Second only to time, money is the next most important tool we have to improve our wellbeing and, ultimately, the quality of our lives. (Obviously things like exercise and nutrition are essential, and time and money allow us to exercise more and eat better).

It’s important not to waste such a valuable tool, so I always go through this checklist before allocating any of my money. It may seem a little overkill, but it’s become second nature to me. After a while, you don’t really think about it anymore.

Not only does this thought process help me save and invest more money. It also makes me happier because I’m spending my money on things that mean the most to me.

And it also gives me peace of mind. I don’t feel guilty about spending money. I don’t spend money for a hit of dopamine when I’m feeling down. In fact, I get the dopamine hit by not spending money — because I know this decision will buy me greater freedom in life.

This peace of mind improves my mental health. Which improves my focus, drive and productivity. Which increases my value to others. Which increases my earning potential. This is what it what a holistic wealth plan looks like.

Step 1 – Are All Needs Covered?

In order to know if our needs are covered, we have to actually identify what those needs are.

Sure, we all understand that we need a roof over our heads, food on our tables, and a means of transportation. These are basic needs today.

But what about other financial obligations that will help us continue to advance our wellbeing over time?

These should also be considered needs. And we should have a clear plan for how much money we ought to allocate to each. Here are some examples:

1) Debt Reduction Contributions

2) Emergency Savings Contributions

3) Retirement Savings Contributions

4) Kids’ College Savings Contributions

5) Financial Freedom Contributions

Spending on needs should be automated, to the extent possible. That way, we never have to think about them. We know they are always covered.

Step 2 – Do I Have Sufficient Emergency Savings?

Having sufficient emergency savings / cash reserve is a foundational aspect of creating wealth.

In addition to the obvious reasons of having an emergency fund (like unexpected home or auto repairs), this also protects our investments as they grow. Because selling an investment when it’s down significantly — to cover a short term cash need — can decimate long-term returns.

A cash reserve allows us to avoid selling investments at inopportune times.

For someone who’s working, three months could be appropriate for a household with one income. And six months could be appropriate for a household with two incomes. If you’re planning a sabbatical or career transition, you’d probably want more.

But the idea is to avoid dipping into investments to cover loss of income.

For a retired individual — or someone otherwise living off their investments — that could be 12-18 months’ worth of scheduled portfolio withdrawals. Maybe even more, depending on circumstances and risk tolerance.

But the idea is the same: avoid selling investments at an inopportune time, such as a bear market in stocks.

Step 3 – Is it a Need or a Love?

Our spending can be described in four different ways: Needs / Wants / Likes / Loves.

I want to minimize spending on wants and likes. These are the type of expenditures that get people in trouble.

Unlike needs and loves, they generally do not bring us any sustained happiness and wellbeing. Therefore, we have to continue spending in order to maintain those things. It can be a financial death spiral.

But how do we distinguish between likes and loves? It can be hard to do sometimes.

For example, I love traveling. But who I’m traveling with is what distinguishes this expense as a love or merely a like. I also love seeing live music. But again, who I’m enjoying the live music with is what makes it a love or a like.

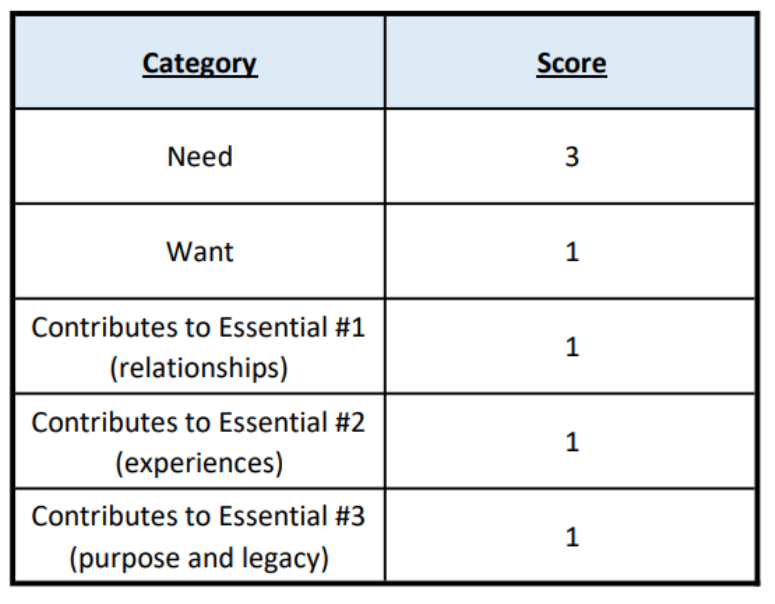

Here is a table I use to help me do this:

A “want” does not become a “love” unless it meets my minimum scoring threshhold of 3. This is based on the three essential aspects of my life that I have identified:

1) Most important relationships

- Nuclear Family (wife and kids)

- Extended Family (parents and siblings)

- Closest Friends

2/ Most cherished experiences

- Traveling

- Live Music

- Outdoor Adventures

3/ Purpose and Legacy

- Staying healthy for my family

- Pursuing my business mission

- Coaching community baseball

Step 4 – Invest Any Surplus

After considering steps 1 – 3, any leftover money can spent or invested. And while I certainly enjoy a good splurge from time to time, I generally choose to invest my surplus.

By investing surplus in a non-retirement brokerage account, I can increase the level of financial freedom I have today. Some of this money is invested to achieve 1 – 5 years goals. Some is invested to achieve longer term goals, like financial independence before retirement.