What does Professor Google Say?

If you do a quick Google search for “how much do I need to retire,” here are the top two answers you’ll find:

1) Use the 4% rule to determine your target

2) Multiply your salary by a factor to determine your target

The 4% rule is a rule of thumb that tells you how much income you can safely withdraw from a typical retirement portfolio of stocks and bonds. The first step is to determine how much income you’ll need in retirement. Then divide that number by 0.04.

Let’s say you will need $100,000 of annual income to live a comfortable retirement. If we divide $100,000 by 0.04, we get $2,500,000. So, according to the 4% rule, you would need $2.5 million before you can retire.

The salary factor rule, on the other hand, bases your retirement savings goal on your current income. The most well-known promoter of this rule is Fidelity Investments.

Fidelity suggests that, in order to retire at 67, you’ll need to have saved 10x your salary by that time. So, if you’re making $100,000 when you retire, you would need $1,000,000 to retire comfortably.

Two different rules. Two wildly different answers — $2.5 million and $1 million. How the heck is anyone supposed to know how (or when) to retire?

That’s why these “rules of thumb” are simply a starting point. And while they can get the conversation going, you must dig deeper.

That’s what I’d like to do today.

Live (and plan) with intention

If you want to retire sooner and with less money, living with intention is the first step to figuring out how much money you’ll need. Intentional living simultaneously reduces the amount of money we need and increases the amount we save / invest.

When we distill our lives down to the things that matter most to us, we can prioritize those things. Which allows us to establish clear personal financial rules around them.

And this makes us much less likely to waste money on things that won’t really improve our wellbeing today or in the future.

On the other hand, when we go through life’s motions without a plan, our financial behavior is far more likely to be influenced by others.

Whether it’s trying to keep up with our peers or falling for advertising — which is designed to make us unhappy so we will buy more stuff — a lack of intention generally leads to a lot of wasted money.

And a later retirement date.

Intentional living also makes us much happier, to boot. When we prioritize the things and experiences we truly love, we enjoy and appreciate those things and experiences more.

Between living a happier life and allowing us to retire sooner (and with less), intentional living should be the foundation of your retirement plan.

Here’s the framework I use

In order to force myself to live more intentionally, I developed a simple scoring system to determine how I allocate my money.

Our spending can be described in four different ways: Needs / Wants / Likes / Loves. I want to minimize spending on wants and likes. These are the type of expenditures that get people in trouble.

Unlike needs and loves, they generally do not bring us any sustained joy. Therefore, we have to continue spending in order to maintain those things. It can be a financial death spiral.

To distinguish between likes and loves, I try to ask myself why I love something.

For example, I love traveling. But who I’m traveling with is what distinguishes this expense as a love or merely a like.

I also love seeing live music. But again, who I’m enjoying the live music with is what makes it a love or a like.

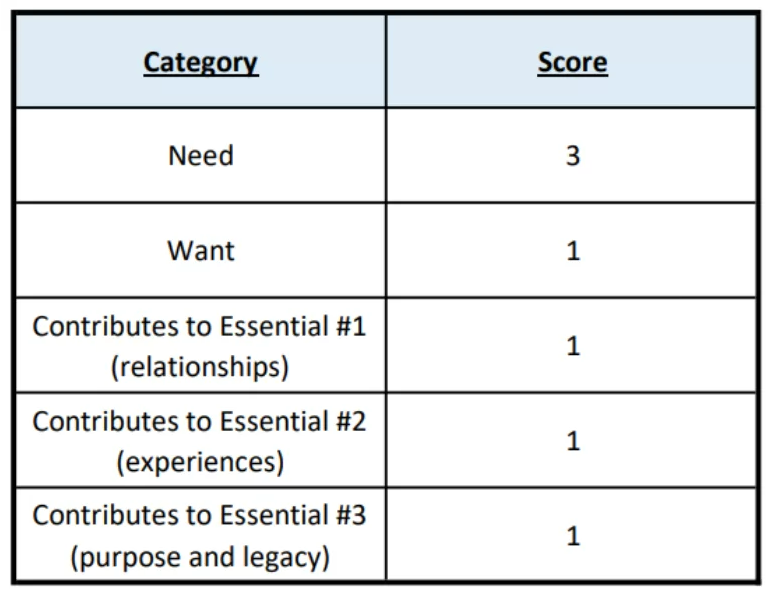

Here is a table I use to help me do this:

Using this table, a “want” does not become a “love” unless it meets my minimum scoring threshold of 3. This is based on the three essential aspects of my life that I have identified:

1) Most important relationships

- Family

- Closest Friends

- Clients

2) Most cherished experiences

- Traveling

- Live Music

- Golfing

3) Purpose and Legacy

- My health

- My business mission

- Coaching little league baseball

Consider sources of supplemental income

Your retirement savings are just one lever you can pull to generate income in retirement. A great way to retire sooner and with less money is to have other levers.

Eventually, you’ll be able to draw social security (or maybe even a pension). It’s important to have a clear idea of how much you’ll receive — and when you’ll start receiving it. For social security, you can get your personal estimate here.

But there are so many other ways to create a sustainable supplemental income stream. By doing things that bring you genuine joy.

And every little bit makes a huge difference in the amount of retirement savings you need.

To illustrate this, consider a retired friend of my family that spends her springs and summers enjoying Cubs games at Wrigley Field, as a guest services employee.

She loves it. In fact, I’m willing to bet she’d continue doing it even if she had millions of dollars.

I’ve never asked her how much she makes, but according to salary.com, the average guest services employee at Wrigley Field makes around $32,000 annually.

Using the 4% rule described above, she would need $800,000 in additional retirement savings to produce this level of income.

Maybe this sort of work isn’t your thing. Maybe you’d prefer to create an online business that you can operate whenever — and from wherever — you want.

Do you have passion and expertise around something that can help others improve their lives? Then you’re extremely qualified to make money helping people.

If you’re an educator, you can teach online, without school politics. If you’re a corporate leader, you can mentor corporate employees. If you’re a great sports coach, you can coach players and other coaches.

Thanks to social media, it’s easy to make a little money doing stuff that brings you joy. As long as you establish a strong personal brand (which isn’t that hard…I can show you how).

And you don’t even have to be that good at running a business. Just being an average solopreneur (one-person business) should net you around $39,000.

Once again using the 4% rule, you would need $975,000 of additional retirement savings to produce this level of income.

When you stop thinking of retirement in terms of the end destination — and start thinking of it in terms of a new and more enjoyable chapter of your life — your retirement savings goal becomes a lot less intimidating.

Extend your time horizon and increase your risk tolerance

As I just mentioned, it’s important not to view retirement as an end destination, but rather the start of a new and long chapter in your life.

Too many people think that a switch gets flipped when you go from accumulation (saving for retirement) to distribution (withdrawing from your savings).

They think that suddenly, you must get super conservative with your investments, because you no longer have time to ride out stock market volatility.

This idea is foundational to the 4% rule. Let me explain why.

The more risk you take, the more reward you can expect. The less risk you take, the less reward you can expect.

If you have a lower-risk portfolio that is only expected to return 6-7% annually, you probably don’t want to be withdrawing more than 4% annually.

But what if your expected annual return over the course of your 20-30-year retirement is 9-10%? This would allow you to potentially withdraw more than 4%.

With a 20-30-year time-horizon, you have plenty of time to ride out a severe stock market downturn. Understanding this, you can potentially increase your risk / reward ratio.

This can potentially allow you to generate more income off your assets, while retiring sooner and with less money than you thought.

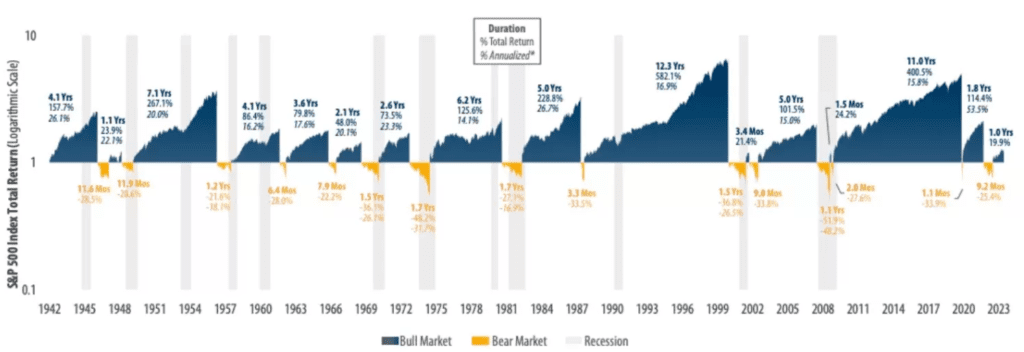

Consider the S&P 500. There have been many times where it’s gone down a lot. And if you sold when it was down, you lost your money. But if you stayed the course, you didn’t.

Because more often than not, it goes up a lot. And those upward trends tend to be stronger and longer than the down trends.

So, with the required patience and discipline, stock investors generally come out far ahead of where they started.

Believe it or not, there has never been a 20-year stretch where the S&P 500 lost value. The worst period included the Great Depression and World War II, yet it still eeked out a gain of just under two percent.

Additionally, 94% of 10-year periods showed a positive return. Said differently, if you stayed disciplined for 10 years, you only lost money 6% of the time.

There are two key caveats here:

1) It’s crucial to have a plan that helps you avoid selling your stock investments while they are down significantly during a bear market. Doing so can kill your portfolio. You can learn how I do this here.

2) You should decrease your withdrawal rate to reflect large gains in your investment portfolio. If your portfolio goes up by, say 30%, and you keep your withdrawal rate of 5% — you’re effectively giving yourself a 30% increase in income. Have your expenses really gone up that much? If not, you should hold your withdrawals steady (allowing the % withdrawal rate to decline).