Hey there friend, I’m going to keep the newsletter to one section today. My wife is giving me the “evil eye” as I type because “my Mother’s Day gift to her should have been not doing any work this morning.”

She’s right. She usually is. So I’ll cut to the chase.

And whether you’re a mother yourself or just celebrating the moms you know, I hope you have a great Mother’s Day weekend!

On Investing

The Power of Compound Interest

Back in October, I forecasted that we were in the early stages of a new bull market for stocks. As a reminder, a bull market is a prolonged period where the stock market goes up significantly (a bear market is the opposite).

Since I made that forecast, the S&P 500 has gone up nearly +15%.

And while we talked about the possibility of a crash last week, I still believe we’re in a new bull market now. One of the hallmarks of a bull market is that it climbs a “wall of worry” – meaning it goes up despite several fears being talked about ad nauseam.

The wall of worry is especially present in the early stages. As Sir John Templeton famously said, “bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

Said differently, fear is high at the beginning of a bull market and low at the end.

Which makes total sense. Recency bias is a human tendency to look at the recent past and extrapolate it into the future.

At the beginning of a bull market, the recent past consists of a big drop in the stock market – often combined with a recession. Which causes a heightened level of fear.

At the end of a bull market, the recent past consists of big stock market gains – often combined with an economic expansion. Which causes a heightened level of optimism.

2009 – 2020 Bull Market

At the start of 2009, we were in the midst of the worst economic recession since the Great Depression. And in the late stages of the worst stock market crash since then, as well.

At no point in our lives has there ever been more fear and anxiety around the economy and the stock market.

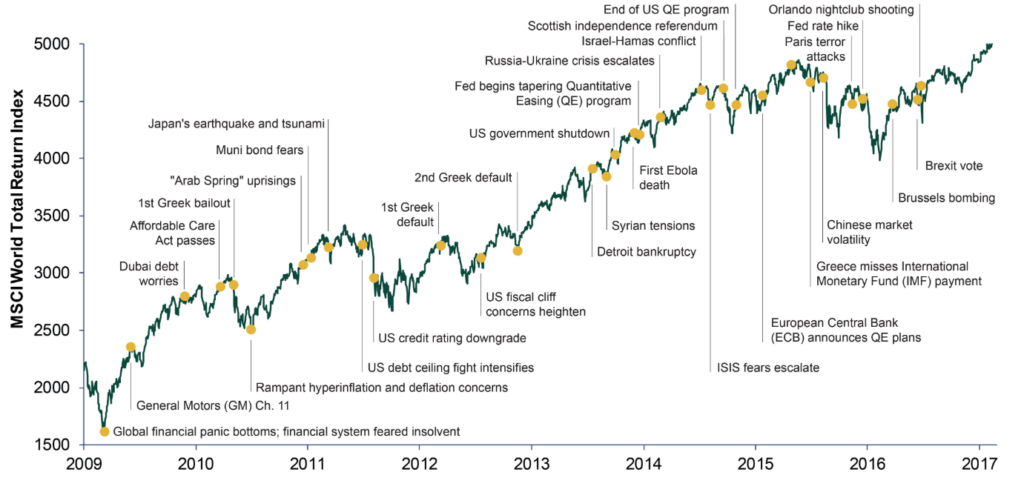

Here’s a great visual of the global stock market performing very well, despite all these fears (courtesy of Ken Fisher’s Twitter account):

Why does the stock market climb the wall of worry?

People expect bad things (because humans are overly emotional). Things turn out better than expected. When reality exceeds expectations, the stock market goes up.

From the beginning of 2009 until early 2020, we experienced one of the longest and strongest bull markets on record.

If you invested $100,000 in the S&P 500 at the beginning of 2009, you would have about $473,562.82 at the end of 2019, assuming you reinvested all dividends. This is a return on investment of 373.56%, or 15.19% per year.

Today

There’s no shortage of fears today. And they are higher than usual because recency bias has us looking at things like covid economic shutdowns, historic inflation, and the damaging effects of rising interest rates.

It looks like a “wall of worry” to me. Which brings me back to the original point of this article. Compounding returns.

The best explanation of compounding returns I’ve ever seen is from Morgan Housel. Here’s how he describes it:

“If I ask you to calculate 8+8+8+8+8+8+8+8+8 in your head, you can do it in a few seconds (it’s 72). If I ask you to calculate 8x8x8x8x8x8x8x8x8, your head will explode (it’s 134,217,728).”

If you let fears drive you out of the stock market, you miss out on a lot of compounding returns. And as Warren Buffett would tell you, compound returns are the single biggest driver of wealth creation over time – 90% of his net worth has come after his 65th birthday.