Cannabis Investing: Betting on Federal Legalization

When investing, it’s important to remember that all investing is a form of speculation. We invest in things that we believe will be worth more in the future. And since nobody can accurately predict the future all the time, we are speculating on it.

In other words, we’re placing bets.

For example, if you invest in a S&P 500 index fund, you’re betting that the US economy will continue to grow and prosper.

If you invest in a bond, you’re betting that the issuer of that bond will maintain a strong enough financial position to pay you all the interest you’re owed (and be able to give your principal back at the end).

And while federal legalization of cannabis isn’t as safe a bet as these examples, there’s a lot of supporting evidence that suggests it could be a good bet. And for a small portion of a well-diversified, long-term investment strategy, it can make sense to place this bet. Provided that you’re properly managing the risks.

Public Support for Cannabis Legalization

While it may not seem like it at times, it’s important to remember that the US Government works for the people. And the people are overwhelmingly in favor of legalizing cannabis.

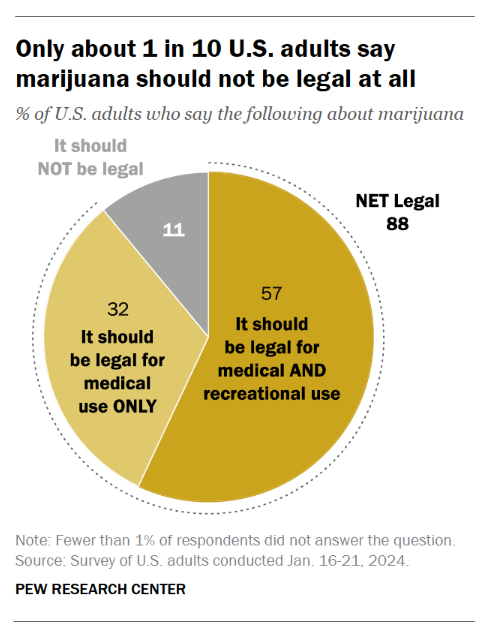

Take a look at the following graphic from Pew Research. As you can see, a whopping 88% of Americans believe that cannabis should be legalized in some form. Perhaps more surprising, a solid majority of Americans (57%) believe that cannabis should be legalized for both medical AND recreational use.

Importantly, we must remember that just because the public overwhelmingly supports an issue, doesn’t mean the government will enact laws in favor of said issue.

The US population is divided into many different groups with different values. And if enough people (and politicians) are staunchly against a particular issue, it can be harder for legislation to be passed.

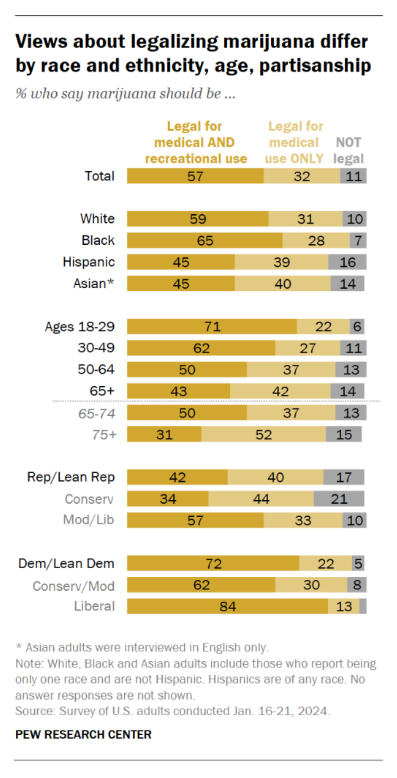

As you can see in the next chart from the same Pew Research study, public support varies by demographic.

Not surprisingly, when it comes to recreational legalization, younger folks are more supportive than older folks. And liberals are more supportive than conservatives.

On the other hand, when it comes to medical legalization, a surprisingly large number of older folks and conservatives are in support of this.

This is very important for two reasons: 1) it puts more pressure on elected officials to support cannabis reform and 2) either recreational or medical legalization would likely create significant financial upside for businesses in the cannabis industry, relative to where they are currently.

Just think about how much money Big Pharma makes on medically prescribed drugs.

And lastly, even the least supportive group of people in the US – conservatives – still overwhelmingly support cannabis legalization in some form. As you can see above, only 21% believe it should remain illegal.

Impact of the 2024 US Presidential Election

Democratic presidential candidate, Kamala Harris, has been very open in her support of legalizing cannabis. It’s likely that a Harris administration would work toward expediting the process.

In fact, her and President Biden have already made major strides this year in “rescheduling” cannabis from a Schedule I controlled substance (alongside heroin / even more restrictive than cocaine and fentanyl) to a Schedule III controlled substance (alongside drugs such as codeine and steroids).

On the other hand, Republican presidential candidate Donald Trump, has sent mixed signals in terms of his stance on cannabis. He has both demonized the drug publicly, while also acknowledging its medicinal uses and popularity among voters.

But he also signed the 2018 Farm Bill in his first term, which legalized the commercial production of hemp nationwide.

And while the law differentiates between hemp and marijuana, they’re actually one in the same from a scientific standpoint. The only difference is in how much THC (the chemical substance that creates a “high”) that each variant contains.

Both are cannabis plants. Hemp simply contains 0.3% or less THC, while marijuana contains more than 0.3% THC. However, despite the smaller amount of THC that naturally occurs in the hemp plant, processors all over the country can – and do – extract all the THC for use in consumable products that contain 0.3% or less THC, relative to their overall weight.

For context, 5 milligrams of THC is certainly enough for most people to feel its effects. And if you put 5 milligrams of THC into a piece of candy or a pill that weighs around 1.7 grams total, the THC content is below 0.3%.

In other words, Trump signed a bill that made it legal for anyone in the United States to get high from cannabis.

All of this being said, my overall opinion is that the 2024 presidential election could either accelerate or slow down the path to federal legalization of all cannabis plants and products. If Harris wins, the process could be accelerated. If Trump wins, it could be dragged out a little longer.

But either way, it appears as though public support has created a momentum that will be very difficult to reverse.

Money Talks

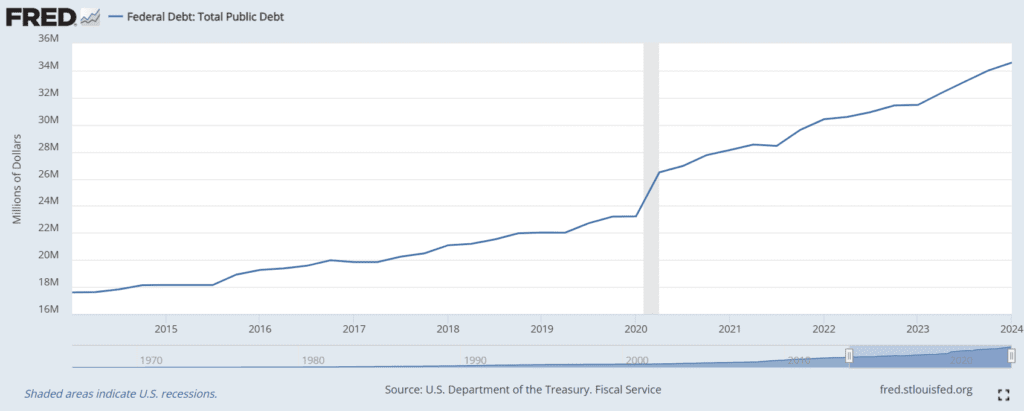

But more importantly, the United States has a big problem right now. Our federal debt is at the highest level it’s ever been, at more than $35 trillion dollars. And simple math tells us that the more we borrow, the more revenue (tax dollars) we’ll need to take in, in order to pay our bills.

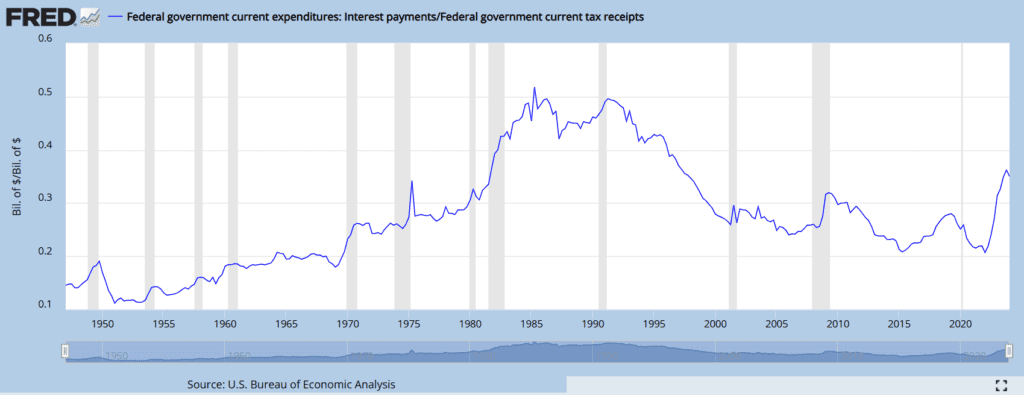

As you can see in the following chart from the Federal Reserve Board of St. Louis, Federal debt interest payments relative to tax receipts – in other words, the amount of money spent on debts relative to the amount of total revenue – is at the highest level in nearly thirty years. And it’s been a rapid increase over the past couple of years.

And whether you look at Republicans or Democrats, neither really wants to create significant tax increases for voters. That doesn’t help them get elected and re-elected. And at the same time, none of them seem to want to stop borrowing and spending.

As you can see in the following chart from the St. Louis Fed, debt has continued to grow at a very steady rate over the past ten years. Six of which were under a Democratic president, four of which were under a Republican president.

If the government plans to keep borrowing / spending – and they know raising taxes on voters generally hurts their popularity – they’re incentivized to find tax revenue elsewhere.

And guess what? Not only can they tax the heck out of cannabis products, but people have also proven they are more than willing to pay that tax.

According to Marijuana Policy Project, through the first quarter of 2024, states have reported a combined total of more than $20 billion in tax revenue from legal, adult-use cannabis sales. And in 2023 alone, legalization states generated more than $4 billion in cannabis tax revenue from adult-use sales, which is the most revenue generated by cannabis sales in a single year.

And these figures don’t even include medical cannabis tax receipts.

Given the overwhelming support of voters in both political parties, this seems like a prime opportunity for the federal government to boost their revenues to further support their spending initiatives.

The Importance of Long-Term Patience

Given all of this data, you may be thinking that federal legalization is inevitable. And that may actually be the case.

However, there is no escaping the reality that it will likely be a long road with many battles and – yes – even the possibility that it never happens at all.

If it does end up happening, I think we could potentially see it happen in two distinct phases: 1) rescheduling / decriminalization and 2) federal legalization.

Phase 1: Rescheduling / Decriminalization

As mentioned earlier, the Biden / Harris administration has already made a lot of headway in getting marijuana reclassified from a Schedule I controlled substance to a Schedule III controlled substance.

While rescheduling wouldn’t necessarily have an immediate impact on the cannabis industry from a fundamental standpoint, it could potentially boost the value of stocks in the industry.

This is because it could potentially speed up the passage of the SAFER Banking Act, which already has strong bipartisan support. The SAFER Banking Act, which is intended to broadly expand banking services for businesses in the cannabis industry, would help those businesses tremendously.

Additionally, rescheduling would allow cannabis businesses to benefit from increased tax breaks, thus improving their profits.

Phase 2: Federal Legalization

If we make it through Phase 1, this would likely lead to increased normalization of the cannabis economy. In my opinion, adding this on top of the already overwhelming public support would likely lead to federal legalization over time.

As mentioned, all of this has the potential to be a very long road. And for current cannabis businesses, it won’t be an easy road.

Plenty of cannabis businesses that exist today will go out of business along the way. And their stock prices will go to zero.

Because of this – IF investing in the cannabis industry is suitable for you – it’s much better to invest in a diversified portfolio that gives you exposure to many different companies within the industry. And over time, the portfolio should be adjusted to reflect developments within the industry, ensuring that you’ll be invested in the winners.

A very simple way to do this is through the purchase of an Exchange Traded Fund.

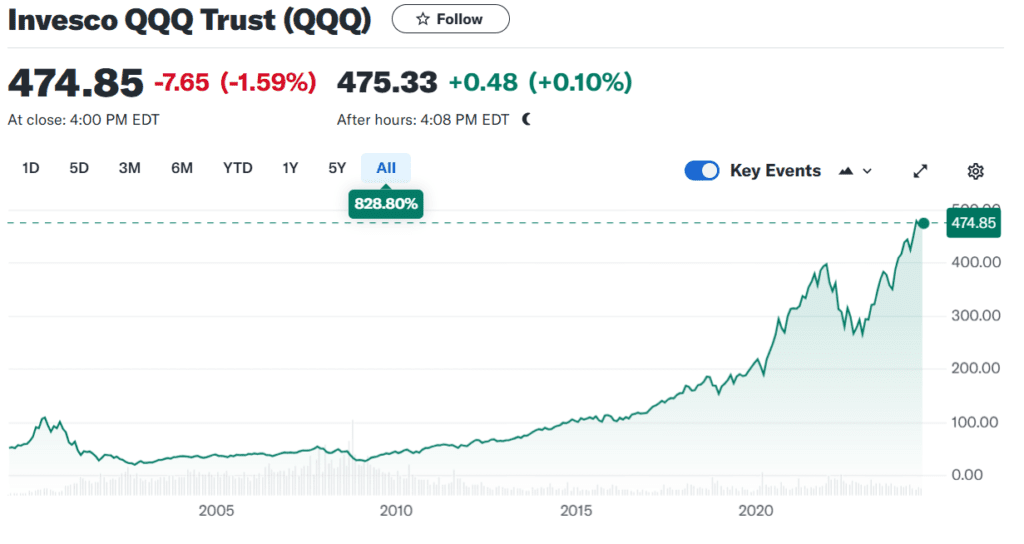

Consider the Exchange Traded Fund QQQ. This fund launched all the way back in 1999 – at the height of the internet / dot-com bubble. It was an easy way for investors to bet on the internet. And just like cannabis, the internet was a very long-term bet back then.

Many internet companies ended up going out of business. Which meant their investors lost everything. As a result, the value of this Exchange Traded Fund actually declined by more than 80% from March of 2000 through September of 2001.

However, if you were a long-term investor – and used a strategy like my time horizon buckets – you’d have still done very well. Especially if you were consistently contributing to your portfolio.

As you can see below, the fund has still increased by nearly 830% since its inception. And this doesn’t even include dividends paid by companies within the fund.

And if you were making regular contributions along the way, you bought shares at an average price of below $50 for an entire decade. Think about how glad you’d be having bought all those shares around $30 or $40, now that they’ve increased by All those shares that you purchased around $30 have since increased by 1,000 to 1,500%!

As always, any investments you make should be part of an overall financial plan that manages risks and protects your financial security. Please consult with a professional financial advisor before investing your money.