Ignore short term noise

Benjamin Graham — one of the greatest investors of all time and mentor to Warren Buffett — once said:

“In the short run, the market is a voting machine. But in the long run, it is a weighing machine.”

From day-to-day and even month-to-month, the stock market is going to do whatever it’s going to do. We have to remember that the stock market is simply a very large collection of humans. And human emotions can be volatile.

On a good news day? The market can soar!

On a bad news day? The market can tank.

But in the long run, fundamentals — which are driven by societal and economic trends — will ultimately determine the stock market’s fate.

This week gave us a great reminder of this. On Tuesday, news came out that CPI (inflation data) came in “hotter than expected” for January.

Instead of the expected increase of +0.2, it came in higher at +0.3 — and the market freaked out. The Dow dropped more than 500 points. And the Nasdaq dropped nearly 2%.

I think this was mostly an irrational reaction.

For big investors — who have experienced tremendous dollar increases during this young bull market — it was an excuse to sell a little bit and take some profits off the table.

And selling begets selling.

When everyone else woke up in the morning and saw the stock market reeling (thanks to the aforementioned profit-taking) — and then heard the negative inflation news — fear became elevated. And elevated fear generally means falling stocks.

But the emotion in the stock market was ignoring two very important things:

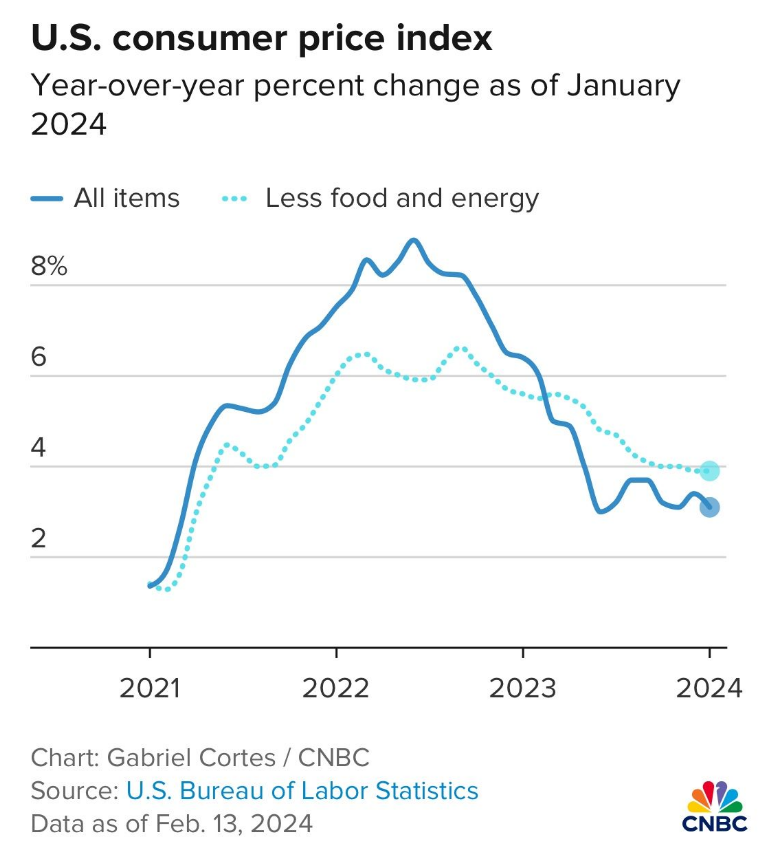

1) The annual rate of inflation fell again. It was +3.1% versus +3.4% in December. And, as you can see in this graphic from CNBC, lower inflation is still the clear trend.

2) Some inflation is good. It means the economy is growing. And deflation means the economy is contracting.

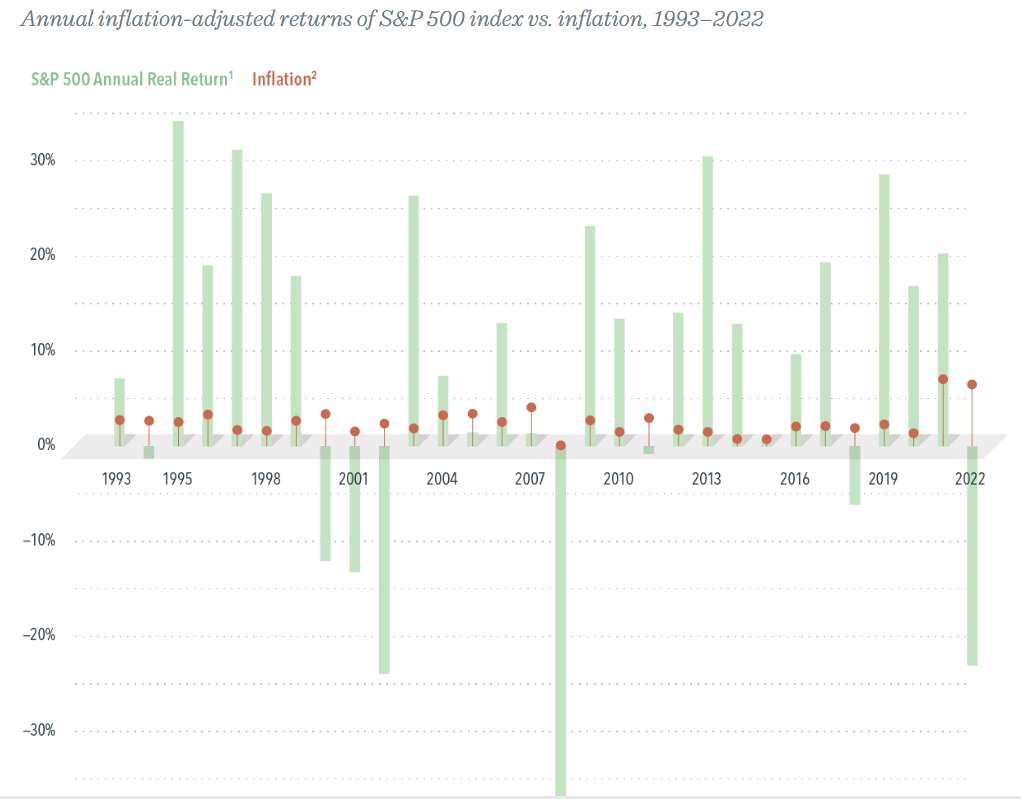

As you can see in this graphic from Dimensional Fund Advisors, our current level of inflation (in the above graphic) is settling in at a pretty normal level. And even if it did go higher, that’s not inherently bad: of the 6 negative years on this chart, only one (2022) happened with higher inflation.

Considering all of this, it wasn’t at all surprising that the market started marching higher in the final hour of trading on Tuesday and then bounced back in a big way on Wednesday.

Sometimes these little panics can last longer than a day. Sometimes they don’t. Either way, the best investors make smart investments and ignore the short-term noise.

It’s better to stick to a long-term strategy, based on future expectations

As I talked about last week, investment performance is about what’s happened in the past. And building wealth is about preparing for the future.

An intelligent long-term strategy — that is designed to benefit from future economic trends — is far more important than how your investments performed during any time frame in the past.

Since we can’t accurately predict the future on a consistent basis, successful investing comes down to speculating on what the future will look like. And planning for risks, in case we’re wrong.

This can be as simple as investing in a broad index fund. In fact, a broad index fund is the core of the strategy I’ve developed: the Reflective Wealth Global Growth strategy.

An index fund can give us exposure to an entire economy. And speculating that human ingenuity will continue driving the entire economy onward and upward isn’t a very risky bet, in my opinion.

But we can also get a little more specific in our beliefs about how society — and by default, the economy — will evolve in the future.

And when done correctly, we can give ourselves the potential to achieve higher investment returns over time. Without exposing ourselves to significant risks that could potentially derail our financial lives.

How I use thematic investing to invest for the future

Identify Growth Opportunities

First, I identify emerging themes I believe to have good long-term growth potential.

Mitigate Company Risk

Company risk refers to the danger that something within a specific company will cause that company’s stock price to fall. To mitigate company risk, I use Exchange Traded Funds that allow me to invest in a whole industry.

Here’s a good way to think of it: Instead of trying to decipher “Google” or “Amazon” from “Netscape” or “Pets.com,” it would have been more prudent to simply make a strategic long-term investment in the Internet.

Thematic ETFs now allow us to take this approach.

Mitigate Industry Risk

Industry risk refers to things like legislative or regulatory actions, which can negatively impact an entire industry. To mitigate industry risk, I incorporate several themes, which are spread out across several industries.

I believe it’s unlikely that any of my selected themes will cease to exist in the future, causing my investment to go to zero. However, it’s important to acknowledge that any one of them could see a trend reversal.

It’s less likely that all six will reverse course. And this is how I diversify industry risk.

Monitor

I need to continuously monitor these trends, because things can change quickly in high-growth industries. It’s important to have the ability to adapt and adjust the target portfolio allocation, when necessary.

Think of it like flying a plane. Once the plane is in the air, the pilot isn’t very active, but he/she is closely monitoring flight instruments to ensure the safety of everyone on board. Likewise, skipping this step can put your money in danger.

My Current Thematic Strategy

We are heading into a significant generational shift. In the coming decades, the following transitions are happening or expected to happen:

1) native analogs to native digitals

2) baby boomers to millennials

3) male wealth to female wealth

This transfer of wealth and leadership will lead to an economic paradigm shift, in my opinion. And this is what my thematic strategy seeks to capitalize on.

I want exposure to industries that I believe will experience significant demand and support from this generational shift.

My Current Thematic Investments

1) Clean Energy

2) FinTech

3) Cybersecurity

4) Genomics and Immunology

5) Cannabis

6) Broad Disruptive Innovation

Rebalancing Strategy

When incorporating thematic investing into a portfolio, a systematic rebalancing strategy is crucial.

You can do this at calendar intervals. For example, every month or every quarter.

Or you can do it at certain “drift” thresholds. Meaning when a certain position drifts too far from its target allocation.

Rebalancing simply means trimming the winners and using the proceeds to buy more of the losers.

This may sound counter intuitive. But emerging trends can experience a high level of short-term volatility. And rebalancing can potentially help smooth things out a bit.

_______________

To help illustrate this, let’s look at the target allocations within my strategy:

• 60% Total World Stock Market

• 10% Value Stock Exposure

• 5% Clean Energy

• 5% FinTech

• 5% Cybersecurity

• 5% Genomics and Immunology Healthcare

• 5% Cannabis

• 5% Disruptive Innovation

_______________

My rebalancing rule is set at a 5% absolute deviation and 50% relative deviation.

Relative deviation means that if any of the portfolio weightings increase or decrease by 50% of their target weighting, I need to rebalance.

So, let’s say the FinTech position increases to a weighting of 7.5% of the overall portfolio (50% higher than its 5% target), while the Clean Energy position decreases to 2.5% of the overall portfolio (50% lower than its 5% target).

I would sell some Fintech and use the proceeds to buy more Clean Energy, bringing the overall portfolio back on target.

Absolute deviation is simpler. Let’s say the Total World Stock Market position increases to 65% or decreases to 55%. Either one is a 5% absolute deviation from the 60% target. I need to rebalance.

Netflix stock provides a good example of how rebalancing can help with long-term growth investments. While I do not recommend an allocation to any individual emerging businesses, the dramatic price swings help to illustrate the point.

January 2010: Around $8 per share

July 2011: Around $42 per share

December 2011: Around $9 per share

June 2021: Around $500 per share

From January 2010 – July 2011 (approximately 18 months), NFLX stock rose approximately 425%, then proceeded to lose almost all those gains over the next 5 months.

And after the big collapse, it went on to gain more than 5,000% over the next decade.

If an investor had high conviction in the long-term merits of the company, rebalancing would have allowed them to systematically lock-in profits when the market pushed the price too high. This would have provided some cushion when the stock fell out of favor.

Conversely, it would have allowed the investor to accumulate more when the market pulled the price too low. This would have provided some extra upside when the stock came back into favor.

All while sticking to the long-term investment thesis.

One of the inherent risks with thematic investing is that a specific theme can go in and out of favor, resulting in a lot of volatility in the short-term. Strategic rebalancing helps account for this.

1 thought on “Investing for the Future”