Small businesses are the bedrock of the American economy

In the United States, we’re free to do whatever work we want to do. You can work for an employer or you can work for yourself.

And in a country of more than 336 million people, there are a lot of brilliant entrepreneurial folks that can start new businesses whenever they want.

Because of this, our economy and stock market — and therefore your 401(k)’s and other investment accounts — have historically depended on small businesses.

According to this article from Forbes:

- 99.9% of all businesses in the US are small businesses

- nearly half of all US employees are employed at small businesses

- over the last 25 years, small businesses have added nearly 13 million new jobs (accounting for nearly two-thirds of all jobs created)

When you consider that consumer spending accounts for roughly 70% of the entire US economy, it’s easy to see the importance of small businesses.

For one, nearly half of the American workforce depends on a small business for income to spend.

But also, every large business was once a small business. The small businesses of today are the large businesses of tomorrow (who pay salaries to the other half of the workforce).

As small businesses go, so goes the economy — and probably your investments.

Recession breeds new small businesses

According to US investment bank, Morgan Stanley, roughly half of all Fortune 500 companies were started during a recession or economic crisis.

As they point out, “Necessity is the mother of invention. This is why warfare and space exploration have routinely spawned radical new technologies which, over time, have become almost mundane in consumer mass market.”

For example, each of the following successful companies were born out of the 2008-09 Great Financial Crisis:

- Uber

- Airbnb

- Square (now Block)

- Slack

- Beyond Meat

- NerdWallet

- Warby Parker

- Venmo

And these are just a handful of the companies that made it big! There are so many others that are contributing to our economy behind the scenes.

Now — imagine if you will — we experienced another period of economic crisis and innovation. Only this time, new business formations more than doubled in comparison.

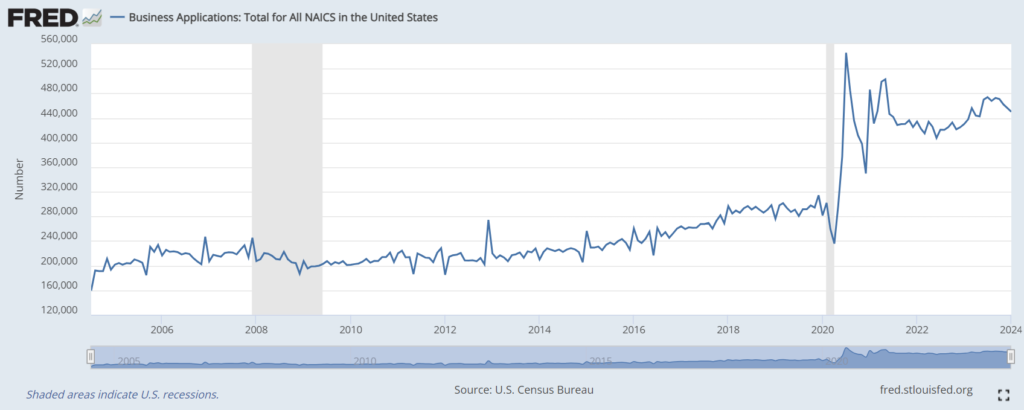

As you can see from the following chart, this is exactly what happened in the aftermath of the covid-19 economic crisis.

And since then, the US economy has remained squarely in what can only be considered an entrepreneurial boom.

While there are several contributing factors to this, one is the big increase in corporate layoffs over the past few years — particularly at big tech companies, where some of the most innovative people tend to work.

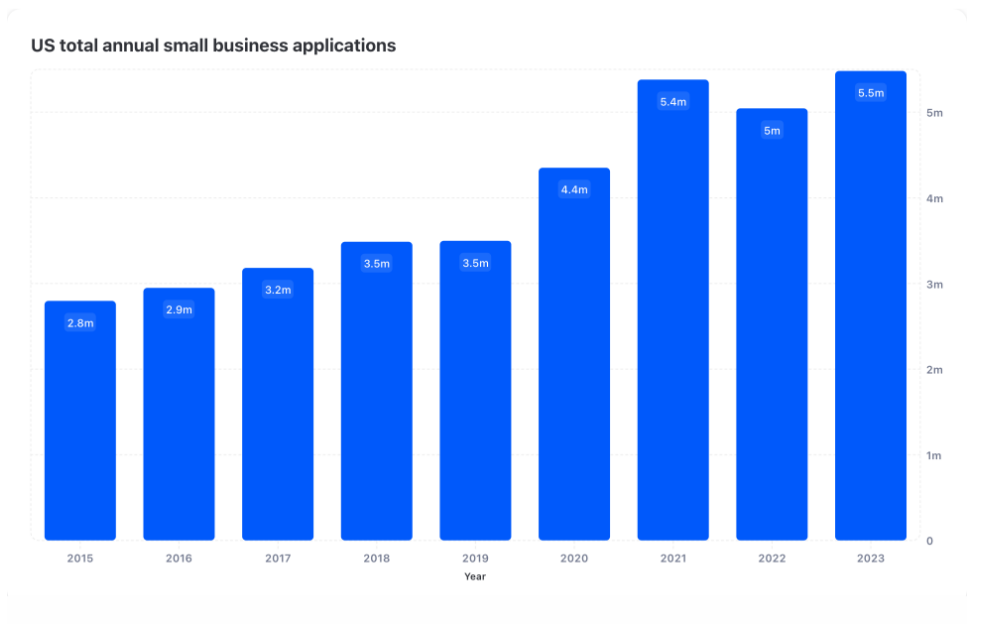

As you can see in this chart from Commerce Institute, 2023 was the biggest year yet for new business formation. In fact, it was an all-time record (beating out the previous record set in 2021).

And then — on top of all this — imagine the government flooded the market with $4.4 Trillion to stimulate economic growth.

Including $814 billion to individual households and around $850 billion to businesses. And they even allowed every citizen to withdraw up to $100,000 from their 401(k) without paying an early withdrawal penalty.

Once again, this is exactly what happened.

As if a period of economic crisis wasn’t enough to incentivize intelligent and capable entrepreneurs in our country, many also received a great deal of financial assistance to boot.

Despite inevitable business failures, the future looks bright

As you may know, most new businesses end up failing eventually. According to data from the US Bureau of Labor Statistics:

- 50% of new businesses fail after 5 years

- 70% of new businesses fail after 10 years

But this also means that:

- 50% of new businesses make it past 5 years, earning revenues and paying salaries along the way

- 30% of businesses make it past 10 years, earning revenues and paying salaries along the way

In other words, just because a business eventually fails, doesn’t mean it doesn’t contribute to economic growth in the meantime.

But let’s take this a step further and just focus on the 30% that make it past 10 years. These are the truly successful businesses that will have the greatest positive impact on the economy.

According to the US Census Bureau:

- From 2009 – 2019, the number of new business formations averaged 2,852,319 per year.

- From 2020 – 2023, the number of new business formations averaged 5,088,422 per year.

Given the 30% 10-year success rate, we could assume that:

- From 2009 – 2019, approximately 855,695 sustainable businesses were created each year.

- From 2020 – 2023, approximately 1,526,526 sustainable businesses were created each year.

This is a substantial difference. So we should expect a substantially different outcome.

The more at bats you get, the more chances you have to hit a home run. And I think it’s safe to assume that we’ll see a lot more home runs in the coming years than we saw before the covid pandemic.

And all of this, in my opinion, adds up to a great foundation for a strong and sustainable economic cycle. Which tends to lead to strong and sustainable stock market returns.

But as always, there are risks everywhere

Despite this powerful tailwind for the economy, there are always headwinds that we need to be aware of.

In my opinion, the biggest risks to the US economy in the coming years are probably going to continue centering around inflation.

As I talked about last week, inflation doesn’t pose a major threat currently. The temporary covid-induced inflation scare has subsided, and we are settling back into very normal and healthy levels.

But that doesn’t mean this can’t change in the future.

Next week, I’ll be discussing how economic conditions in other countries around the world may actually pose an inflationary threat to the US economy in the future.

To be clear, I’m not overly concerned. And that’s because I always remind myself that humans are incredibly smart.

Whether inflation is high or low, the best entrepreneurs and business leaders in the world are probably going to figure out ways to run successful businesses.

1 thought on “The small business boom (and why you should care)”