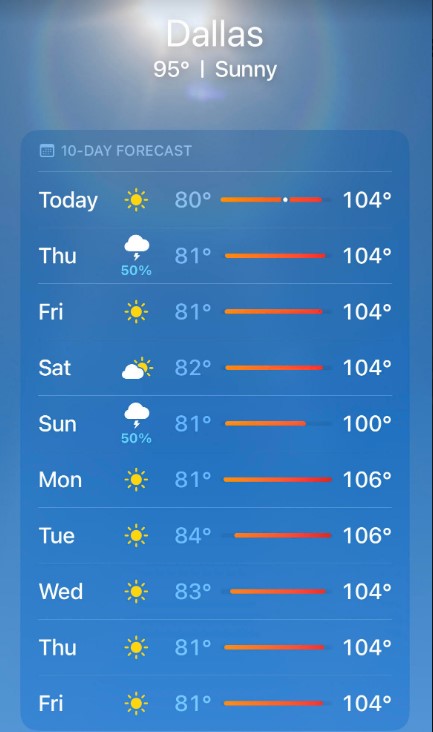

Hey there, my friend. How’s summer going for you? Probably better than here.

Holy hell is it getting hot in Texas!

This week, I wanted to share a thought provoking article I came across. It’s from Tim Denning’s blog. I’ve referenced Tim before, but for those of you who aren’t aware, he’s an Australian blogger.

He has a gigantic following, thanks to his unique and compelling views on building wealth through online entrepreneurship.

On Wealth Mindset

The Basic Formula for Getting Rich

In this article, Tim discusses Felix Dennis’s formula for getting rich. Felix Dennis is the founder of Maxim magazine and has built several other businesses, earning hundreds of millions of dollars in his life.

There are a few parts, in particular, that I wanted to highlight. And I’ll share my own thoughts, as well as talk about how they can be applied to a personal financial plan.

- Counting Your Money is a Poor Man’s Game

The gist here is that wealthy people don’t pay attention to how much money they have. They are too busy figuring out how they can make more.

I admit this is certainly a bit impractical. Must be nice to have that much money, that you never have to worry about it. And it must be nice to be that good at making money, that you can forever make more.

If you’re rolling your eyes at this…I get it.

But, it does remind me of a very important characteristic of successful personal financial planning: counting your taxes is a poor man’s game.

You’ve heard me talk about this in the past. But it’s always a good reminder. Don’t let the tax tail wag the dog. The more you worry about taxes, the more you are incentivized to make short-term decisions that can inhibit your long-term growth.

With investing, you should be happy when your tax bill goes up. It means you’re making more money. Yes, minimize your tax bill (legally). But don’t step over $100’s to pick up $5’s.

And – as I mentioned in last week’s newsletter – don’t fall victim to the Wall Street sales pitches that prey on your fear of taxes.

- Spend More Time Learning and Less Time Scrolling and Procrastinating

We all have more free time than we like to believe. Yes, we always feel busy. But that’s what happens when we procrastinate (which you know you do).

If I spend thirty minutes scrolling through Facebook, this has a cumulative effect. All of a sudden, I’m 30 minutes behind schedule. And then – at the end of the day – I have an hour and half’s worth of work that I didn’t get done.

And then I yell at anyone who will listen, “there’s just not enough time in the day!”

On the other hand, learning helps us turn our free time into money.

What if instead of scrolling, I finally started reading that book that all the successful people are recommending? What if instead of watching an hour of Netflix at night, I finally enrolled in that online course to learn about running a successful online business?

Here’s one of the greatest pieces of financial advice I’ve ever received:

Invest in yourself first. Your ability to make money is your most valuable monetary asset. You want to invest in yourself so much that you are forced to diversify into things like stocks, real estate, etc.

- Wealth is a Choice

Let this one sink in for a bit. Sit with it until you’re no longer uncomfortable with the fact that you haven’t made this choice yet (unless you have, then great).

I get that there are certain scenarios where people are working multiple jobs, just to put food on the table. That sucks and – in my opinion – should never happen in the United States of America. But that’s another conversation for another day.

If you’re on this newsletter, odds are you make decent money. Spending on wants all the time is a choice. Not being satisfied with what you have is a choice. Buying depreciating assets like cars is a choice. Not buying appreciating assets is a choice.

Every little bit of savings helps. Because the magic of compounding can turn small contributions into giant sums of money over time.

Which brings me to the most important point made in this section: “Most jobs never lead to wealth. If you ever want to be rich, then at some point you’ll have to either start a business or own a part of other people’s businesses.”

This is why investing in the stock market early and often – with patience and discipline – is absolutely essential. When you own stocks, you become a business owner.