Bitcoin has gone mainstream

Did you hear the news this week? After a very long wait – and many failed attempts – the SEC finally approved a Bitcoin ETF. In fact, they approved 11 of them in one day!

Bitcoin is no longer lurking in the shadows. An ETF – or exchange traded fund – is an efficient, affordable, and regulated investment product. These products have grown at a significantly higher rate than mutual funds and are widely expected to surpass total mutual fund assets.

I clearly cannot speak for the SEC.

But as an observer from the outside, one could infer that it’s no longer the wild-wild west days of bitcoin. It appears that it’s getting an official seat at the table.

The case for bitcoin as a portfolio hedge

Throughout history, investors have looked for ways to hedge their bets by investing in “non-correlated” assets. For example: if I invest in stocks for growth, it makes sense to have a portion of the portfolio in cash or bonds, in case things turn south.

Another variation of this is hedging against inflation and/or the devaluation of the US dollar. Since things like stocks / bonds / real estate are denominated in US dollars (meaning this is what you receive if you sell them), many investors want to hedge against the risk that those dollars will be worth less in the future.

Historically, the most popular way to do this has been investing in gold.

__________

A little history on gold and the dollar:

Before we abandoned the gold standard in ’71 – the US dollar was explicitly backed by gold. This means the government couldn’t simply “print” more money. In order to create more money, we had to mine new gold to back it.

After ditching the gold standard, the government could increase money supply without mining more gold. And if the government can simply print more money, the value of the dollar could decrease. Remember, when there’s more of something, the value decreases.

__________

This naturally led to many investors using gold as a hedge against US dollar fluctuations. Now, whether or not gold is actually an effective hedge is up for debate.

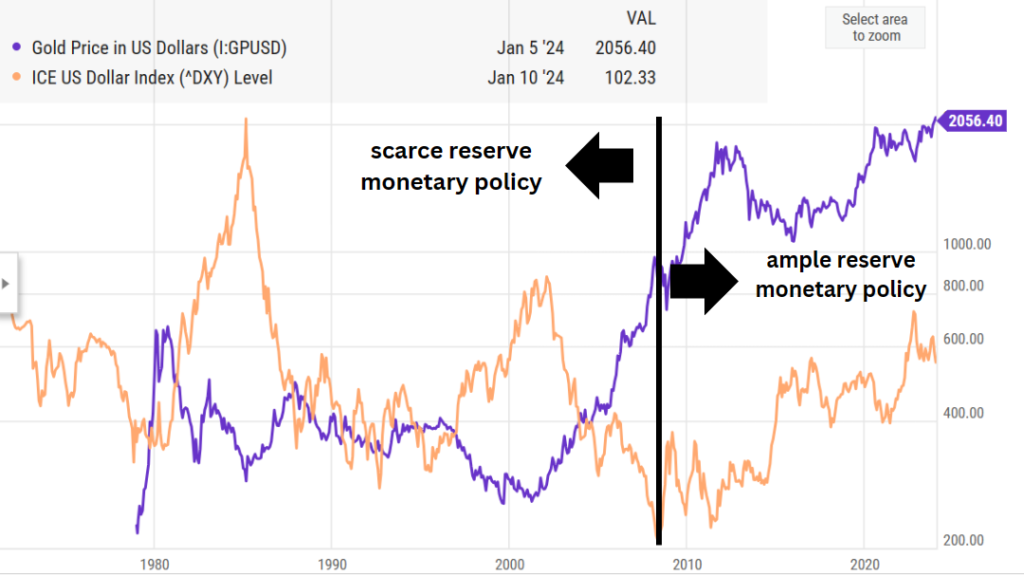

The chart below illustrates that there have been times when it worked quite well and other times when it didn’t. When the two lines move in opposite or different directions, it worked well. When the two lines move in the same direction, it did not.

As I’ve noted several times before, the Federal Reserve switched from a “scarce reserve” monetary policy to an “ample reserve” monetary policy in 2009, in response to the Great Financial Crisis. And in 2019, they permanently adopted the ample reserve framework.

This is important. As you can see above – after this paradigm shift – the two lines have been trending in the same direction.

Why?

Because ample reserve monetary policy has led to lots of money printing and lots of debt. Because of this, many investors have assumed that inflation will eventually spiral out of control. And as a result, they’ve been buying lots of gold.

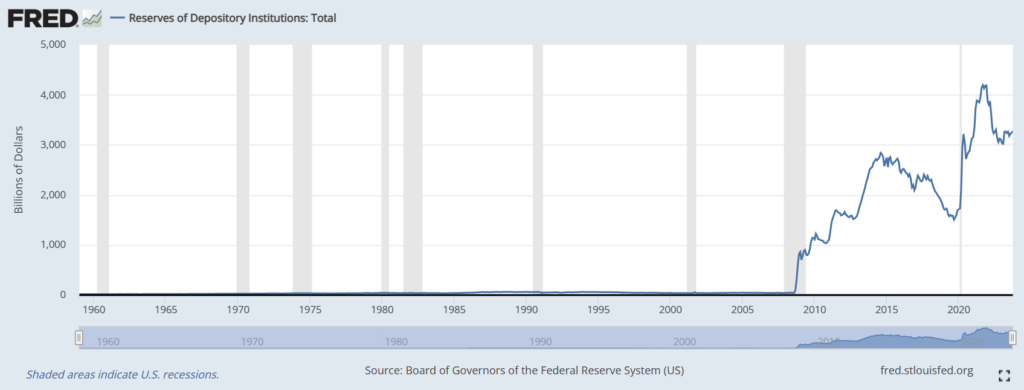

However, what these investors fail to realize, is much of the excess money is sitting in bank RESERVES – this is why it’s called ample RESERVE policy. As you can see in the following chart, bank reserves exploded in 2009 and 2020. In response to the Financial Crisis and Covid.

And in the aftermath of each “black swan” event, the trend has been downward. Seems like part of the whole ample reserve plan, if you ask me.

So, while everyone was expecting inflation / dollar devaluation – and buying gold – the value of the dollar actually increased.

This is very important, because now the US Government can basically print as much money as they want and not worry too much about inflation. (The recent bout of inflation appears to have been a temporary condition, resulting from the economic chaos that came out of covid shutdowns across the globe – you can read more about that here).

And when a government can print as much money as they want, without worrying about inflation, they probably will.

And this is where bitcoin and other cryptocurrencies come in as a viable hedge against the US dollar

Like gold, they are scarce assets. They must be mined. They cannot be produced at will. For this reason, both make sense as a hedge against the US dollar.

However – unlike gold – bitcoin can actually be used as a currency. It’s hard to buy a car with a bar of gold. And, as far as I know, you can’t mail gold coins to any online businesses, in exchange for goods or services.

On the other hand, there are a growing number of stores and online businesses that accept bitcoin. In fact, there are even entire countries that have adopted bitcoin as legal tender.

If the US Government ever got so out of control with spending and borrowing, that the world began to lose faith in the dollar – it’s possible (not probable) that the US dollar could lose its reserve currency status. Because bitcoin is an actual currency, it can pose a threat to the dollar’s status.

And this is precisely why I believe bitcoin and other cryptocurrencies make for a good hedge against it. While gold was a decent hedge in the analog age, bitcoin could become a more viable hedge in the digital age.

The case for bitcoin as a growth investment

As I already stated, gold has been used for decades as a hedge against the US dollar. Because of this, it has become a staple in many investors’ portfolios. From individual investors to hedge funds and institutions, it’s pretty common to see gold and other precious metals in large portfolios.

As a result, the current “market cap” of gold is nearly $14 Trillion. Market cap is calculated by multiplying the price of gold by the amount of gold in circulation. In other words, it’s the total value of the gold market.

On the other hand, bitcoin’s market cap is less than $1 Trillion.

If bitcoin does become a standard asset within an investment portfolio – like gold – I think it’s reasonable to expect its market cap to increase.

Will it go all the way up to $14 Trillion? I have no idea.

But – what I do know – is that value is in the eye of the beholder.

Neither gold or bitcoin have any intrinsic value. A gold bar cannot earn profits like a business. Nor can a token of bitcoin.

These assets are simply worth what a buyer is willing to pay for them. So if the new digital generation views bitcoin as a better hedge than gold, it very well could go that high. If not, then it probably won’t.

Either way, I see significant upside potential. Because these new ETFs make this asset safer and easier to access. And they could also pave the way for institutional acceptance of crypto on Wall Street.

So should you invest in Bitcoin?

As always, I can’t answer that question for you unless I have a full understanding of your financial circumstances.

But for me personally – while I believe bitcoin makes for a decent hedge against the US dollar and has a lot of short-term upside potential, I’m waiting for a diversified basket of cryptocurrencies within an ETF wrapper.

Each crypto token is a totally different currency with unique risks. Just like each stock is a totally different company with unique risks.

And if you’re familiar with the startup world, you know that first movers aren’t necessarily the winners. In fact, “first-mover advantage” is often considered a myth.

Was Google the first search engine? Nope, that was Archie. And by the time Google launched in 1997, we had already seen the launches of Yahoo, Lycos, AltaVista, and Ask Jeeves.

Was Facebook the first social media platform? Nope, that was Six Degrees. And who could forget MySpace?

I could list more examples, but you get the point.

At the end of the day, cryptocurrency is a technology. Blockchain technology to be specific. And as with any technology, there will be advancements that happen.

Bitcoin has the highest level of acceptance and the most financial backing at the moment, but that’s not guaranteed to last.

For now, I’m holding off on investing in bitcoin and waiting for a more diversified approach to investing in this potentially world-changing technology.

Bryan,

As we discussed last week, I am very skeptical of cryptocurrencies in the short and long terms until governments come to terms on how to manage and regulate them. The fact that they are ether and not a commodity to be traded, they have less real value than paper currencies today. And, as they are a computational result from transactional data out of Blockchain software, that there are a finite number of coins that can result per a cryptocurrency is a fallacy since numbers are not finite. What started as one, Bitcoin, has been duplicated across numerous iterations (copycats) with new names and the same promises of value.

The way the coins have been “sold” there has been no registering of ownership and thus no repository to validate true ownership. It is up to the owner to maintain there tokens and passwords to same. If they do not, then can lose their entire investment with the loss or theft of either. Additionally, when the criminal community decides to steal these coins, all they will need to do is duplicate what has already been done and they can take over a currency. Once discovered, the market for that coin will collapse and the world cryptocurrency market will be crippled. This where the governments are going to have to step in to formalize to the coins and their markets. I do foresee something coming in these areas.

So, as you said in your article, for now I do not see cryptocurrencies as a reasonable investment area.