The US Fed has been saying all along that they would continue raising interest rates until the inflation battle has been won. As we’ve talked about before, the Fed’s primary tool for fighting inflation is raising interest rates. Whereas their primary tool to fight deflation is lowering interest rates.

On Wednesday, Fed Chairman Jerome Powell sent a strong message to the stock market. He said they would have to see “substantially more evidence to have confidence that inflation is on a sustained downward path.” And he set the expectation that they would continue raising rates through next year, with no reductions until 2024.

The stock market did not respond well. After this news broke, the S&P 500 fell by over -2% in about half an hour. And this move was sustained. From the time the news broke until the stock market closed on Friday, the S&P 500 had fallen by about -5%.

The relationship between interest rates and inflation

It’s important to understand the reason why higher interest rates combat inflation. Interest rates are simply the “cost” of money. Just like a price tag on an item at the grocery store. Only instead of getting food, we get to borrow a pile of money. Money that we can spend, invest and contribute to growing the economy.

So if the Fed increases the cost of money, they can reduce demand for it. And if there is less money being borrowed, that should bring down prices. Because if fewer people and businesses are buying stuff, prices must come down to attract more buyers.

Expectations versus reality

This is why everyone is now expecting a recession next year. I don’t disagree with this. I think it’s reasonable to expect a recession. Our economy has been through a significant inflation shock. The real question is: will it turn out better than, worse than, or about the same as what’s expected?

The gap between expectations and reality is what moves the stock market. For example, take a look at the last two bull markets. The last one began in March 2020, when the entire global economy was shutting down from covid and we were going through the deepest economic decline since the Great Depression. The previous one began in March 2009, when the entire global financial system had just been to the brink of collapse.

In both cases, expectations were at extreme lows and reality started to improve..

Weighing Possibilities and Probabilities

It’s hard to say how bad a recession is being priced into the stock market at the moment (“priced in” just means it is reflected in the market’s value – the drop after this week’s Fed news is an example of recession expectations being priced in). Will the news from this week and the expectation of a recession continue to drive stock market sentiment? If so, how long will it last?

Unfortunately, nobody knows the answers to these questions. How could we? It’s nearly impossible to predict how millions of super emotional humans will collectively feel about the stock market at any given moment.

But there are three possible outcomes:

- Reality turns out better than expected. This would probably be a catalyst for higher than normal stock market returns, as expectations catch up to reality.

- Reality turns out as expected. This would probably be a catalyst for normal stock market returns (which tend to be good). Because fear and uncertainty around future economic pain would start to go away. And less uncertainty is typically a positive for stocks.

- Reality turns out worse than expected. This would probably be a catalyst for lower than normal or negative stock market returns.

As they say, two out of three ain’t bad. I like the odds of a good outcome for the stock market.

Forecasting the current situation

Of the three scenarios above, I believe the most likely outcome would be #1. The reason for this is simple. The Fed bases their decisions on official inflation data, which is backward looking (lagging). For example, the November inflation rate isn’t reported until December. And the December inflation rate won’t be reported until January.

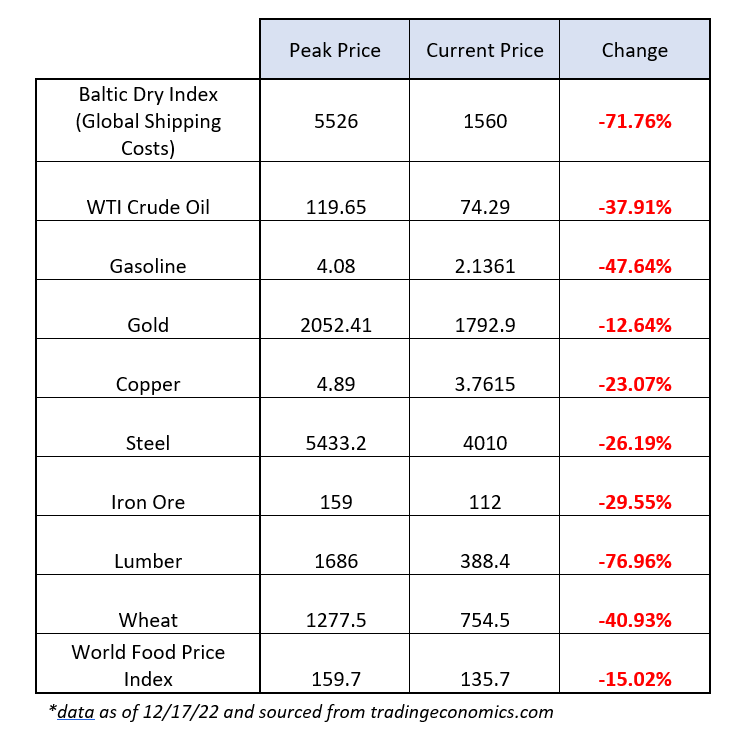

But if we look at leading inflation indicators (such as commodity prices), they have been falling substantially for most of this year:

And as these leading indicators continue to work their way downstream, they will start to reflect more in the lagging inflation data. I believe inflation has peaked and is no longer a huge threat, so the Fed should continue to surprise the market by pulling back on rate hikes faster and sooner than people expect. Meaning the expected recession will either not materialize or will be milder than expected. And positive surprises are great for the stock market.

My guess is the Fed sees all the information I’m sharing with you, but they are still talking tough on inflation because they want to reign in potential speculation that could occur in the stock market, if they were to give an “all clear” signal.

Too Long, Didn’t Read Everything

In summary, the Fed is setting up fearful expectations that they will continue to raise interest rates until the economy is in a recession. And I think things will turn out better than expected. Which means good stock market returns for 2023, as the early stages of a new bull market takes hold.

Nice write up! I think you are right on point.