Using Debt to Maximize Wellbeing

We all want to maximize the quality of our lives, right?

And while money alone doesn’t do this, it sure as heck is an important part of the equation. As our financial wealth increases, so does our freedom over how we spend our time.

With a solid plan, we can eventually get to a point where most of our time can be spent doing things that bring us joy.

There’s simply no disputing the fact that more money often leads to a much higher quality of life.

And debt is an excellent tool to help us get there.

But once we’re there, I believe it’s best to eliminate it.

Debt (financial leverage) is great for building wealth

The easiest way to explain financial leverage is to talk about how a home mortgage can give us a significant amount of it.

Leverage simply means that your investment returns are based on a much higher dollar amount than you actually invest.

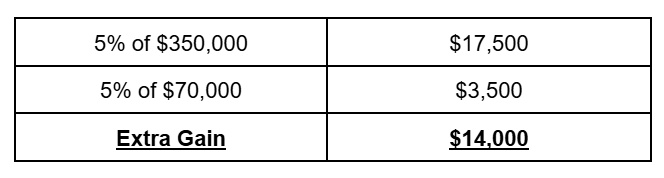

If you buy a $350,000 house with a 20% down payment, your initial investment outlay is $70,000. And let’s say your home appreciates by 5%.

Your gain is based on 5% of the $350,000 home value, not 5% of the $70,000 you put in. Thanks to leverage, you’d make an extra $14,000 on your investment.

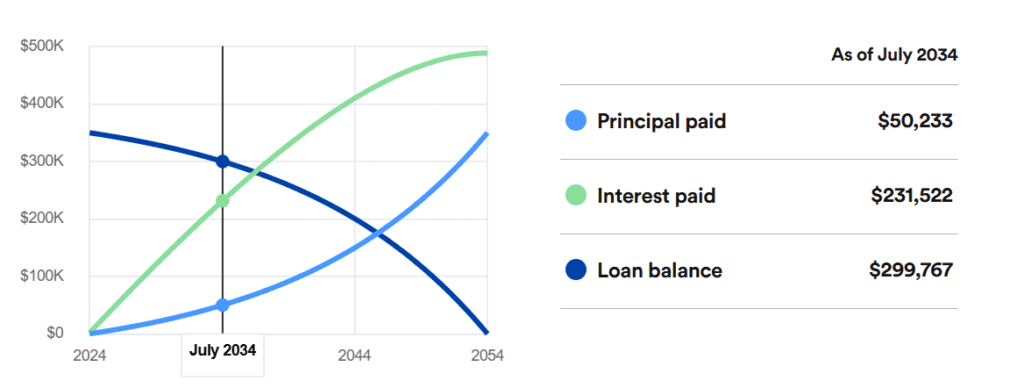

Now, let’s take this a step further. Let’s factor in all your mortgage payments (principal and interest).

As you can see in this amortization chart from bankrate.com – despite the fact that you start earning returns on the full $350,000 property value from day 1 – it would take more than 10 years before you actually contribute $350,000 of your own money.

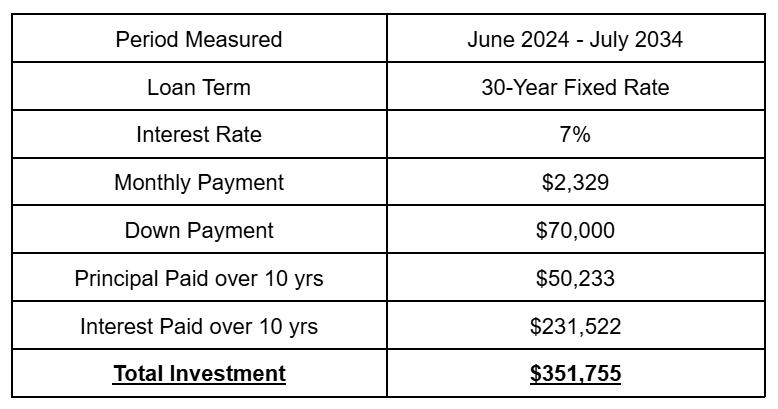

Given all of this, let’s take a more detailed look at a 10-year comparison between buying a home with a mortgage (leverage) versus investing in a diversified investment portfolio (no leverage).

Based on historical data, it’s reasonable to expect a 5% average annual increase in your property value over time. And for a diversified investment portfolio, it’s reasonable to expect around an 8% average annual increase in value over time.

Suppose you had a choice to either make the purchase outlined above or rent and invest your savings. And let’s say you could rent a home for $2,000 per month.

Scenario 1

Purchase the home with a 30-year mortgage. Initial investment is your $70,000 down payment. Ongoing investments are equal to the additional monthly cost of $329 versus the rental option ($2,329 mortgage payment – $2,000 rental option = $329 extra).

Your profit over ten years would be the equivalent of:

- $350,000 home with 5% average annual appreciation

- Less $70,000 down payment

- Less $39,480 ($329 monthly x 12 months x 10 years)

- Less $299,767 remaining loan balance

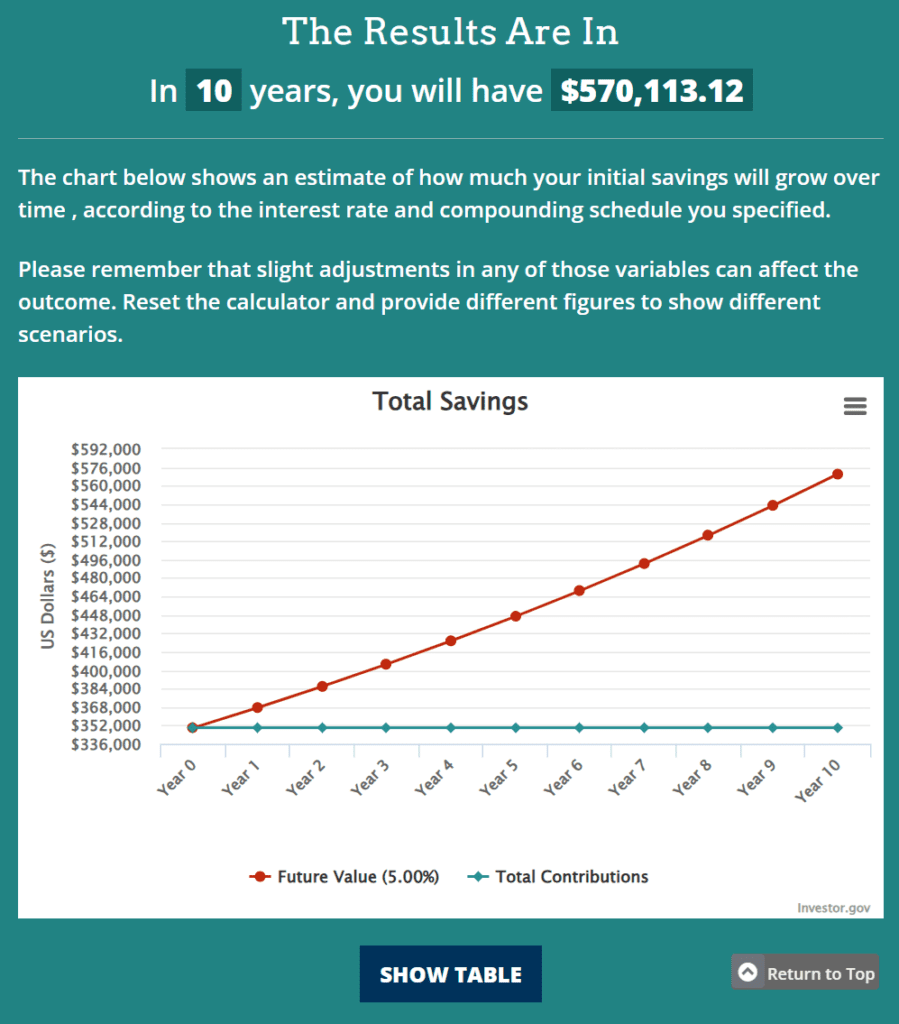

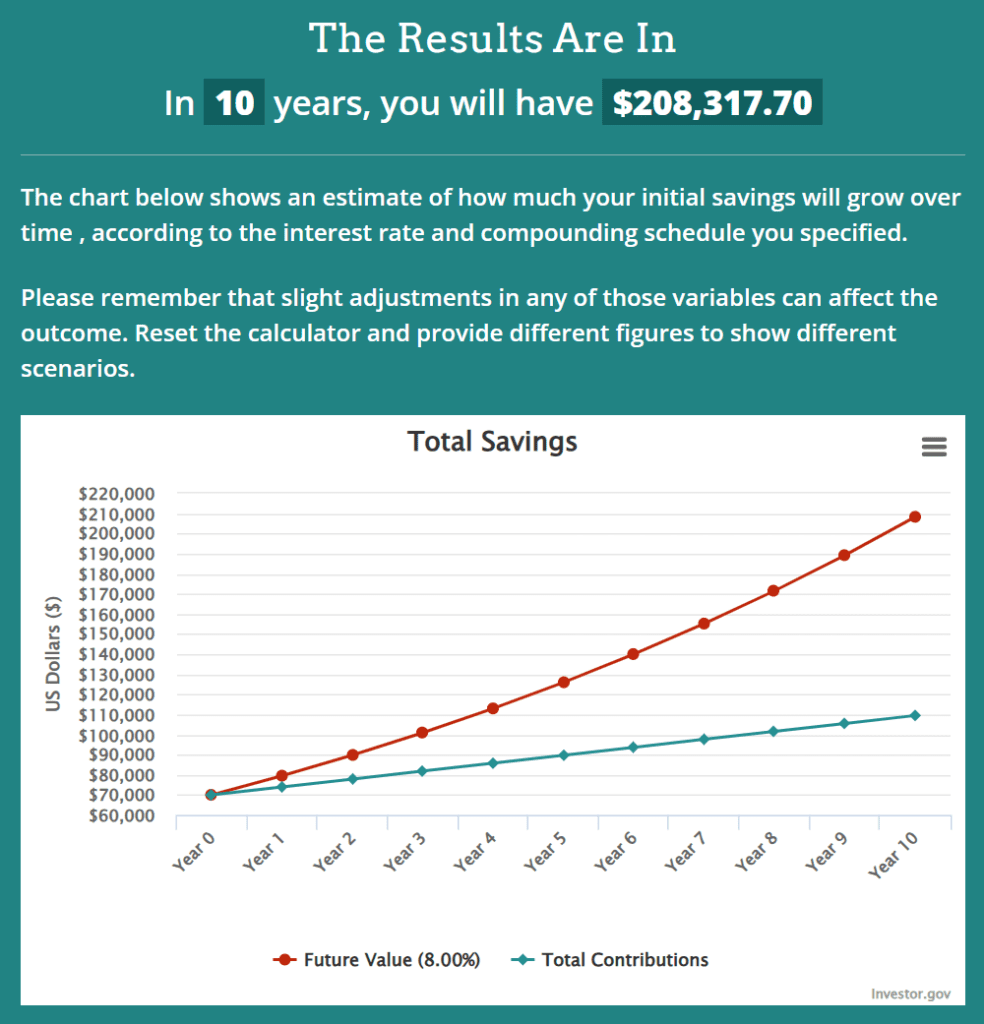

As you can see in the following compound interest illustration from investor.gov, after 10 years, you could expect your home to be worth somewhere in the neighborhood of $570,000.

And then we need to back out your out-of-pocket costs:

+ $570,000 total value

– $70,000 down payment

– $39,480 additional monthly payments

– $299,767 remaining loan balance

*Total Gain of $152,857*

Scenario 2

Invest the $70,000 down payment in an investment account, instead. And choose to rent at $2,000 monthly. And assume your rent never increases over the next ten years (very unrealistic). And invest your monthly savings of $329 into your investment portfolio.

Your profit after ten years would be the equivalent of:

- $70,000 initial investment + $329 monthly contributions at 8% annual growth rate

- Less $70,000 initial investment

- Less $39,480 contributions ($329 x 12 months x 10 years)

As you can see in this compound interest illustration from investor.gov, after 10 years, you could expect to have around $208,000

And then we have to back out your investment contributions:

+ $208,000 total value

– $70,000 initial investment

– $39,480 monthly contributions

*Total Gain of $98,520*

To summarize: despite earning a higher interest rate (8% versus 5%) each year by forgoing a mortgage and investing in an investment portfolio – the leverage from using a mortgage would still help you earn over $50,000 more in ten years ($152,857 – $98,520 = $54,337).

Imagine if interest rates were lower? And what if rent ever increases over that ten year span (highly likely)?

Both of these would significantly increase the additional gain from using a mortgage with a fixed monthly payment.

This is the power of leverage for someone who has not yet built a much wealth.

But after you become wealthy, the risk begins to outweigh the reward

To be clear, debt never stops becoming a great tool to build more wealth. If you already have millions, you could continue using debt to get richer and richer.

But after a while, you start to wonder if the juice is worth the squeeze.

After all, if you already have a $3 million net worth, what’s the upside of adding another million to it?

Would it meaningfully improve your wellbeing and quality of life?

Maybe. But probably not.

But what cannot be disputed is the more debt you have, the higher your stress levels will probably be.

As Morgan Housel pointed out in a recent blog post:

“As debt increases, you narrow the range of outcomes you can endure in life.”

What does he mean by this? Well, life is pretty unpredictable. You never know when a recession is going to happen, when a pandemic might break out, when a natural disaster may hit, when an unexpected illness or death may occur in your family.

There are so many other factors that can come into play and introduce volatility into your life. It’s impossible to name them all.

And that’s why everyone is guaranteed to have several of these unexpected events happen to them throughout their life.

When we have a lot of debt, we have less financial flexibility. Which means we aren’t able to adapt as easily.

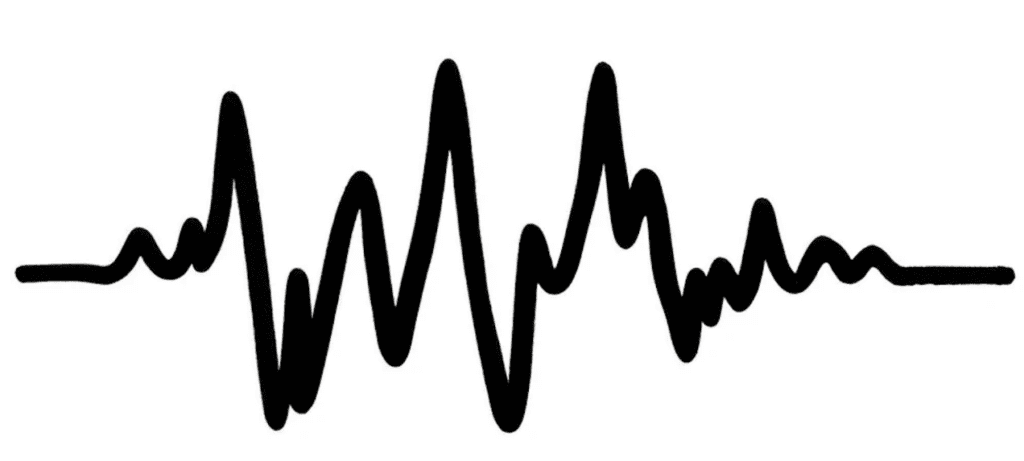

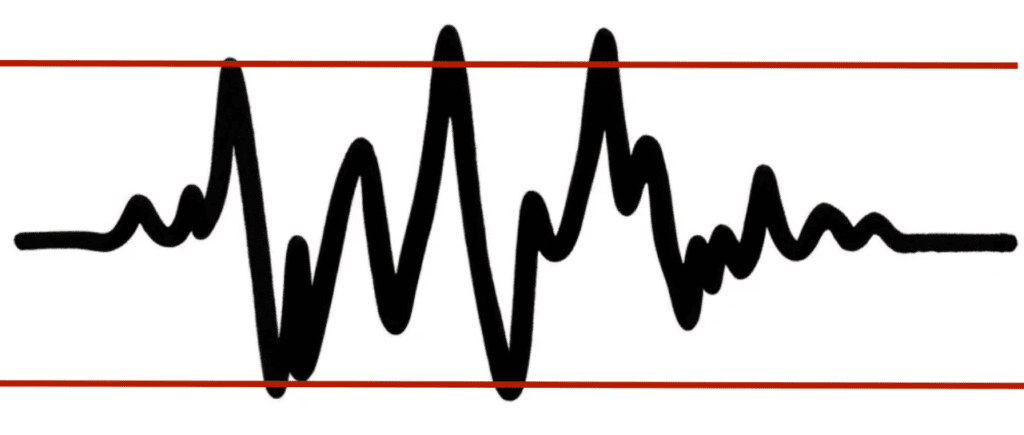

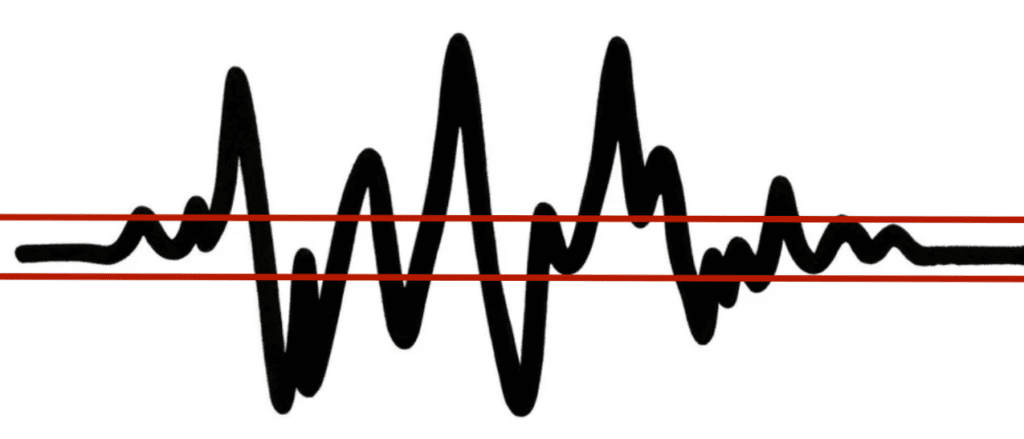

Here are three images taken directly from Mr. Housel’s blog post, which is linked above. These images really help illustrate the dangers of taking on debt.

This first image represents the volatility that can occur over one’s lifetime, thanks to unexpected negative events.

This next image represents how well a person with no debt might be able to endure this volatility without any financial trouble. Only the most extreme events would have any kind of negative financial impact on this person.

This last image represents how well a person with lots of debt might be able to endure this volatility without any financial trouble. Thanks to the high level of debt, this person is in a much more difficult position.

This person has much less ability to adapt and thrive financially when bad things happen.

So again, if you’re already wealthy, could you use debt to get even richer? Sure you could.

But is it really worth the added risk? And the added stress of all that uncertainty?

To me, it’s not. Use debt to build wealth. Then, when you have wealth, enjoy it and be patient.

The benefit of slow, compounding returns is incredibly powerful. With the right plan and strategy, you should continue to see your wealth grow significantly. Without using any debt.