (black swan)

A black swan event, by definition, cannot be predicted. An example of this would be the entire world economy shutting down in response to covid-19. If this happens, all bets are off. And my forecast goes down the drain.

So, let’s focus on the first one. Will the impact of inflation and rising interest rates end up getting even worse than currently feared? This would be pretty hard to do, in my opinion. Currently, investor sentiment is at its worst level since the 2008 Financial Crisis. And in April, it was even lower than the depths of the Financial Crisis. And the news flow seems to get more pessimistic by the day. The market expects this situation to be really bad.

The basis for my forecast is pretty simple: There’s too much pessimism and I think things will turn out better than expected.

For one, it’s a low bar to exceed right now. Additionally, it looks to me like inflation is – and always was – a temporary issue. It was just exacerbated when corporations padded their profits and war broke out in Ukraine. As these pressures are easing up, and supply chains are clearing up, this temporary inflation could start fading faster than we think.

Given all the fear and pessimism around this issue, that would be a powerful positive surprise for the stock market. And I think it will serve as a catalyst to usher in a new bull market.

What is inflation?

Inflation is a complex topic. There are a lot of nuances. And there are many things that can contribute to it. But in its simplest sense, it is when a currency’s purchasing power is eroded. Often, it is referred to as a period when more money is chasing fewer goods.

Basically, if there’s a lot more money floating around, but there’s not as much stuff to buy with it…then you’re going to have to part with more of your money in order to be one of the people that’s able to acquire the stuff.

So the most significant inflation would occur when there is both more money and fewer goods. But we also would see inflation if there was more money (when there’s more of something, it’s not worth as much) chasing the same amount of goods. Or if there was the same amount of money chasing fewer goods (when there’s less of something, it’s worth more).

Said differently: inflation can occur if the value of money decreases OR if the value of goods increases. Either way, it costs more to buy stuff.

What caused the current inflation?

Many believe the current inflation is the worst scenario above: both more money and fewer goods. They claim that central banks have been “printing money” since the 2008 Financial Crisis. The chickens are finally coming home to roost.

And now, supply chain disruptions (from covid shutdowns and war in Ukraine) are hitting us from the “fewer goods” side of the equation.

They claim the Fed “dropped the ball” in labeling inflation transitory. And in doing so, let it spiral out of control. We even hear some people say we are headed for 1970s-style inflation.

I don’t buy into this. I think the Fed was actually correct in calling this inflation transitory in early 2021. It should have been. I believe this inflation was exclusively a result of supply shortages. Not excess money supply or increased demand.

A quick study on M2 money supply helps to illustrate this. M2 money supply is a good representation of money circulating through the economy. Therefore, it is a good indicator of inflationary pressures. M2 represents things like cash, checking deposits, and “near money” such as savings deposits, money markets, and other assets that are highly liquid (easily converted to cash).

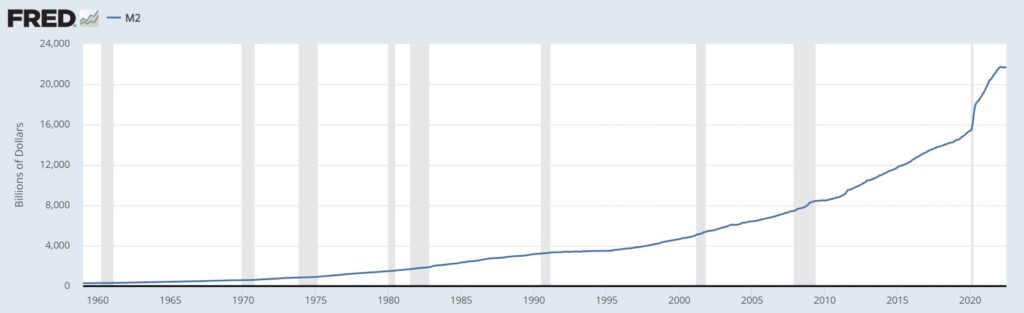

Take a look at the chart below, which illustrates the history of M2 money supply. Keep in mind, this is a linear chart, not a logarithmic chart, so the increases to the right look more significant than they actually are.

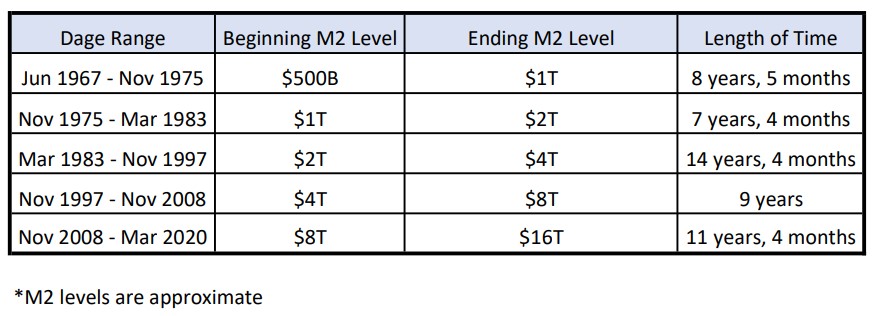

Now, let’s look at how long it typically takes M2 money supply to double. This data was collected from St. Louis Fed:

Then, from the beginning of covid shutdowns – March 2020 – M2 money supply grew all the way to nearly $22T in just two years. At this pace, it would have doubled in about five years.

Clearly, this is the fastest rate of increase we’ve ever seen. And furthermore, the period of money “printing” since 2008 was pretty tame. It was the second longest doubling period on record. Not a big contributor to inflation today.

This helps explain why I think they were right in calling it transitory. They increased money in circulation to help keep people and the economy afloat, knowing it would cause a spike in inflation. But once we worked through supply chain issues, supply levels should catch up to demand (which would inherently slow a bit after the initial “pent up covid demand” had been spent), bringing inflation back to a more normal level.

But corporations saw it as an excuse to increase their profit margins. After all, they had just suffered through shutdowns and a whole lot of lost revenue. So, instead of absorbing the hit, they used temporary inflation as an excuse to raise prices. It makes up for a little bit of their lost revenues from shutdowns, while also setting them up for fatter profit margins when this temporary inflation passes.

And yes, I get that this is to be expected. But maybe the Fed had some faith that companies would actually buy into their own sales pitches of “we’re all in this together.” Either way, this situation alone probably would have been less painful.

But then a war happened. And maybe you could say they should have predicted this. But I don’t know. Predicting how Putin is going to act? That’s a bit nitpicky.

And so, inflation really started permeating throughout the economy. So now, it’s sticky. And we’re all feeling it. This creates massive public support to fix it.

So now, the Fed changes their tune. Maybe they were thinking:

“Well, raising interest rates is our tool to fight inflation. And everyone wants us to do that. Cool, let’s start raising rates. It will increase demand for US debt (reinforcing our borrowing ability). It will strengthen the dollar while hurting other currencies (reinforcing the US standing atop the world order). It will also give us the ammunition to combat a future stock market collapse, in the event hiking does too much damage (having the ability to cut rates again).”

And the crazy thing is this: raising interest rates doesn’t do much to bring down the current type of inflation. Raising rates decreases demand, through higher borrowing costs. But this was never demand driven inflation. It was supply driven inflation. And people typically aren’t taking out loans to pay for their living expenses.

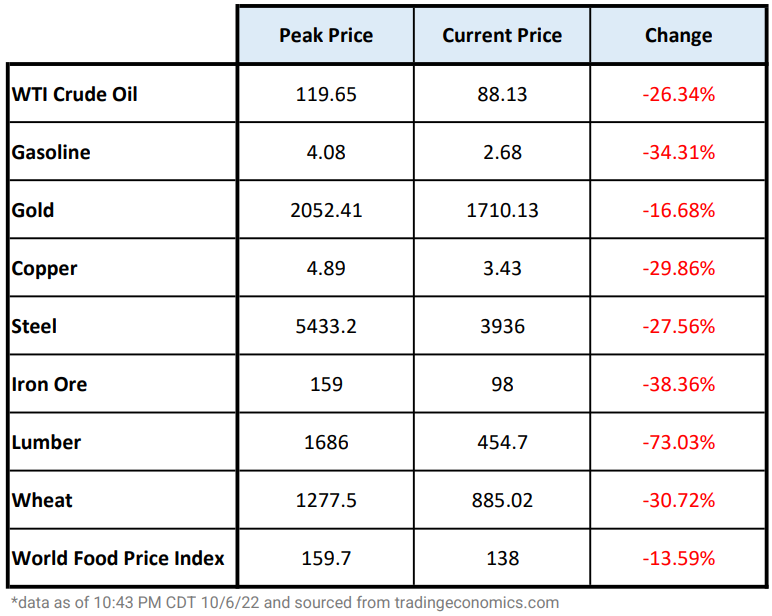

So here we are. Inflation is tough and we all hope it will go away soon. The good news is, I think it will. The commodities markets are telling us as much. And just like the stock market tends to be a leading indicator of the economy, the commodity markets tend to be a leading indicator of inflation. If the market expects the economy to improve from current levels, the stock market tends to go up. And if the market expects higher inflation, commodity prices tend to go up.

Here’s a look at some commodity prices over the last several months. It’s starting to look a lot like mean reversion after the unprecedented shocks from covid shutdowns. If this continues, it shouldn’t be long before these falling prices are fully reflected in the inflation rate.

Probabilities

Because nobody can consistently predict the future over multiple economic and market cycles, it is so important to consider the probabilities. And in this scenario, the probabilities also tell me it’s a good time to be invested.

Consider the primary drivers of the stock market right now:

1 – Q3 Earnings: These are expected to be bad – possibly the lowest since Q3 of 2020.

2 – Fed Funds Rate: Another big hike of 0.75% expected next month.

3 – Inflation Data: Expected to continue coming in way above the Fed’s target rate of 2%

And when things are expected, they are priced into the stock market. If some of these things start coming in better than expected (not even necessarily good), that could be a catalyst to the upside.

You could even argue that if any one of them comes in strong, it could potentially be a catalyst. For example:

- If Q3 earnings come in better than expected: This could indicate that the impact of inflation / higher rates isn’t as bad as we thought, so maybe we don’t have to worry about the Fed hiking us into a deep recession.

- If the Fed’s rate hike comes in lower than 0.75% – or they give forward guidance that pulls in their end-game projections a bit: This could indicate that businesses will start seeing better profit margins, so we should expect earnings to start improving.

- If inflation data starts coming in better than expected: This could create the expectation that the Fed will begin to lighten up on rate hikes, again suggesting that profit margins could start improving, so we should expect earnings to start improving.

Are these all theories? Yes, they are. And I think it’s kind of cool that this illustrates my point that nobody can predict the future all the time. It’s way too hard to predict how an entire human society – with all their collective emotion – will react to any of the scenarios we’re currently debating.

The best we can do is think as logically as possible and play the probabilities. And right now, I believe there’s a high probability that market expectations have gotten too low. Almost like a bubble in reverse.

What if I’m wrong?

Even if my forecast is wrong, I’m not too worried.

I could see two alternative scenarios:

1 – Continued Gradual Decline

The economic data consistently come in worse than expected, while the Fed hikes us into a deflationary recession / deeper bear market. But just like raising rates fights inflation, cutting rates fights deflation and stock market collapses. And given their aggressive rate hikes this year, they now have this tool again. Cutting rates has historically created a strong recovery in the stock market.

2 – Capitulation

This means panic selling. And it’s usually a fast drop in the stock market. Since it’s driven primarily by sentiment, the recovery tends to be very quick as well. This is extremely difficult to time correctly.

Either way, I believe being invested in stocks currently puts longer-term probabilities in my favor.

- With scenario #2, I’d rather be invested than try to time things – missing out on that recovery would be devastating to my long-term returns.

- While I don’t think scenario #1 is probable, given how pessimistic sentiment already is, it’s always a possibility. But I think if you have a 5-10 year time horizon or longer, stocks still represent a nice growth opportunity.

Trying to time these things often does more harm than good. Especially when we are already nearly -25% down in this bear market. And the average bear market decline is -36%.

I’m hanging tight and sticking to my plan.