Basic investment advice will often tell you that owning a broad US index fund — such as one that tracks the S&P 500 — is sufficient diversification for your portfolio.

After all, even Warren Buffet has been known to proclaim “never bet against America” to anyone who will listen.

And it’s true that America has been the world’s economic leader for generations. And betting against that has proven to be a terrible mistake.

But to suggest that it’s sufficient to only invest in the US stock market is a lie.

Owning international stocks is not betting against America. It’s being an intelligent investor.

And if you want financial freedom — which I want for every reader of this newsletter — it would behoove you to be an intelligent investor.

It’s about playing defense

It’s obvious that investing in just one stock is pretty risky. Doing this means you’re betting that a single CEO and executive team will do all the right things to legitimately grow that company’s business.

And it’s also pretty obvious that investing in just one sector of the economy — be it technology, healthcare, finance, or energy — is risky. Depending on economic conditions, certain sectors can perform poorly while others perform well.

But for some reason, many investors do not apply this same logic to investing in only one country.

Which is odd, because — whether it’s regulatory changes, currency fluctuations, or monetary policy — there are several factors that could result in a single country’s stock market going from hero to zero.

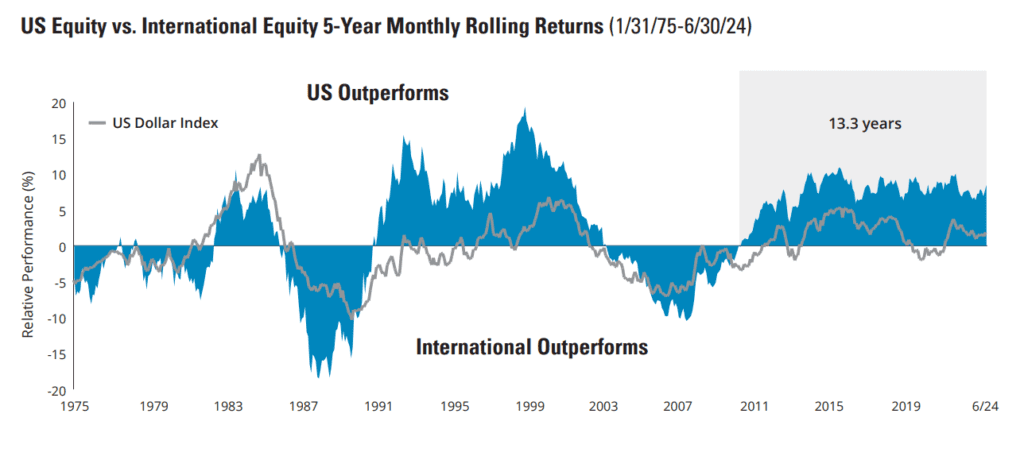

Because of this, history shows us that there have been several periods where international stocks were much better to own. The following chart from Hartford Funds illustrates this.

What if this trend were to reverse?

After all, the US has been outperforming for an abnormally long 13+ years.

Do you have enough international stock exposure to mitigate your risk?

And right now, it’s also about playing offense

The world has been experiencing increased globalization for a very long time. As technology has evolved, so has the ability to communicate and do business with every country on Earth.

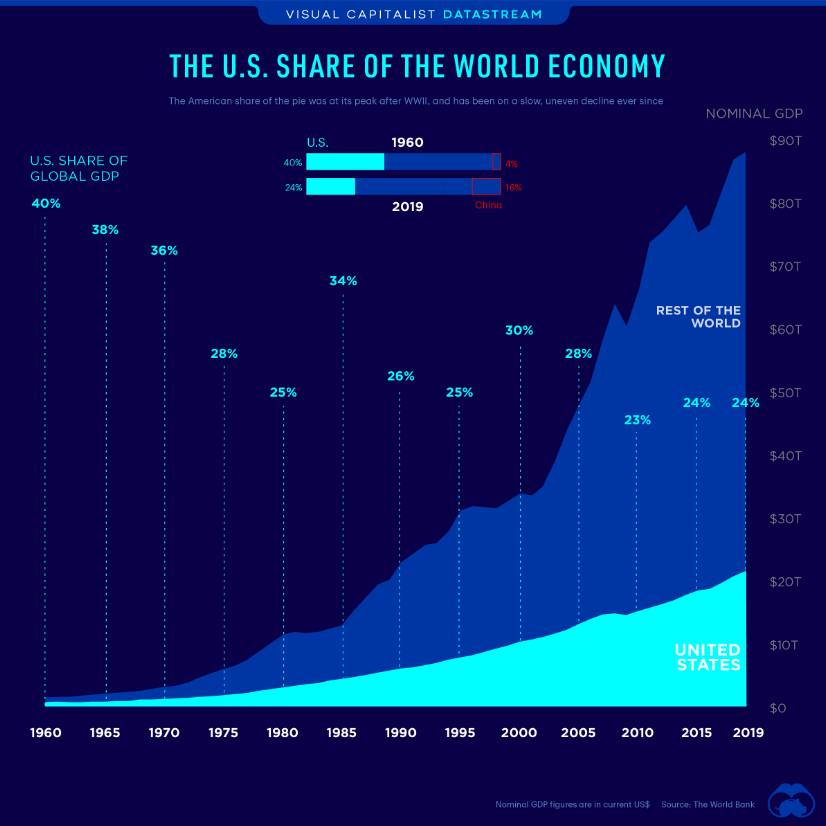

And thanks to the incredible technological advancements in modern history, this has accelerated quite a bit. The rest of the world has been catching up to the United States, from an economic standpoint.

As you can see in the following chart from Visual Capitalist, the United States’ share of the overall global economy has fallen from 40% in 1960, to only around a quarter of it today.

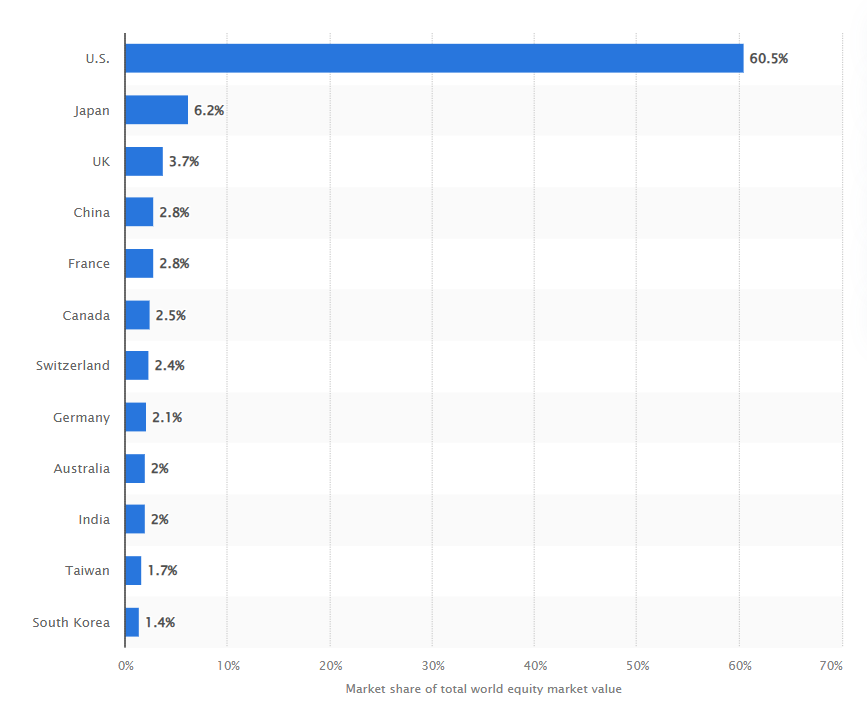

However, the global stock market has yet to reflect this.

Remember, the economy and the stock market are two different things. When an economy performs well, businesses tend to perform well, and their stock prices go up.

Despite the fact that the rest of the world’s economies have significantly outpaced the US economy, their stock markets have not.

As you can see in the following chart from Statista, despite only contributing around 25% to the global economy, the US still makes up more than 60% of the global stock market.

Why the disconnect here?

There are several contributing factors, many of which are probably unknown. But a big reason for this has been the capital markets infrastructure around the world.

Said differently, the US has the most mature and developed stock market in the world. This makes it easier for new businesses to be created and funded.

In other parts of the world, this has not historically been the case. However, technology appears to be changing this. Especially as we move further away from the analog economy toward the digital economy.

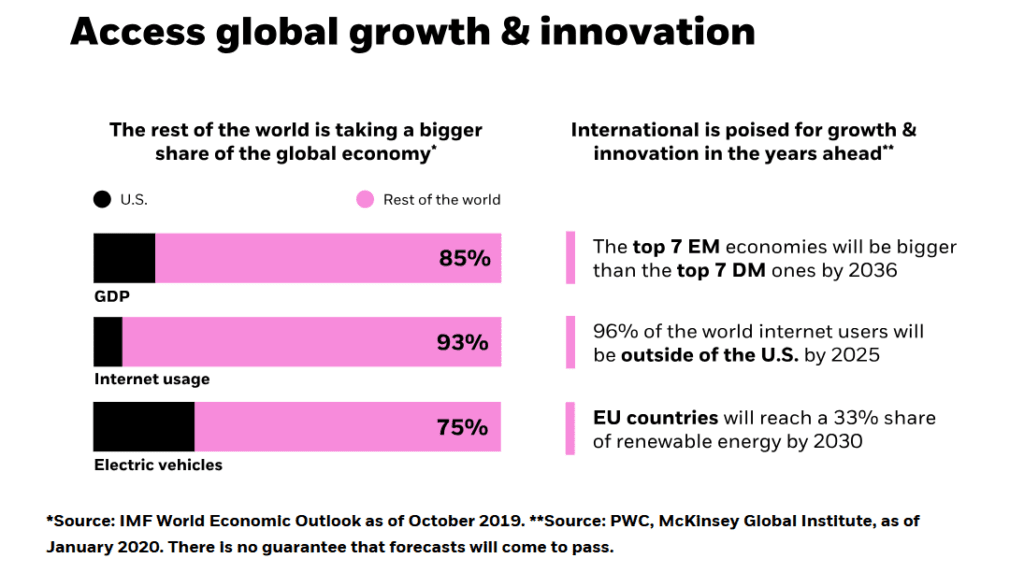

In fact, according to this research report from the worlds’ largest asset manager, BlackRock:

- The top 7 emerging market economies will be bigger than the top 7 developed market economies (including the US) by 2036

- 96% of internet users will be outside the US by next year

Will the global stock market start to become a better reflection of the global economy? And if so, is your portfolio positioned to take advantage of this?

Even if I’m wrong, you should still reach your goals

What if you increase your international stock exposure and all this talk about the rest of the world’s stock markets catching up to the US turns out to be wrong?

That’s the beauty of all of this. You’d probably be fine.

Because if the US stock market continues its dominance, it should still drive the rest of the world forward.

Your portfolio might lag behind one that is 100% US stocks. But with a good financial plan, you should still be able to reach all of your financial goals.

To illustrate this, consider the Vanguard Total World Stock Market Index Fund.

This particular fund consists of approximately 62% US stocks and 38% international stocks. This is in line with the current global stock market capitalization illustrated above, where the US currently makes up about 60% of the entire world stock market.

As mentioned above, international stocks have underperformed US stocks for over 13 years now.

But despite this, the Vanguard Total World fund has still delivered an average annual return of around +9.5% during that time frame. And its total return since its inception in 2008 has been around +233%.

That’s lower than the S&P 500’s average annual return of around +11.7% in this time frame. But it’s still substantial growth that will help most investors achieve their goals.

And at the end of the day, that’s what investing is all about.

*This is not a recommendation to buy any securities. Please do you own due diligence before making any investment decisions.