Historical stock market returns during election years

Many people think that election years can have a big impact on the stock market. And it’s not an irrational thought. Election years tend to be volatile years for our society, particularly from an emotional standpoint.

There’s uncertainty around who our next president will be. And the candidates are throwing around a lot of intense political rhetoric. Telling us how they are going to change the course of our country if they are elected.

And on top of this, there can be a lot of fear. We’ve become so polarized that many people in our society view one candidate as being evil. And if that evil candidate is elected, our country is doomed.

So it’s natural to worry that all this uncertainty and fear will have a big impact on the stock market and our investments.

But in reality, the candidates bark a lot louder than they bite. And they don’t have as much of an influence on private businesses and consumers – who drive our economy – than most people think.

Underneath the surface of the dog and pony show, you’ll find that election years tend to facilitate an economic and business climate that actually has more certainty and steadiness than in most other years.

Why? Because in an election year, politicians are laser focused on getting elected. Not legislating. So, it’s much less likely that any major legislation will be passed.

And when there’s a low probability of legislation being passed, businesses can forecast and execute their business strategies with relative ease.

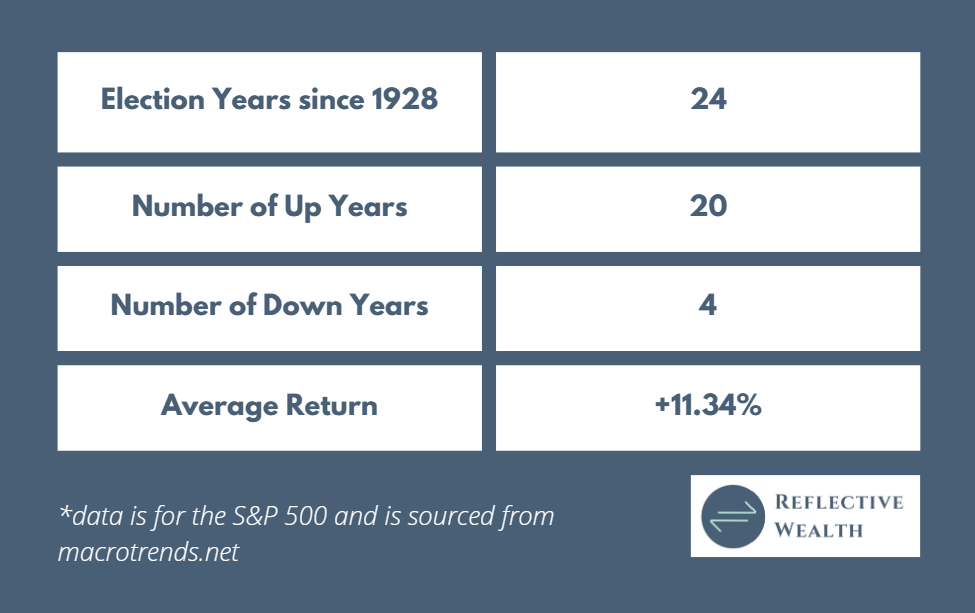

As you can see in the following table, election years have historically been good for the stock market. The average return of 11.34% is higher than the historical yearly average of around 10%. And in the four down years, three of them were down by only 10% or less.

Historical stock market returns in the year after election

The year after the election is a little different, though. For the opposite reason that I stated above.

In year one, whoever gets elected is in a hurry to show their supporters that they are going to follow through on all their promises (despite the fact that they rarely do, because they have less power than we give them credit for).

In year one, they’ve moved on from campaigning to legislating. And when they’re busy trying to pass legislation, there’s a heightened risk for the economy and businesses. Because when new legislation is passed, there are generally winners and losers. So it becomes a little harder for businesses to forecast and execute their plans.

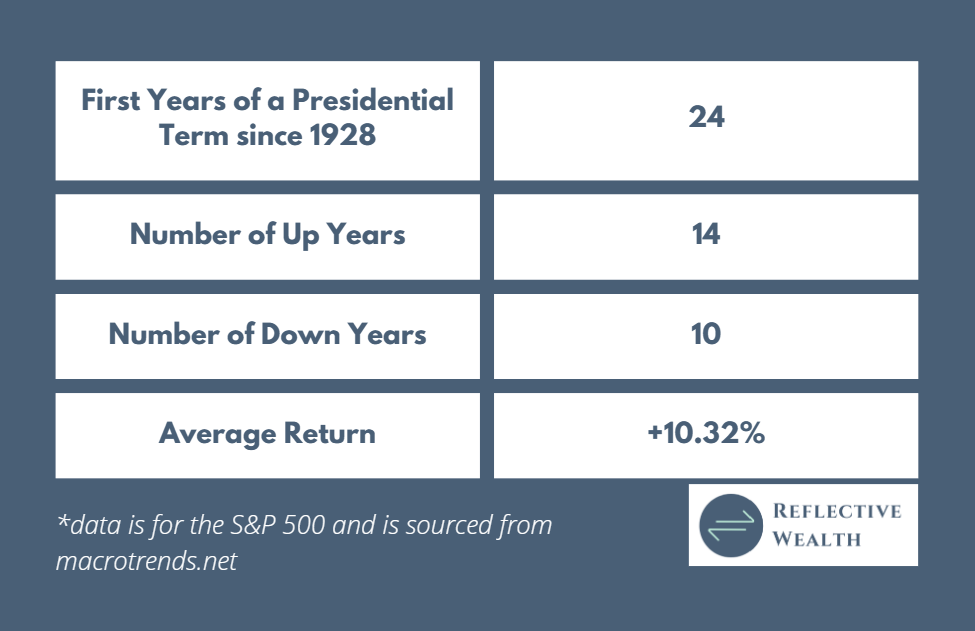

As you can see in the following table, results haven’t been as good in year one of a presidential term. While the average return is still in line with the historical stock market average, there’s a lot more volatility in outcomes.

Does it matter if it’s a Republican or a Democrat?

I’ve had many conversations with many people throughout my career and – when it comes to investing – everyone tends to think their preferred political party is better for the economy and, therefore, the stock market.

I’m willing to bet that we’ll hear a lot of these arguments in the coming months. If the bull market in stocks continues as we approach the election, Biden will be touting it. And if things reverse, and the stock market goes down, Trump will be blaming it on Biden.

But does the party of the US president really make any difference in this matter? Is one party better for the market than the other?

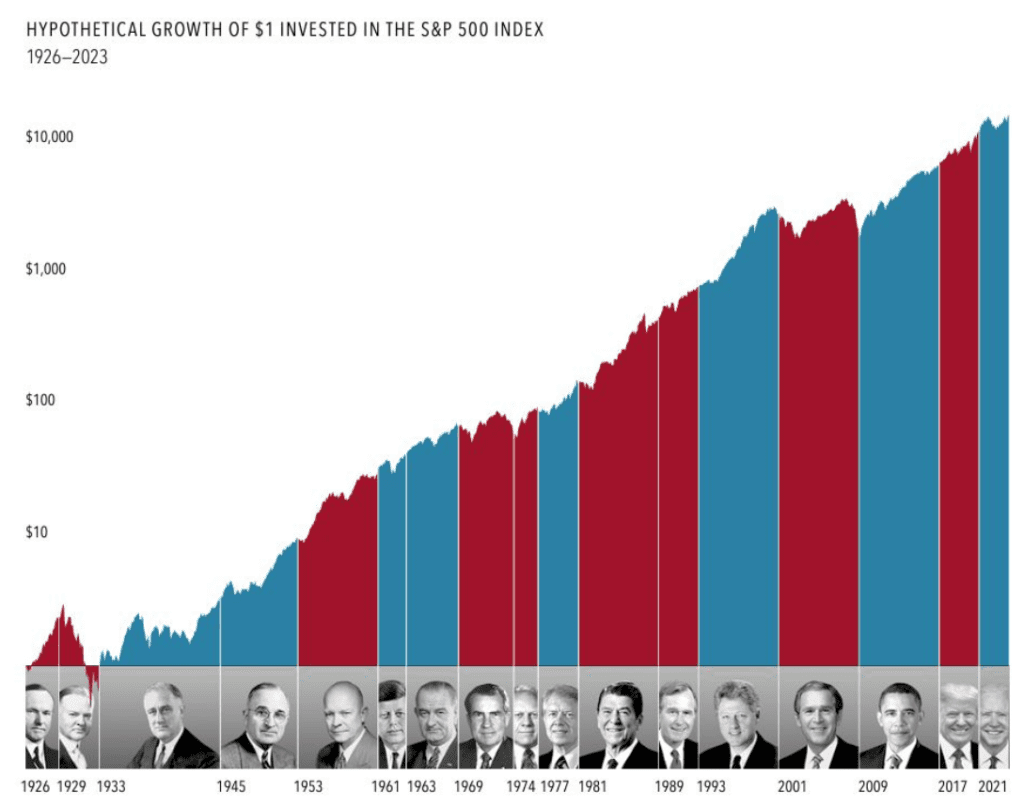

As you can see in this chart from Dimensional Fund Advisors, the answer is “not really.”

The only thing we can say with certainty is that the stock market tends to go up over time. Which makes sense. Because no matter who the president is, the American people wake up every day and try to make the best of life for themselves and their families.

And as long as we have enough people working towards progress, the economy moves onward and upward. And as long as the economy moves onward and upward, the stock market should too.

Besides, it can take years for legislation to impact the economy

Now, when looking at the above graphic, you might say that Democrats are better for the stock market. Because the worst periods on this chart are red. And there’s not a single blue period where the stock market was negative.

But one could counter by saying the economic conditions that created the negative periods were actually a result of the previous administration’s policies. Because legislation can often take years before it has any real impact on the overall economy.

For example, the root of the 2008 financial crisis was the Gramm-Leach-Bliley Act in 1999. This act allowed commercial banks, investment banks, securities firms, and insurance companies to consolidate. Whereas previously, each was required to be a separate institution.

This created an incentive structure for subprime mortgage lending.

Banks would approve shoddy loans because more loans meant more sales of mortgage backed securities, known as collateralized debt obligations (CDOs). And more sales of CDOs meant more opportunities to sell insurance policies on these securities, known as credit default swaps.

And on top of all this, the Gramm-Leach Bliley Act allowed large investment banks to run their operations without any regulation.

So, despite the fact that the 2008-2009 Great Financial Crisis happened on Republican President Bush’s watch, it was actually a result of legislation that was passed by Democratic President Clinton.

Certainly, the Bush administration’s blunders turned it into a bigger crisis than it otherwise would’ve been. By letting Lehman Brothers fail on one hand, while coordinating the bailout of Bear Stearns on the other, they created massive uncertainty and panic. The kind of panic not seen since the run on the banks during the Great Depression.

But the point remains. The stock market is no better or worse, simply because one party holds the office of the president.

Ignore the noise and stay the course

At the end of the day, private businesses don’t care who the president is. Whoever it is – Democrat or Republican – private business owners and corporate executives are going to adapt to whatever environment exists. And they’re going to do what they always do. Make money.

Certainly, if major legislation gets passed, there can often be winners and losers. But there’s always winners and losers. And the stock market moves onward and upward.

To illustrate this, consider that in 1980, six out of the top ten largest companies in the S&P 500 were energy companies. And at that time, the energy sector made up around 25% of the overall S&P 500. And today, it’s only around 4% of the overall S&P.

Clearly, energy has been a losing sector in the economy over the past 40 years. But the winners have more than made up for this. And the overall stock market has done this over that time span:

Stay invested in a properly diversified stock portfolio. Have a financial plan that ensures you won’t be forced to sell during a major downturn. And stay the course.

Your future self will thank you.