This week, inflation fears were running rampant again. We saw a few inflation indicators come in “hotter than expected” and now everyone is starting to worry again that the Fed will keep raising interest rates to slow the economy and, as a result, throw us into a bad recession.

I’m not so sure. I just think these reports mean the economy is healthier than people think. And that’s a good thing.

Let’s dive into that a bit…

Inflation doesn’t really matter to stocks

One of my favorite finance writers, Nick Maggiulli, once pointed out how stocks have performed about the same throughout history, whether there’s inflation or not.

Here is what he found out about US stock market returns in the two years:

- Following high inflation: +18.5%

- Following low inflation: +18.7%

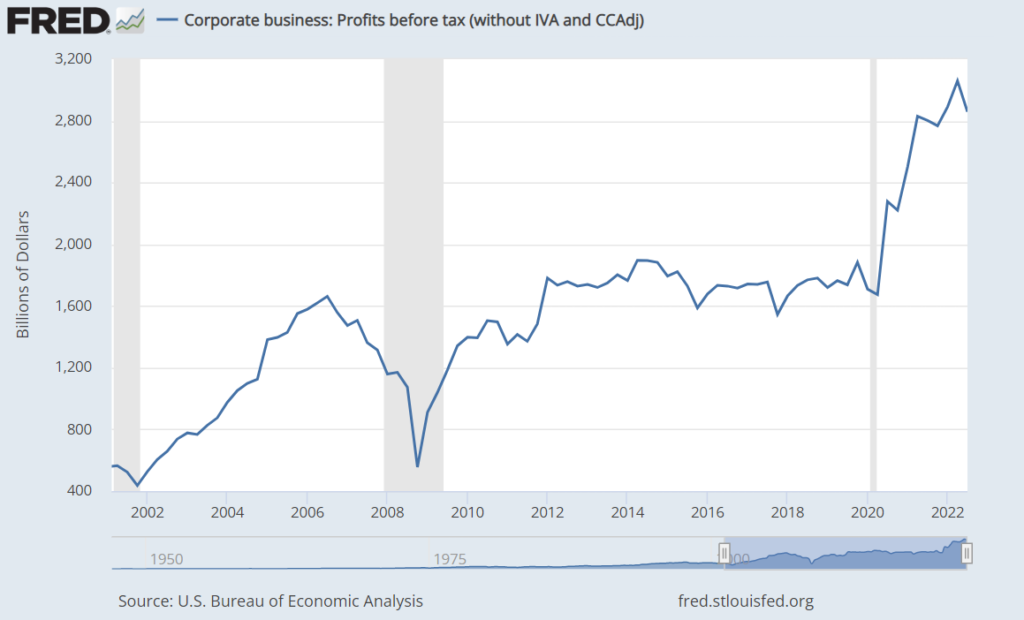

And I don’t think inflation matters much to stocks today either. For one, US corporations have padded their profits significantly, through raising prices:

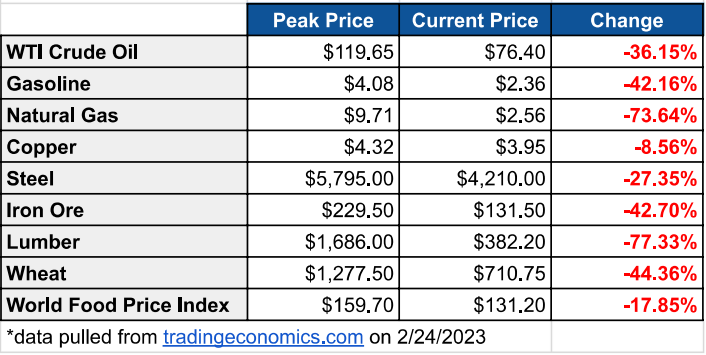

Then, when you consider the amount by which many of their input costs have been falling:

It sure doesn’t seem like a nasty recession is in the cards. Yes, marginally higher wages may squeeze their profits a bit. Remember input costs are simply the cost of doing business, other than wages.

Profits = revenue – (wages + input costs)

So, if wages go up, that could reduce profits. However, if input costs continue falling, that could offset the rise in wages. Either way, it doesn’t seem like a massive threat.

Interest rates matter more

If inflation is indeed persistent, then we may be in for continued interest rate hikes by the Federal Reserve. Remember that raising interest rates is their primary tool to fight inflation. And higher interest rates tend to make people and businesses less willing to borrow money. Less borrowing tends to mean less economic growth.

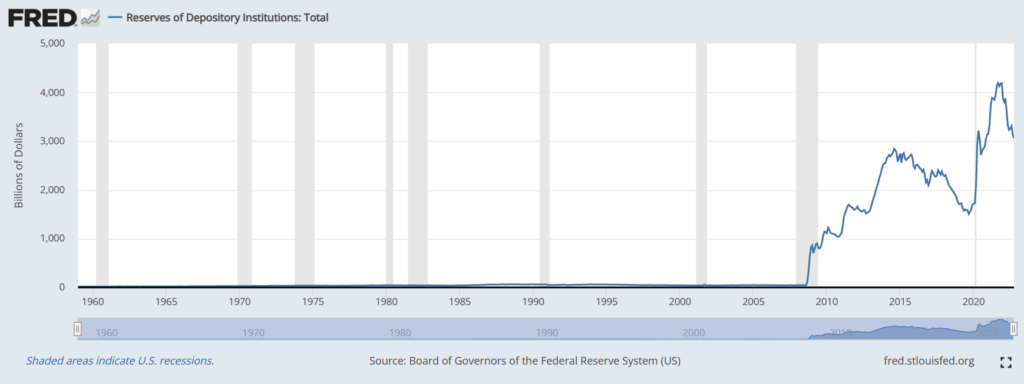

However, and this is a big “however,” there are two sides to this equation. And that is the side of the lender. And right now, banks are still highly incentivized to keep lending money. Thanks to the Fed’s “ample reserve” monetary policy, banks are sitting on mountains of cash:

This means they don’t have to borrow money in order to make loans. So higher interest rates are actually making lending more profitable for banks – versus if they had to borrow money, in order to lend it (the traditional way before the 2008 financial crisis). Rather than paying high rates to borrow money, they can just lend out money they are paying miniscule interest rates on (think about the rates on checking and savings accounts).

This big spread allows banks to be very competitive and offer select loans at lower rates, if they want to. And if the economy continues chugging along – as it appears to be doing – why would businesses stop borrowing and investing in their operations?

“Better than expected” or “as expected” are usually good

As I’ve said many times before, the economy doesn’t have to be great for the stock market to go up. It just has to be better than the collective market is expecting. And often, when things turn out exactly as expected, that is good too. Because uncertainty fades away.

Given everything I’ve outlined, I am having a tough time seeing a scenario where a recession happens and ends up being worse than expected. So I’m still pretty optimistic about how the stock market will perform this year.