Wall Street is at it again. Trying to squeeze more money out of you.

Technology has disrupted the investment industry by drastically reducing costs for investors. And the internet’s bright lights of transparency have created a much more informed public.

People are now aware of the excessive fees and commissions that have historically been a staple among financial institutions.

This is great, in my opinion. It will allow the best advice and the best advisors to rise to the top.

But Wall Street isn’t going down without a fight. They’re constantly looking for ways to justify higher fees.

And the latest “shiny object” is called Direct Index Investing.

What is index investing?

To understand DIRECT index investing, you need to understand index investing.

Index investing is done through index funds. These are investment funds that are designed to replicate the performance of an underlying index.

Some of the most common indexes are the S&P 500, the Nasdaq Composite, and the Russell 3000.

Unlike traditional investment funds, they are not actively managed by a fund manager. They simply replicate the index and are adjusted periodically, in order to reflect any changes in the index.

This is great for two reasons:

- Managed funds are much more expensive. Index funds have significantly lower fees, which can improve your returns over time.

- Most professional fund managers can’t beat the indexes. Simply investing in the index often gets you better results.

When you invest in a traditional index fund, you purchase shares in a single investment.

For example – if you buy the Vanguard S&P 500 Index Fund (VOO) – you get EXPOSURE to all 500 companies within the S&P 500 index. But you only have one investment listed in your account (VOO).

What is direct index investing?

Direct indexing takes this a step further. It allows you to eliminate the fund structure and simply own all the components of an index separately within your investment account.

For example – instead of investing in the Vanguard S&P 500 Index Fund – a financial advisor can purchase each of the 500 stocks separately within your account. Instead of 1 investment, you now have 500 investments.

Why would you want to do this? Two main reasons are often cited:

1) Customization – You don’t have to own all 500 stocks with direct indexing. You can customize this, to exclude companies you don’t like or companies you think will not perform well.

Problem is…the more you customize, the more the portfolio becomes actively managed. And if over 90% of professional money managers cannot beat an index, why would you or your advisor be able to do so?

2) Tax Loss Harvesting – This is what financial advisors like to tout. My industry is always trying to prey on your fears of paying too much in taxes. It’s one of the most tried and true marketing tactics in their arsenal.

Tax loss harvesting means intentionally selling something at a loss, in order to “book the loss” for tax purposes.

As you probably know, you have to pay a tax when you realize “capital gains” (aka sell something for a gain). And booked losses can be used to cancel out these gains and minimize your tax liability.

With an index like the S&P 500, it isn’t uncommon for many of the 500 stocks to be down during a given year, while the overall index is up. Being able to sell these individual positions allows you to book losses.

Problem is…most taxpayers get zero benefit from this. In fact, a study from Aperio (the direct indexing arm of the largest asset manager in the world, Blackrock) shows that this only applies to 8% of US taxpayers.

What does direct indexing cost versus traditional indexing?

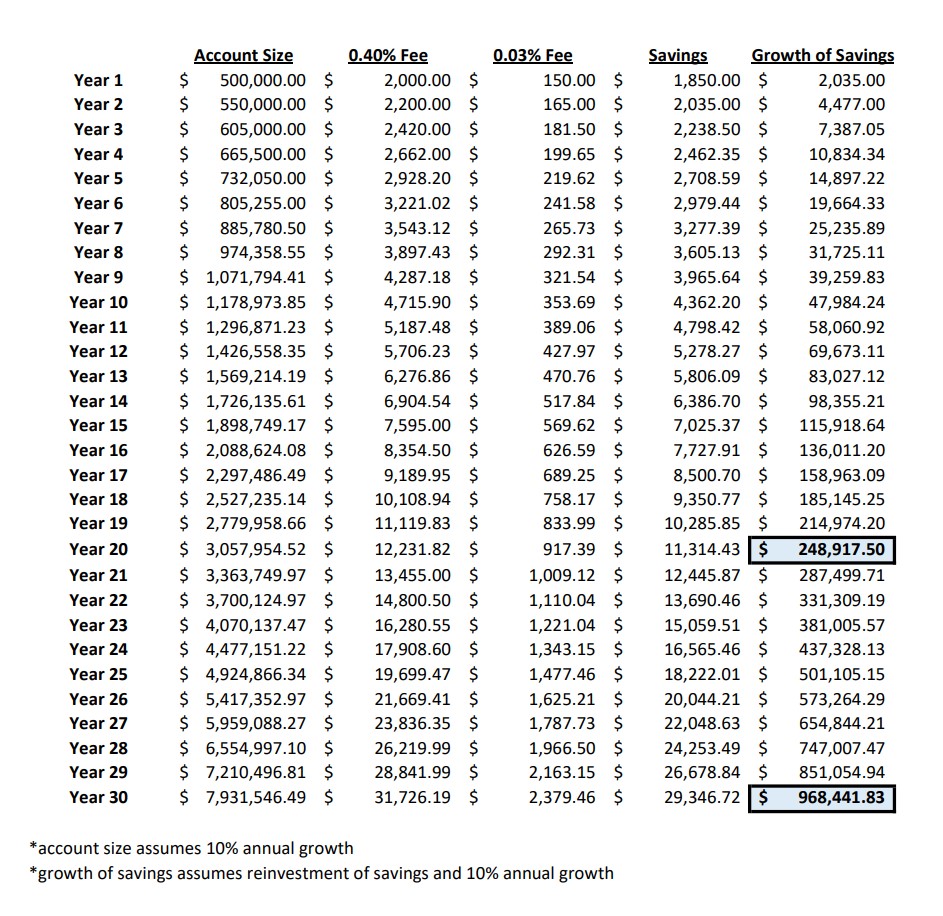

This is where the juice usually isn’t worth the squeeze for investors. Costs for direct indexing can vary, but it typically averages around 0.40% annually. On the other hand, the cost of owning the previously mentioned Vanguard S&P 500 Index Fund (VOO) is only 0.03% annually.

So let’s do a quick comparison:

S&P 500 Direct Indexing = 0.40%

Vanguard S&P 500 Index Fund = 0.03%

Difference = 0.37%

This may not seem like a lot, but let’s look at an illustration where the fees are applied over a 30 year time period.

Keep in mind, this illustration assumes exactly 10% returns every year. This is totally unrealistic. However – over a long period of time – 10% is a reasonable expectation for average annual returns. In fact, the average return since the S&P 500’s inception in 1957 (through 12/31/22) is 10.15%.

As you can see, this illustration shows that direct indexing – when you factor the difference in annual fees and growth in the stock market – would cost you a lot more money over time.

With this illustration, direct indexing would cost $248,917 over twenty years and it would cost $968,441 over thirty years.

These time horizons are much lower than the average investor’s lifetime. And they are reasonable for someone retiring in their 60’s.

Is direct indexing worth it?

For most people, direct indexing is not worth it. If your financial advisor recommends it to you, make them do the math and show you exactly why the added cost is justified for your particular situation.

Is it possible an advisor can save you a quarter of a million dollars in taxes over 20 years? Or a million dollars in taxes over 30 years?

Sure, it’s possible. But it’s not probable. At least not for most people.

The industry has simply taken a strategy that has historically been available only to ultra wealthy people and – thanks to technology – are now able to offer it to average folks.

It sounds cool. You can now invest like the big dogs!

But it’s just another shiny object.