Hey there friend! Do you remember the movie Wayne’s World? This was one of my favorite movies when I was a kid.

I remember me and all the neighborhood kids constantly quoting lines from the movie. None of which stand out in my mind more than “GAME ON!”

As you probably recall, this happened when Wayne and Garth were playing street hockey. When a car came, it was “game off.” And when the car passed, it was “game on.”

Well, I found myself thinking “game on” this week when the stock market began to tell us that the temporary correction — where the S&P 500 fell by -10.27% from 7/31/23 through 10/27/23 — is likely over.

You see, just like a car temporarily interrupts a game of street hockey, stock market “pullbacks” and “corrections” temporarily interrupt bull markets. And just like those cars passing through, pullbacks and correction are very common.

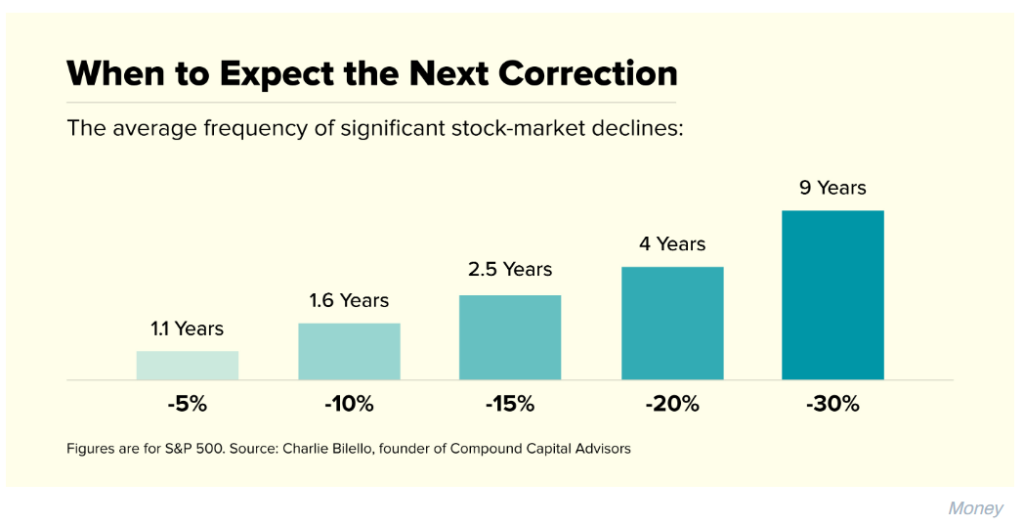

Just take a look at the following graphic, from a money.com article back in October 2021. For context, a pullback is considered a decline of -5 to -10%, a correction is considered a decline of -10% to -20%, and a bear market is considered a decline of -20% or more.

Basically, we can expect the stock market to decline by -5 to -15% every 1-2 years on average. When looked at from this perspective, the recent decline of -10.27% is totally normal and nothing to get too worked up about.

After all, the current bull market began in October of 2022, so it’s a little over a year old now. And this is the first correction we’ve had. Which actually is kind of mind-boggling, considering all the fears around interest rates and inflation. Again, totally normal and to be expected.

Now, let’s take it a step further. Let’s consider the probabilities of another giant decline – or bear market – happening in the near future.

As you can see in the chart above, a -20% decline happens about every 4 years on average. And a -30% decline happens every 9 years on average.

We just had a -25% decline from January 2022 – October 2022. And we just had a -34% decline from February 2020 – March 2020.

Is it possible to get three bear markets within a 5-year span? I suppose. Is it probable? I don’t think so.

______________________________

Now that we have some historical context around how the stock market tends to behave, we can take a closer look at what’s been going on currently, from a fundamental standpoint. And make a pretty good judgement about what’s playing out right now.

The stock market surged higher on Thursday and Friday, finishing with its best week of 2023. At the closing bell on Friday, the S&P 500 had posted a weekly gain of nearly +6%.

Should this continue, it would be a great illustration of what happens when uncertainty begins to fade.

The Fed has now held interest rates steady in three out of their last four decisions. And investors now have more clarity around what interest rates will look like from here.

I think this signals that inflation is under control. Which leading indicators have been telling us for quite some time. All you have to do is look at global commodity prices to get a sense for how significantly economic input costs have been falling over the past year-plus.

And as such, I think this signals that interest rates will stay put unless we see a steep economic decline. In that scenario, the Fed can now cut rates to stimulate the economy again.

All of this would be good news for the stock market because a lot of the recent fears would prove to be false.

But regardless, right now it reduces uncertainty in the market. And when uncertainty falls, stocks tend to go up. Plain and simple.

______________________________

While these short-term drops can be scary, great investors are able to shake them off and stick to their strategy and financial plan.

It’s not easy to do. Not only is it painful to see the value of our accounts go down, but the media is also constantly throwing out scary headlines to make us think it’ll keep falling.

But we have to remember, that’s the media’s job. Scare people. Increase their ratings and views. Make more money.

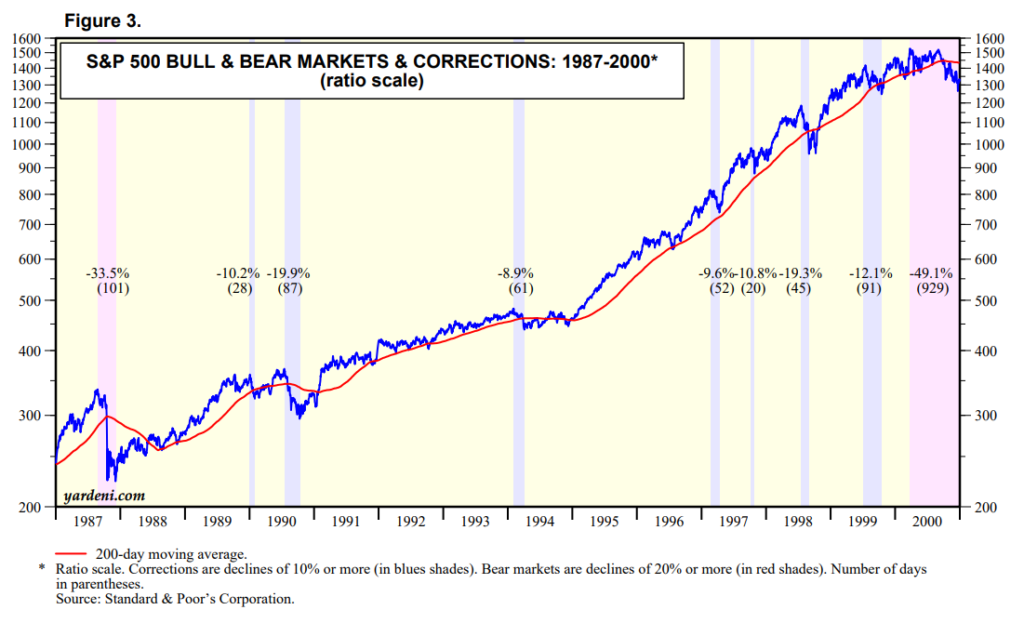

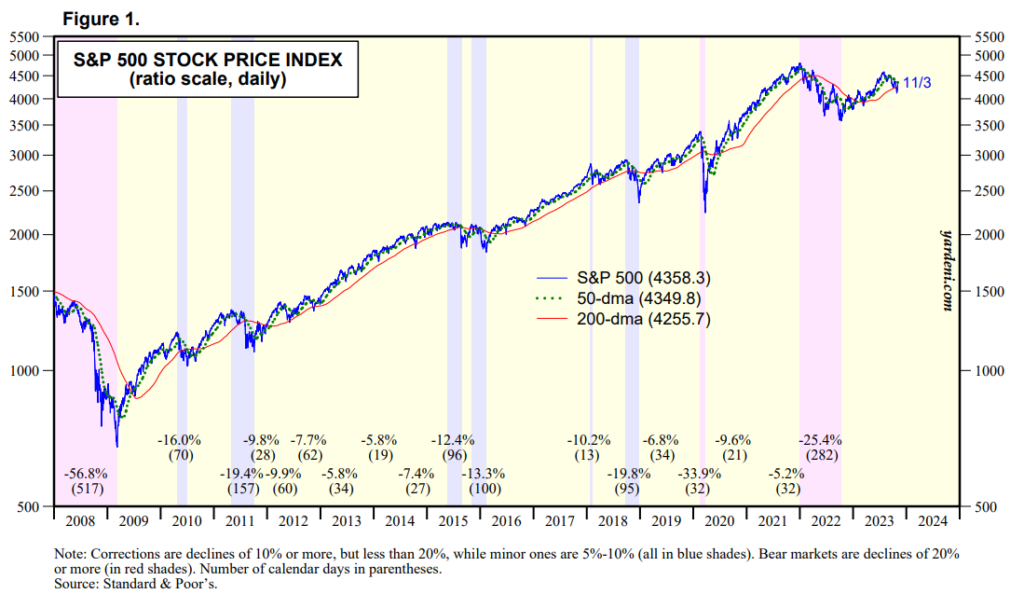

I will leave you with two more charts to digest, courtesy of Yardeni Research.

First, take a look at this chart from 2008 through today. Despite experiencing 13 separate pullbacks and/or corrections (average decline of -11.1%), the S&P 500 had a total return of +438.85% from March 2009 – February 2020. In other words, a $10,000 investment would have grown to $53,885.

Next, take a look at this chart. Which occurred during the booming 1990’s. Despite experiencing 7 separate pullbacks and/or corrections (average decline of -12.97%), the S&P 500 had a total return of +434.26 from January 1990 – December 1999. In other words, a $10,000 investment would have grown to $53,426.

Bottom Line: Don’t let pullbacks or corrections scare you out of the stock market, if your long-term financial goals require you to grow your assets. They are totally normal. I consider them the “price of admission” to benefit from significant compounding growth over time.