Hey there, friend. I recently had a conversation with one of you, where we talked about the mission of this community and the goal of the newsletter. The mission of the community is to help people gain financial freedom, through conversations about wealth mindset and investing. And financial freedom can be affordable, if we prioritize the right things in our lives. That’s what Affordable Freedom is all about. Feedback of the Week Speaking of feedback, I wanted to share some that I received after last week’s newsletter. Not only was it helpful, it made me laugh at myself. And I think that’s important. If we take ourselves too seriously, it’s significantly harder to be happy. Here it is: “Good article. Just one thing: the word is “segue”, which means to transition from one activity to another. The term originated in music to describe the transition from one movement of a piece to another. Segway is the brand name for a 2 wheel upright personal transporter.” In last week’s newsletter, we apparently rode a segway from the intro into the first reflection of the week — LOL We won’t do that anymore. But PLEASE — if you ever have any feedback, email it to me. Good feedback allows me to improve my value. And that’s more important to me than money. Affordable Freedom Podcast I’m launching the affordable freedom podcast on June 1st. The conversations will center around wealth, values, and financial freedom. I have some amazing guests lined up already. People who have achieved financial freedom, people who ditched their unfulfilling career in favor of more happiness, and financial experts who have a passion for education and advancing financial literacy. I’ll keep you posted as new episodes launch. And I hope you find as much value out of listening/watching as I get out of recording them. On Mindset — Reflection #1 Rich vs Wealthy: Summarizing the Differences I’m a big believer that wealth is about much more than money. An unhappy rich person is not wealthy. For me, wealth is synonymous with well-being. Yes, money enhances our happiness and well-being. When we go from struggling to being able to cover our needs, both of these things increase significantly. After that, we see incremental benefits and diminishing returns. This article did a great job of illustrating the point with some good detail. Here’s how the author defines “rich” and “wealthy”: 1) Rich: High income, luxurious lifestyle, expensive material possessions, short-term financial success 2) Wealthy: Diverse portfolio of investments, passive income streams, financial independence, long-term financial planning and stability The most important takeaway from this article was the idea that wealth is not a number, it’s a lifestyle. True wealth is when you:

- can do work you love (for potentially less money)

- have freedom to pursue passions and interests

- are free to do what you want

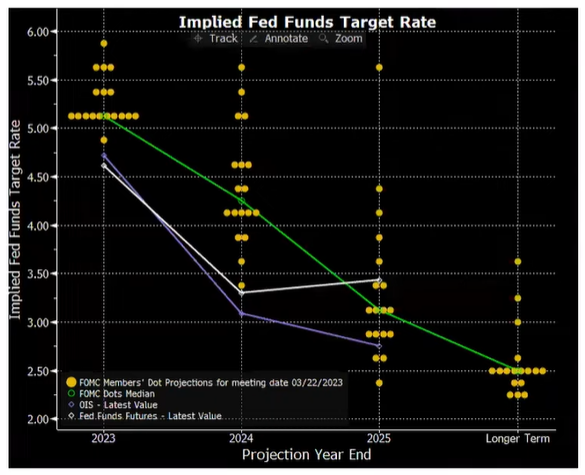

And there are two ways to get there: 1) increase your net worth or 2) decrease your desires. Building wealth doesn’t have to be complicated. Don’t make it harder than it needs to be. On the Stock Market — Reflection #2 Eventide CIO Update This is a link to a webinar hosted by the CIO of Eventide Investments — Dr. Finny Kuruvilla. He highlights three different narratives we are hearing at the moment. And he provides supporting data that help us figure out how to interpret these narratives. Narrative 1 – The Federal Reserve is telling us that interest rates will be higher for longer. This is significant because the Fed raises interest rates to curb economic growth and fight inflation. So, this would mean that inflation is still a threat to the economy. I don’t believe this narrative. Check out this chart from the webinar. It shows the Fed “dot plot” graph. This illustrates a poll of each member of the Federal Reserve. The poll determines where each member believes the Fed Funds rate (interest rates) will be over time. As you can see, the Fed expects interest rates to come down substantially after peaking this year. It’s important to look at what they do, not what they say.

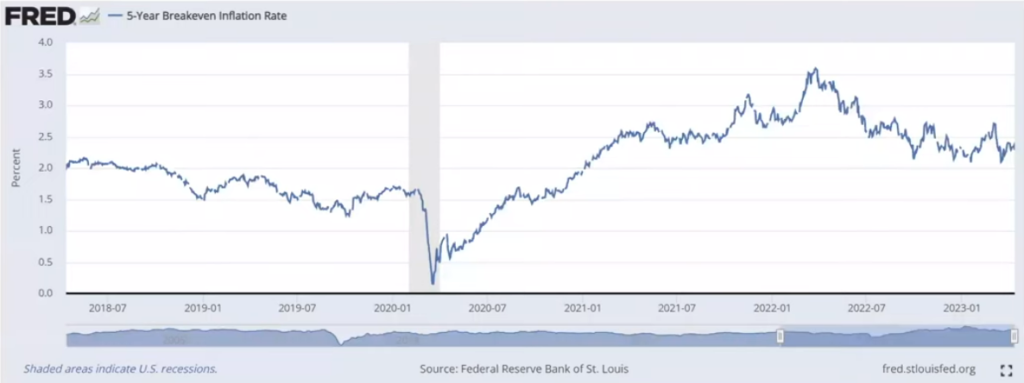

Narrative 2 — The bond market expects inflation to continue falling. This is significant because when inflation falls, it is known as deflation. And deflation — if it picks up too much steam — can quickly turn into an economic recession. The following chart shows the “breakeven inflation rate,” which is essentially where the bond market believes inflation is headed. As you can see, this sits barely above 2% at the moment. Which is in line with normal, healthy levels.

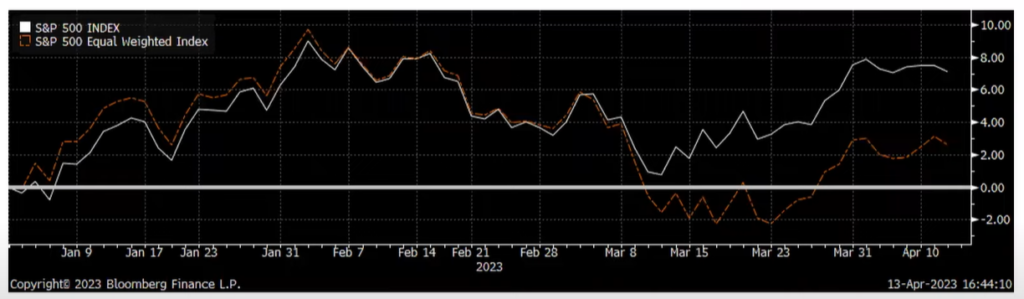

This is good. But if it falls a lot lower, it could be an indicator of an impending recession. Narrative 3 – The stock market is dismissing recession concerns. The stock market typically goes up if it anticipates economic growth. And it goes down if it anticipates economic contraction. The S&P 500 is up nearly +9% so far this year. So, the common assumption is that the stock market is dismissing recession concerns. But, if we dig a little deeper, we find that this isn’t necessarily the case. Take a look at the following chart. It illustrates the performance of the overall S&P 500 versus the equal weight S&P 500. As you can see, the overall S&P 500 (white line) is handily outperforming the equal weight index.

This is important because small companies are equally represented in the equal weight index. Whereas the overall S&P 500 is skewed significantly to the largest companies (think Apple, Google, Amazon, etc). Often, when the market anticipates recession, we see money flow into big, stable companies with strong balance sheets. And that’s exactly what’s happening now. The Takeaway: The Fed dot plot tells us that we can expect interest rates to be cut over the next few years. The bond market is telling us that inflation is under control. And the stock market is telling us that a recession could be coming. I still believe we are in the early stages of a new bull market (prolonged upward trend in the stock market). Lower interest rates are good for economic growth. Tamed inflation is good for consumers and economic growth. And when the stock market anticipates recession, it creates more surprise power to the upside for the stock market. And — even if we did get a recession that is worse than expected — the Fed would likely cut rates aggressively to fight it. This has always pushed the stock market up. Usually in a fast and furious way. You don’t want to miss out on that. As always, it’s best to stick to a long-term plan and keep your emotions in check. _________________________ As a member of my community, you are always welcome to pick my brain. I’m happy to help you in any way I can, with no expectations. After all, I believe helping people unconditionally is a great way to build a word-of-mouth business!

Pick My Brain Forward to a Friend! If you get value out of this newsletter, I’d be so grateful if you forwarded it to a friend. And let them know they can use this link at the bottom to sign up themselves: Affordable Freedom Community – Free Membership _________________________