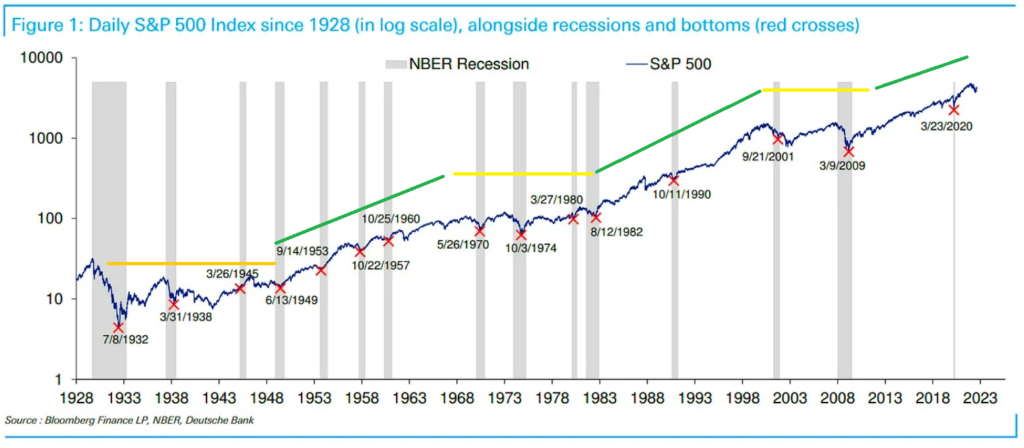

Hey there, friend. Hope you had a great week. And I hope you’re able to enjoy a restful weekend today and tomorrow. As I’m typing this morning, I can just imagine all the productivity gurus and hustle bros bashing me. You see, I slept in until 9:00 this morning, had breakfast with my family, and watched some music videos from the new Little Mermaid movie with my kids. And now, it’s 10:28 and my newsletter still isn’t ready to send. Sure, I know in my head what I want to write. But surely if I wanted to be worth a damn, I would have gotten up a 5:00 this morning, taken a cold shower, ran 5 miles, and sent my newsletter at 7:00 on the button, right? Screw that. My goal is to enjoy my life. Not be some kind of superhuman. I write good content. And you read it (or don’t) when it’s convenient for you. Ok. Off my soapbox and on to the newsletter… ____________________ The Fear Machine is Churning AgainDeath, taxes, and the media trying to scare the crap out of us. These things are inevitable. After great performance so far in 2023, the S&P 500 has been correcting a bit since August began. After topping out at 4,588 on July 31, the index is now at 4,369. This represents a decline of -4.77%. The tech-heavy Nasdaq has fared even worse. It closed out July at 14,346 and now sits at 13,290. This represents a decline of around -7.3%. And you better believe the media is jumping on this. They’re recycling all their stories about runaway inflation and imminent recession. Everyone knows that the media — in general — likes to peddle fear and anger. They stir people into a frenzy, which gets more eyeballs and more clicks. Which generates more ad revenue. But what you may not know is that it is even worse when it comes to financial media. In addition to wanting more viewers, financial media also caters to the financial industry. When you start digging, you start to see a lot of money exchanged between the two — between advertising dollars, paid interviews, and other such arrangements. And historically, the financial industry has benefitted massively from transactions. The more frenzy, the more transactions, the more revenue for financial institutions. Always keep this in mind. And be sure to always take “doom and gloom” coverage with a grain of salt. Stock Market Outlook – Is a Recession Imminent? We’ve been hearing about imminent recession for almost all of 2023 so far. And this talk has picked up steam in the media recently. Should you be worried about your stock portfolio? Not necessarily. Take a look at the following chart.

The gray bars on this chart represent past recessions. The green lines represent secular bull markets (prolonged uptrends in the stock market). The yellow lines represent secular bear markets (prolonged periods of little to no gain).

- There have been seven recessionary periods during secular bull markets

- There have been nine recessionary periods during secular bear markets

* The ’82 recession touched the end of a secular bear AND the beginning of a secular bull. And if we think critically about the current environment, I see reason to believe we could potentially be in a secular bull market similar to the one that occurred in the 80’s and 90’s. 2 reasons for this: 1) That massive secular bull was preceded by the worst stock market declines since the Great Depression. And today is preceded by the worst stock market declines since the Great Depression. Recency bias creates fear around the stock market. And fear sets the stage for things to turn out better than expected — which is typically great for stock market returns. 2) The 80’s and 90’s were one of the most prolific periods of innovation in history (PC and the Internet). Today is one of the most prolific periods of innovation in history (AI, Genomics, Clean Energy, FinTech, I could go on…) A recession could very well be imminent. But it could be just like past recessions that occurred during secular bull markets. Whatever happens, if you have a long-term investment strategy that is backed by a solid financial plan, you shouldn’t have anything at all to worry about.