Rise of the growth economy

To understand why I think we’re heading into an era of unprecedented business growth (and value creation) — which should lead to significantly higher stock prices across the board — we need to understand the Fed’s “ample reserve” monetary policy.

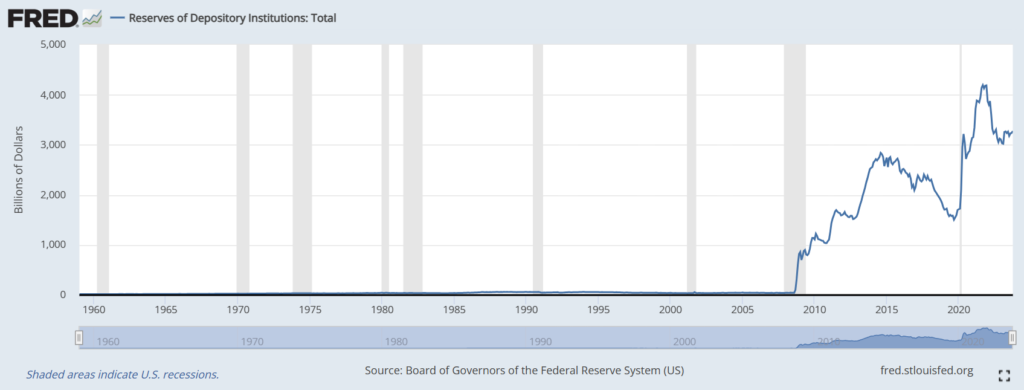

Ample reserve policy was formally adopted by the Fed in 2019. Although it began, in earnest in 2009. Which was in direct response to the Great Financial Crisis of 2008-2009.

Prior to this, the Fed had always operated under a “scarce reserves” model.

The differences are pretty complex. You can learn more here.

But in the simplest sense, scarce reserve policy means there’s NOT a lot of excess money in the banking system. And ample reserve policy means there IS a lot of excess money in the banking system.

As you can see, the amount of banking reserves has skyrocketed since 2009.

Simple economics tells us that when there’s more of something, it costs less. And when there’s less of something, it costs more. Knowing this, it’s safe to assume that — as long as the Fed continues with ample reserve policy — interest rates (cost of borrowing money) will be low, relative to historical norms.

Now, you might ask: what about inflation? All this money printing decreases the value of the dollar. And that causes inflation.

You wouldn’t be wrong, in theory. But there’s a key distinction. All this extra money is not circulating throughout the economy. And excess money only causes inflation if it’s chasing goods and services (and therefore driving up prices).

Part of the Fed’s ample RESERVE framework is to keep all this extra money sitting in bank RESERVES. Ready to use if the economy crashes and needs to be stimulated. So, it’s not really a driver of inflation.

This is why the Fed is now projecting three interest rate cuts in 2024 (remember, raising interest rates is their tool to fight inflation). Heightened inflation was always a temporary phenomenon that came out of COVID. It’s now behind us and we can resume with the previously scheduled ample reserve era. Which, again, began in 2009.

Hence, my prediction that we’re on the brink of a strong growth economy.

Low interest rates incentivize risk taking. If you don’t earn much on interest, a lot more money will go after higher returns elsewhere. This should lead to a lot more money flowing into the stock market.

And the businesses behind these stocks will choose to reinvest in their growth, rather than paying higher dividends to shareholders.

Because if interest rates on cash and bonds are low, companies don’t have to pay high dividends to sway investors to buy their stock. Instead, they can pay a much lower dividend and reinvest money back into the business.

More reinvestment = more growth.

Of course, some companies will do a better job than others. And as usual, the winners will be the ones that drive the overall stock market. So, it’s important to have a well-diversified investment portfolio that ensures you plenty of exposure to the winners.

Hedging with cryptocurrencies

At the end of the day, this is all a giant experiment being conducted by the Fed and other central banks around the world. And experiments can go bad.

For this particular experiment, I think the worst-case scenario would be interest rates end up back around 0%, stay there for too long, and the government racks up way too much debt to be taken seriously anymore.

If lower interest rates reduce the value of money by making it less costly to borrow, then 0% interest rates — in theory — could eventually render the dollar worthless.

The US dollar is not backed by any physical commodity (like gold) anymore. It is simply backed by the full faith and credit of the US government.

The world is catching on to this. People are starting to understand that money isn’t real. It’s a construct of the human imagination. The only real things are that which we can acquire with money.

Our collective belief that the United States government will be efficient stewards of the world’s largest economy is the only thing that gives the dollar power.

If enough people across the world lost faith in this (and let’s be honest, Washington sometimes seems intent on making this happen), the dollar could lose its status.

To hedge against this risk — and actually to make a small speculative bet as well — I think it can make sense to have a small portion of a well-diversified portfolio in cryptocurrencies.

The problem is — as of now — it’s difficult to gain easy exposure to a diversified basket of cryptocurrencies. Because although all crypto tends to move up and down in value together, each currency is an entirely different investment.

The best approach, just as investing in stocks, is diversifying. The good news is this could be on the way in the near future, as the industry is making a lot of headway on packaging crypto within an ETF wrapper.

But until then, I’m holding off. Until we see mass adoption, I don’t see a serious threat to the US dollar. And if the masses do get on board, there should be several easy and smart ways to invest in crypto.

Core / Satellite Investment Approach

All of this being said, my approach to investing is designed to take advantage of the emerging trends that I believe will increasingly benefit from the new growth economy. But at the same time, it’s important to protect my portfolio. Because nobody can make accurate forecasts all the time.

To do this, I use a “core/satellite” approach.

My core is a broad index fund. This single fund gives me exposure to well over 9,000 companies, spread out across the world. And it’s structured in a way where the largest companies are represented more than the smallest companies. I view it as owning the entire global economy. Which, in my opinion, is a pretty safe bet in the long run.

Then, as a way to achieve even higher returns, I build around this index fund with several emerging trends that I think will experience a lot of growth over the next decade.

And just like my core index fund, I use ETFs for each of these trends. Therefore, I’m able to manage risk by investing in an entire industry. Versus trying to pick individual winners and losers. Just like the overall stock market, the winners within these themes are likely to drive the returns for the entire industry. I want to ensure exposure to these winners.

The Reflective Wealth Global Growth Strategy

If you’d like to learn more about my investment strategy, you can click the following link:

Reflective Wealth Global Growth Strategy

You’re free to use it however you see fit. Although, if you aren’t an experienced investor, I’d recommend speaking to a professional about it.

And if you’re interested getting help from me, I use portfolio management software to automate this strategy. While also providing my clients with planning and guidance to manage risks and stay on track with their life goals.

My motto is “plan for the best, but be content with the rest.” Any time we’re seeking great investment results, we have to make sure our long-term financial security is not compromised.

Please do not take any of this as advice or recommendation, unless I’ve already done planning for you and have recommended my strategy in your account(s). Otherwise, this is for educational purposes only.

This is how I manage my own money and I’m sharing it with you in the spirit of transparency. As always, forward looking statements could prove to be wrong.