This will be my last newsletter until January 7th. I will be taking some time off to be in the moment and enjoy the holidays with my family. During this time, I will reflect on everything I am grateful for, including this community. Thank you for being a part of my life in 2022!

I hope you have some time to slow down and enjoy the holidays as well. Merry Christmas and Happy Holidays from the Huhn Family!

Read on below for some year-end market commentary…

Weekly market update

It was another volatile week in the stock market. After a big positive day on Wednesday – the S&P 500 was up nearly +1.5% thanks to some good corporate earnings reports – the market gave back all of those gains (and then some) on Thursday. For the week, the S&P 500 was relatively flat, rising by about +0.97%.

There really wasn’t any earth-shattering news. It just seems like the market is still being driven by fear and emotion, primarily around the Fed raising interest rates. Last week, we talked about how I think these fears are overblown and the future reality will be “less bad” than everyone fears. Which means good news for the stock market in 2023. I have not changed from this viewpoint.

Ample Reserves Monetary Policy

In the past, I have discussed “ample reserves” monetary policy, but I wanted to address it again as we close out the year. Because I think this is a largely ignored factor that provides a good foundation for stock market performance for the foreseeable future. And as a long-term investor, I like looking out a little further into the future.

Since the 2008 Financial Crisis, the US Fed has operated within an “ample reserves” policy framework. This is in stark contrast to the traditional “scarce reserves” framework, under which they had always operated until that point.

The nuances that exist within these two contrasting frameworks are complex. But, in the simplest sense, “ample reserves” means banks are flooded with excess cash reserves and “scarce reserves” means they are not.

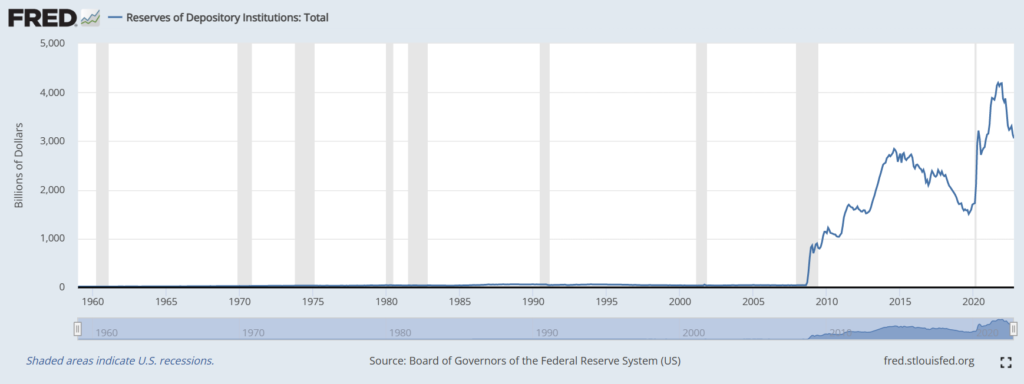

Take a look at the following chart, which illustrates the massive increase in bank reserves since the ample reserve framework was introduced in 2008:

Prior to 2008, total bank reserves never got much higher than $60 Billion. Today, we sit at over $3 Trillion. This is money that is simply sitting in bank reserves, ready to be lent out.

What does this mean for interest rates?

As we talked about last week, interest rates are simply the cost of money. And when there’s more of something, it costs less. When there’s less of something, it costs more.

So, when the system is flooded with excess cash – like it is now (and so long as we continue to operate with ample reserves) – the cost of money should remain low.

Therefore, interest rates (the cost of borrowing money) should remain low. Yes, the Fed has been raising interest rates all year to fight inflation. But, once this fight is over (which it seems like we are getting close) I think we will remain in a historically low interest rate environment. In fact, the Fed has already indicated that they could start reducing interest rates again in 2024.

What does this mean for the stock market?

As for the stock market, lower interest rates tend to be a good thing.

- Lower interest rates mean a lower return from bonds. A lower return from bonds increases demand for stocks, which offer higher return potential. More demand for stocks means higher stock market valuations.

- Lower interest rates mean lower operating costs for businesses. Lower operating costs for businesses mean higher profit margins.

- Lower interest rates mean lower borrowing costs. Lower borrowing costs mean more business investment and better return on those investments.

Low interest rates are a big reason why the bull market from 2008 – 2020 was one of the longest and strongest on record. And if we are indeed in a new paradigm of lower-than-normal interest rates – which I believe we are – all of this adds up to a great foundation for stocks to continue to deliver good returns.