This week’s blog post describes what I believe is the core of an intelligent long-term investment strategy. If you’d like to understand the foundation that this core is built on, you can follow this link to view that article: Using Time Horizon Buckets to Grow and Protect Wealth.

Core Investing Beliefs

1) The Power of Human Ingenuity

Throughout history, humans have created solutions that not only help us address problems, but also profit from them. Therefore, the economy has always moved onward and upward over time, despite the occasional recession.

I don’t believe the future will be any different, from this standpoint. At the core of my strategy, this is what I am investing in.

2) Efficient Markets

Just like any market, the stock market is simply a collection of people buying and selling stuff. This buying and selling is based on known information.

And in the digital age, everyone has instantaneous access to it. Therefore, this information tends to be immediately reflected in stock prices.

Because of this, I believe it’s impossible to consistently predict short-term market movements.

3) Conviction and Patience

When we invest in stocks, we become owners in those businesses. Therefore, investing requires a business owner mentality.

Good business owners complete rigorous due diligence before they begin. Then, they commit. They do not bail out, just because of a rough patch. Nor do they take the profits and run, after a good stretch.

Same with investing. We should invest in what we understand, with long-term conviction. Only adjusting when necessary.

Profit off that which you contribute to

If you work (or have worked) and spend money, you are contributing to economic growth. And when an entire nation of over 300 million people does this, the economy (and stock market) plows onward and upward over time.

If you’re contributing to this progress, you should ensure that you’re also profiting from it. Always.

This is at the very core of an intelligent, long-term investment strategy. And depending on your personal circumstances, you would build around this with secondary investments. But for this particular article, we’re focusing on the core.

All investing is a form of speculation. Risk levels can vary widely, but investing can be boiled down to buying stuff we believe will be worth more in the future. Since we cannot predict the future, we are speculating on it.

With this understanding, it’s reasonable to bet on the power of human ingenuity and its ability to continue driving the economy forward.

This is why the core of this strategy is to invest in the entire global economy. It’s a high probability investment, with much lower risk than individual businesses.

Global diversification (versus US-only) is important for a couple of reasons:

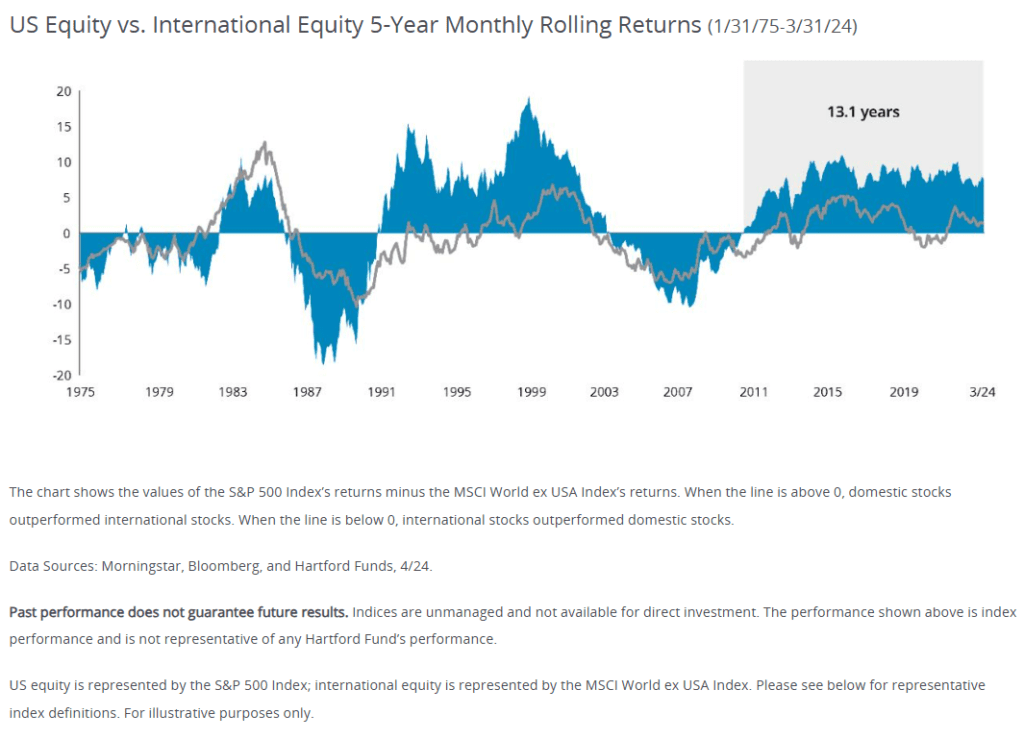

1) It provides better diversification and a potentially smoother ride. The US and International stock markets have typically moved in cycles. As you can see below, we’ve been in a cycle of US outperformance for over 13 years. If history is any guide, it makes sense to be ready for a reversal in trend at some point.

2) We are living in an age where the world enjoys more connectivity across borders than ever before. And there’s every reason to believe this will only accelerate. A prudent investment strategy will be based on what’s going on in the world today and where things are potentially headed.

Developed vs. Emerging markets

When considering economies and stock markets across the globe, there are two categories they can fall into: developed markets and emerging markets.

Some examples of developed markets are the United States, Canada, and the United Kingdom. Some examples of emerging markets are China, India, and Taiwan.

Developed Markets

For developed markets, I believe it’s best to use index funds.

That’s because in developed markets, stocks tend to be priced pretty efficiently. This means that all information is reflected in the value of the stock market. When this is the case, it’s harder for an investment manager to have any information that provides them with an advantage.

It’s part of the reason why the vast majority of active investment managers don’t beat their index. And those that do, often can’t repeat it consistently over time.

Therefore, it’s best to use a “passive” index fund here. This means it is not actively managed by a fund manager. It is simply designed to replicate an entire stock market index (like the S&P 500).

Over time, the economy will change. Industries will evolve. Companies will fail. Because newcomers are thriving. A good stock market index fund is designed to adapt and reflect these changes, so it can keep thriving as well.

This is why – just like developed economies – developed stock markets have always gone up over time, despite temporary setbacks.

Emerging International Markets

In emerging markets, on the other hand, stocks can often be priced inefficiently. This means that all information is not necessarily reflected in the value of the stock market.

When this is the case, it can be beneficial to have a fund manager that studies and deeply understands the inner workings of these markets. Therefore, I think it’s best to use actively managed funds here.

It’s important to keep in mind that there are also a lot of active managers that underperform in emerging markets, just like in developed markets. However, I believe a large part of this is because there are so few investment managers that are pure emerging market managers.

Many actively managed emerging market funds are secondary offerings from US investment management companies. They have an in-house team that is assigned the task of researching and managing these funds.

It’s better to consider an investment company that specializes in emerging markets and even has boots on the ground in those markets. This can equip the investment management team with unique inside knowledge as to how those markets operate, so they can better identify potential price inefficiencies.

The firm I’ve chosen to use in my strategy is Rayliant Global Advisors.

While there are never any guarantees that an active manager will outperform an index, I believe a good management team has a higher probability of outperforming in emerging markets, rather than developed.

Conclusion

I believe the core of a good long-term investment strategy is an allocation to the entire economy. This enables your portfolio to always participate in the growth of the overall economy and stock market. Over long periods of time, this has proven to be a reliable investment with a lot of upside.

For developed markets, I believe it’s best to use inexpensive passive index funds, due to widely efficient pricing in those markets. For emerging markets, I believe it’s best to find a good active manager that can potentially exploit pricing inefficiencies within those markets.

As for how much money should be allocated to each of these categories, a good benchmark to replicate is the FTSE Global All Cap Index. This is not a recommendation. It is simply meant as a starting point in determining the right allocation for you. Currently, the composition of this index (as of 7/31/24) is approximately as follows:

United States (developed market): 63%

Developed International Markets: 27%

Emerging International Markets: 10%

I hope you found this helpful. My next post will begin diving into the “satellite” investments that I use to build around this core. The idea behind these satellite positions is to potentially increase growth over time.

If you didn’t catch last week’s article, it outlined the foundation that must be in place before any money is invested. To read that, please follow this link: Using Time Horizon Buckets to Grow and Protect Wealth.