Welcome to the weekend. I hope you had an awesome week!

This morning, I thought I would start out with a picture that says – well – probably more than a thousand words.

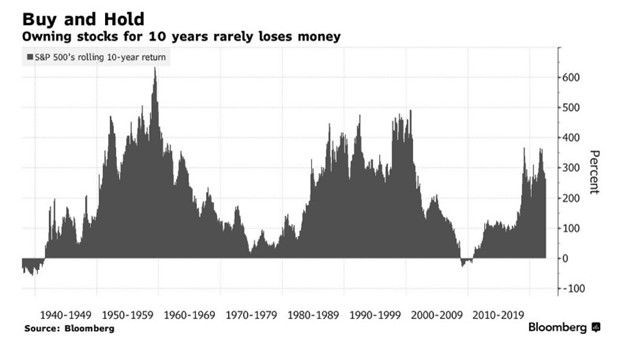

This chart shows rolling 10-year returns for the S&P 500, which is widely considered the most important barometer of the US stock market. Just in case rolling returns is a new concept to you, let me explain.

If we look at the stock market gain from 10 years ago until today, that gives us a 10-year return number. Then if we do the same thing tomorrow, we get a new 10-year return number. If we continue to do this over a long period of time, we get a chart that represents rolling returns. Or the picture above.

As you can see, there are really only two periods where rolling 10-year returns went negative. If you had the ability to buy a S&P 500 index fund and hold it for 10-years, there are only two periods of time – going back to the 1930’s – where you would have lost money.

-

If you bought stocks right before the Great Depression, and held on for 10 years, you would have lost money.

-

If you bought stocks at the peak of the dot-com bubble in the late 90’s, and held on for 10 years (which included the two worst bear markets since the great depression), you would have lost money.

Other than that, you would have done pretty darn well. Generally, 10-year returns would have been more than double (+100%).

Crazy, right? Especially with all the fear the media likes to pump out every day.

Conventional wisdom tells us to pare down stock risk, as we get closer to our financial goal. For example, if retirement is 10-years out, we are told we should be transitioning to a more conservative portfolio (often more bonds and less stocks). Knowing the history outlined above, why would I ever do that?

I wouldn’t.

I would stay invested in a diversified stock portfolio. And I would simply make sure I have sufficient cash savings set aside (12-24 months’ worth of withdrawal needs). That way, I don’t have to sell any of my investments if I’m unlucky enough to fall into the rare scenario of bad 10-year returns.

As it applies to the current environment, I’m pretty optimistic about how my portfolio will look in 10 years. We just went through a bear market this year (S&P 500 down more than 20% from prior peak). We have also been dealing with a light recession. Is it possible the next Great Depression or Financial Crisis is looming? Sure. Is it probable? I don’t think so.

With that, I’ll click send and wish you a great rest of your weekend! ______________________________

If you’re new to RW Weekly, here is my disclaimer: Nobody can predict short-term stock market movements on a consistent basis, over multiple market cycles. Not even the most skilled investment managers, who spend most of their waking hours dedicated to trying.

I never let my forecasts influence my longer-term investment portfolio. Rather than trying to be the unicorn that can “beat the market” all the time, I stick to a strategy that I believe puts long-term probabilities in my favor.

You can learn more about my full investment process here. ______________________________