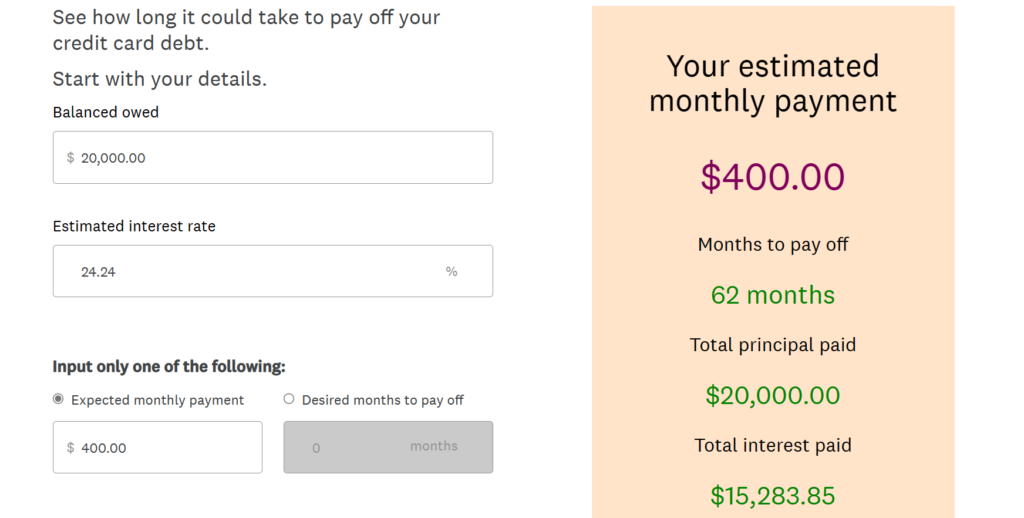

Hey there, friend. I hope you had a great week. This week, I received a question about paying off debt. So, I thought I would make this the topic for today. The best newsletters are when I can help you with specific things that are on your mind currently. So, as always, I encourage you to email me questions any time. Not only will I answer them for you, I’ll create a weekly installment around it. Because if you’re thinking about it, I promise you…someone else is too. Question of the Week I have some low interest debt and some high interest debt. I know I should probably pay off the high interest stuff first. But from a psychological standpoint, I want to get rid of the low interest debt because of what it represents. It brings back bad memories. Is it ok if I pay that off first? My Answer No. Pay off the high interest debt first. While I totally understand and can appreciate the emotional side of money. This is a scenario where your decision must be 100% logical. _______________ Let’s assume a person has the following debts: 1) Debt 1 = $20,000 balance / 24.24% APR / $400 monthly payment2) Debt 2 = $20,000 balance / 4.95% APR / $400 monthly payment3) $40,000 of cash available Scenario #1 1) Pay off Debt 2 in full2) Continue monthly payments on Debt 13) Invest the remaining $20,000 in a S&P 500 index fund By continuing the $400 monthly payment on the high interest rate debt, you will end up paying an additional $15,283.85 of interest before you would finally pay off the debt after about 5 years (62 months). Here’s an illustration of this:

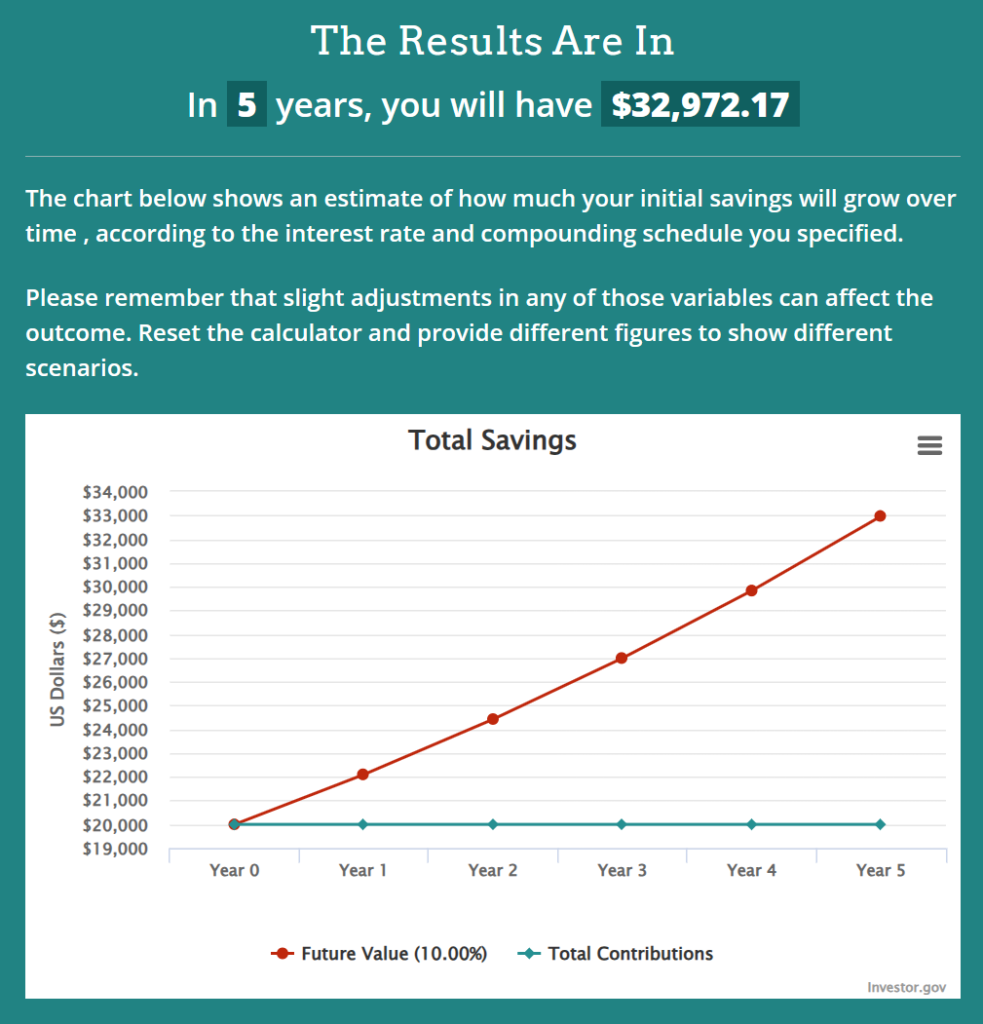

On the other hand — since you still had $20,000 to invest in a S&P 500 index fund — you’ll hopefully make some money to offset the additional interest paid. Assuming the historical average annual return for the S&P 500 of around 10%, that $20,000 would be worth $32,972.17 after 5 years. Please note that stock market gains and losses vary significantly from year to year. However, by using the long-term average, we can at least make some rough calculations that can help to inform our decision-making process. Here’s what that would look like:

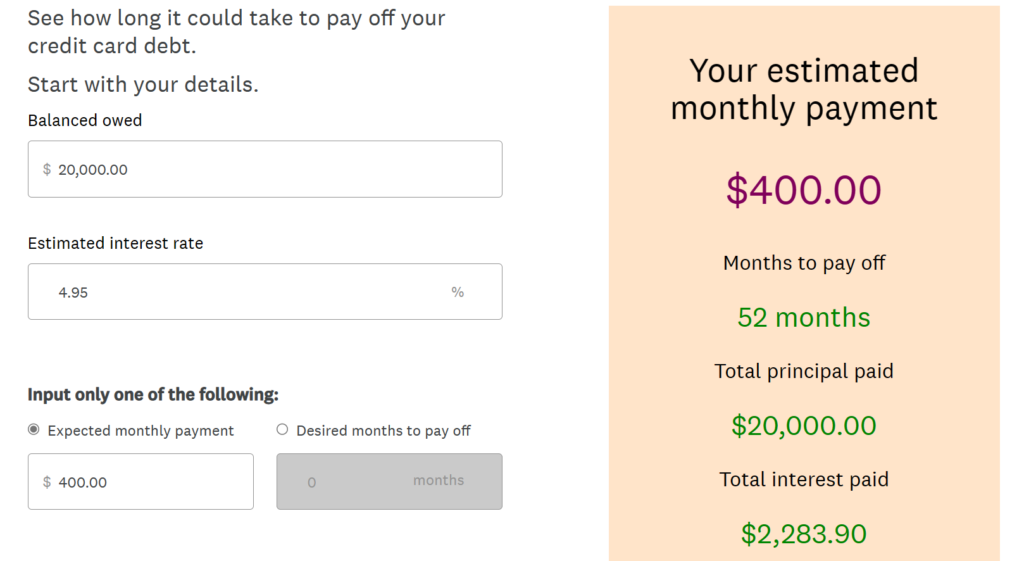

So what’s the net result of this scenario? You would now have $32,972.17 — and if you were to subtract out the overall interest payments of $15,283.85 from Debt 1 — your net result would be $17,688.32. Scenario #2 1) Pay off Debt 1 in full2) Continue monthly payments on Debt 23) Invest the remaining $20,000 in a S&P 500 index fund By continuing the $400 monthly payment on the low interest rate debt, you will end up paying an additional $2,283.90 of interest before you would pay off the debt in just over 4 years (52 months). Here’s an illustration of this:

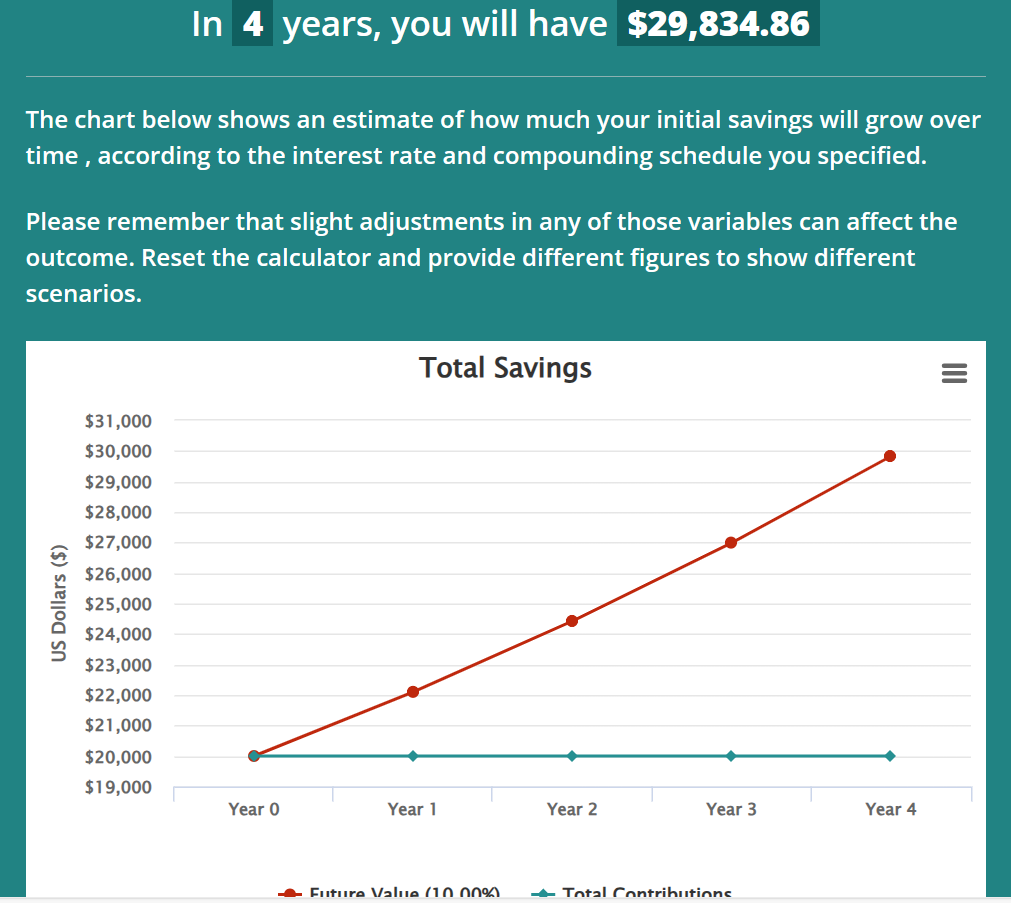

On the other hand — just like in the previous scenario — you still have $20,000 left to invest in a S&P 500 index fund. Here’s what that would look like, adjusted for 4 years rather than 5:

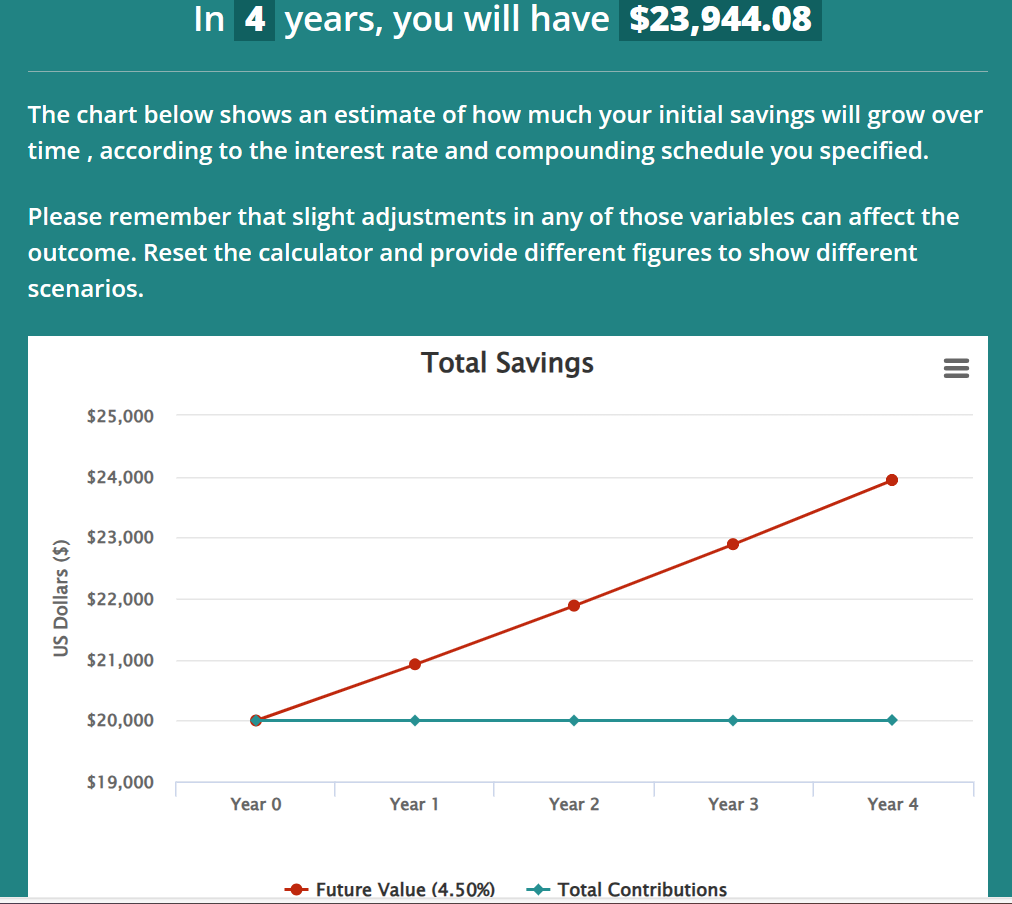

So what’s the net result of this scenario? You would now have $29,834.86 — and if you were to subtract out the overall interest payments of $2,283.90 from Debt 2 — your net result would be $27,550.66. Let’s take it a step further… The net balance in scenario #1 was $17,688.32 The net balance in scenario #2 was $27,550.66 Scenario #2 (paying off the high interest rate debt) is the clear winner by a total of $9,862.34. But let’s take it a step further and take a look at scenario #2 again. However — instead of assuming the optimistic stock market annual return of 10% — we assume the safety of a CD with an interest rate of 4.5%. Here’s what the $20,000 invested would look like in this scenario:

So now, your invested balance is only $23,944.08. And when you subtract out the overall interest payments of $2,283.90 from Debt 2 — your net result would be $21,660.18. This is still higher than the net result of $17,688.32 in Scenario #1. Said differently, the best-case scenario carrying high interest rate debt is still worse than the super conservative scenario of carrying the low interest rate debt. I hope this illustrates the dangers of paying high interest rates. Use banks…don’t let them use you. Pay off high interest debt as soon as possible. It can be a major drag on your wealth over time if you don’t.