Prioritize the Essentials

It’s amazing how much clearer and easier life seems to get when you distill it down to the essentials. Through that clarity, building wealth also becomes a lot easier. A great way to do this is through the Rule of Three. In writing, this is a method to make a story more impactful and memorable.

Similarly, when applied to our lives, this rule can help us maximize how impactful and memorable our personal narratives are. And in turn, how likely we are to live an intentional life and stick to our wealth-building plan.

So, we begin by asking the question, “what are the three most important aspects of my life?”

For me, it is:

- My most cherished relationships

- Activities and experiences with those people

- Purpose and Legacy

Then, I further break each of these into three sub-categories:

Relationships

- Nuclear Family (wife and kids)

- Extended Family (parents and siblings)

- Closest Friends

Activities

- Traveling

- The Arts

- Hiking and Outdoor Adventures

Purpose and Legacy

- Lead a happy and healthy family life

- Grow my business

- Improve my community

This clarity helps me use my most valuable resources, time and money, for what they are. Tools to build the ideal life for me and my family.

Spend Mindfully

Now that you’ve identified the most important aspects of your life, you can be mindful of how you spend your money. Expenses that don’t contribute to these things are not likely to improve your well-being and should be considered for elimination.

Ironically, spending less tends to make us happier (assuming all our basic needs are covered). Because we are using our money to maximize that which brings us sustainable joy and fulfillment.

And it also builds a nice financial cushion and greater wealth over time. Between increased savings and a lower cost of living, mindful spending can help us create a financial safety net. If we ever find ourselves in financial trouble, our lifestyle is easier to maintain. This helps us preserve what we are building for the future.

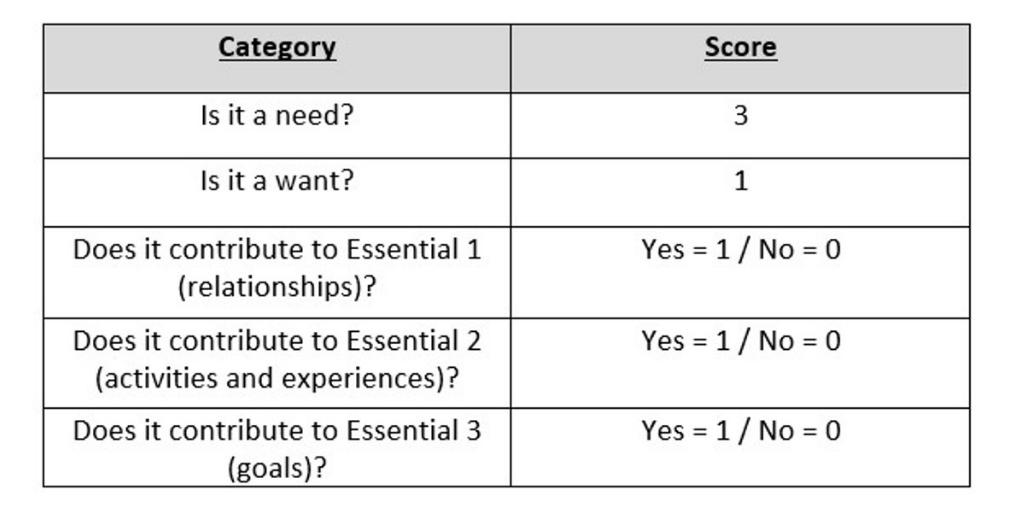

Here is a scale I use to be more mindful of, and prioritize, my expenses:

My threshold is 3. If an expense falls below this threshold, it is eliminated. If a need doesn’t contribute to any of my essentials, I look for ways to minimize that expense.

Here are a few examples:

Attending a sporting event with an acquaintance

- Need or Want? Want (1 point)

- Does it contribute to my most important relationships? No (0 points)

- Does it contribute to my most important activities and experiences? No (0 points)

- Does it contribute to my life goals? No (0 points)

- Total Points = 1 (below 3, do not spend money on this)

Weekend trip to hang out with my brother

- Need or Want? Want (1 point)

- Does it contribute to my most important relationships? Yes (1 point)

- Does it contribute to my most important activities and experiences? Yes, travel (1 point)

- Does it contribue to my life goals? Yes (1 point)

- Total Points = 4 (meets my threshold, spend money on this)

The car I drive

- Need or Want? Need (3 points)

- Does it contribute to my most important relationships? No (0 points)

- Does it contribute to my most important activities and experiences? No (0 points)

- Does it contribute to my life goals? No (0 points)

- Total Points = 3 (This is a need, but I will find a way to minimize it).

Obviously your needs, wants, and values are going to be different than mine. But I hope this provides a useful framework to think about how you are using your most valuable resources – time and money. This is truly the foundation of any financial plan. Without mindfulness and intention, it is very difficult to see any progress in our financial lives.