Quick Refresher on Dividends

I’m sure you know what a dividend is. But here’s a quick refresher so we’re all on the same page.

Companies utilize the capital markets to raise money, which they can then use to operate their business. The two methods of raising money in the capital markets are selling bonds and selling stocks.

Bonds pay interest. Basically, if you buy a bond, you are lending money to the company. When the bond matures, they’ll give you back your money. And along the way, they’ll pay you interest.

If you buy a stock, you are not lending money to the company — you are becoming a partial owner of that company. Therefore, you do not receive your principal back after any period of time. There’s no guarantee of what you’ll get back. If and when you decide not to own the stock anymore.

Because the company is not borrowing your money, they do not pay you any interest. But they can choose to pay dividends. Which are paid on a regular basis — typically monthly or quarterly.

Our (often irrational) Love Affair with Dividends

For those that don’t know, I spent most of my career on the product distribution side of the investment industry. This means that I worked for fund companies.

You’ve probably heard of mutual funds. And given their significant rise in popularity, you’ve probably heard of exchange traded funds (ETFs) too. But there are lots of different kinds of funds in the investment world — such as unit investment trusts, closed end funds, and structured products, to name a few.

I won’t go into the details on how each of these funds work. That’s irrelevant to my point.

The point I’d like to make is this: During my decade-plus career of working for these companies, funds that focused on a dividend strategy (investing in stocks that pay high dividends) were almost always the best-selling funds for my firm.

I know this is anecdotal — and I wasn’t able to find any data that shows exactly the amount of assets that go into these funds. But all my previous employers put significant resources into developing new-and-improved dividend strategies.

Why? Because it’s the easiest sales pitch of all time.

When investors receive a dividend, they receive something that is tangible and easily quantifiable. While speculation on future value of the stock is intangible and uncertain.

As long as that dividend comes every month, many investors don’t even pay attention to much else.

Especially retired investors. They think, “this is great…I’ll never have to touch my principal…I can just live off the dividends.” It seems like “free money” to them.

And it’s not just fund companies that understand this flaw in thinking.

The companies themselves understand the appeal of paying a dividend to shareholders. Paying or increasing a dividend can often lead to a rush of new investors.

Think about this for a second.

Bad and mediocre companies — who don’t create a whole lot of value and struggle to grow their business — can create an illusion of value by paying a dividend.

If their business isn’t growing very much, their stock price probably won’t go up that much. As a result, they may have a difficult time raising more money through the issuance of stock.

But they know people love dividends. So they can pay a dividend and voila! They’re able to raise more money.

Now, I’m not saying all dividend-paying companies are bad. I’m just explaining the fallacy of investing in stocks merely because they pay nice dividends.

The (inefficient) Truth about Dividends

When you own the stock of a company that pays a dividend, they’re simply giving you your own money back.

All they’re doing is transferring cash from the business to you. And as a shareholder, you are a partial owner of the business. So, the portion of cash they distribute to you was yours to begin with.

As a matter of fact, the second they pay that dividend, the value of the stock you own usually drops in an equal amount. You net zero.

But it FEELS like you got something.

What if you owned the stock of a really well-run company? A company that had a great business model and was creating significant value for their customers? Wouldn’t you prefer they reinvest that money in the business, so the value of the stock you own could increase MORE than the amount of the dividend they could pay you?

Personally, I’d rather own a company whose stock price goes up by, say 10% — rather than a company whose stock goes up by 5% and then they return all of that to me in the form of a dividend. With the former, I can sell some of the stock if I want to collect some income — while leaving the rest of the gain invested to continue growing my wealth.

And that’s the inefficient truth about dividends.

When you receive a dividend, the money doesn’t grow anymore. It becomes inefficient capital. And you don’t grow your wealth by owning inefficient capital.

Legacy telecom companies are great examples of companies that pay a high dividend. But are terrible at innovating and creating value for customers and shareholders. For example, AT&T currently pays a whopping 6.66% dividend and Verizon pays an even more impressive 6.76% dividend.

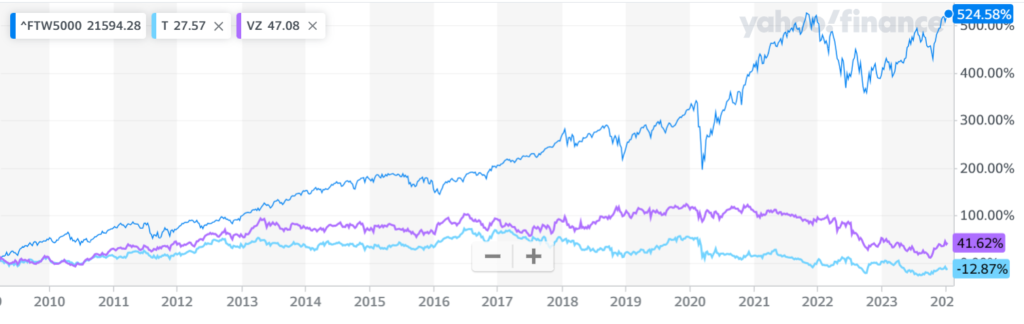

But as you can see in the chart below, the performance of their stock prices has been miserable for a long time.

This chart shows Verizon and AT&T stock versus the Wilshire 5000 Index. The Wilshire 5000 is a representation of the entire investable US stock market.

Wouldn’t you rather just own an index fund — so you can own both great companies and dividend-paying companies — and create your own dividend by selling a little bit each year?

Great Companies Use a Balanced Approach

Now — again — all of this isn’t to say that dividends are bad. There are great companies that pay dividends. In fact, I would prefer a company that pays a small dividend to a company that pays no dividend at all.

Why?

Because paying a dividend creates accountability to shareholders. If the company must pay a dividend to you on a regular basis, there’s an increased incentive to manage their finances in a responsible way.

However, as you can see above, paying a high dividend means the company you own has little incentive to be a great business.

Because they know — as long as you get your dividend, you’ll be happy.

And this is the great fallacy of dividend investing.