Over the past few months, I have been forecasting that the rate of inflation would start to slow more than most people expect. Which would cause the US Federal Reserve to slow the pace of rate hikes sooner than expected. And this would be a positive surprise that serves as a catalyst for the stock market. So far, this has been panning out. But first, let’s review some of the basics.

Inflation and “Rate Hikes”

Rate hikes (increasing interest rates) is the Fed’s tool to fight inflation. Here’s the basic concept: By increasing interest rates, large purchases will slow down because financing becomes more expensive. And if less people are buying stuff, prices need to fall to entice them to do so.

This year’s bear market in stocks has been almost exclusively driven by these rate hikes. Because while they can help bring down inflation, they also tend to slow down the economy. And a declining economy is generally not good for the stock market. This is a big part of why the S&P 500 has gone down so much this year – with the decline reaching as much as -25% in September and October.

Expectations versus Reality

As I’ve stated many times, things don’t have to be all roses and sunshine for the stock market to do well. When expectations are really bad – as they have been all of this year – reality just has to be better than expected. This has been the basis of my forecast.

Over the course of the past month or so, this is exactly what has been happening. The last two inflation reports came in better than expected. And now, this week, the Fed began signaling a slowdown in rate hikes – sooner than many expected. Sure enough, the stock market has bounced back nicely. In fact, the S&P 500 is now only down around -15% from its previous high (rather than the -25% it had been down just over a month ago).

Now, this doesn’t necessarily mean we are totally out of the woods. Inflation could begin surging to the upside again. Although, I don’t think that is likely. To me, the bigger threat now seems to be a potential recession. Again, since rate hikes tend to slow down the economy, a recession is now widely expected to occur in the early part of next year.

However, once again, stock market performance will likely come down to expectations versus reality. Since recession is already widely anticipated, this expectation is already reflected in the stock market. If it does not materialize or ends up being milder than expected, that could be another catalyst for stocks to charge forward.

The Rise in Entrepreneurship

Regardless of what happens over the next few months, I remain a long term investor. And there is a big positive for the US economy that many people are not talking about. In my opinion, it has the potential to provide foundational support for a vibrant economy over the next 5-10 years. I am talking about the rise in entrepreneurship that was born out of the pandemic.

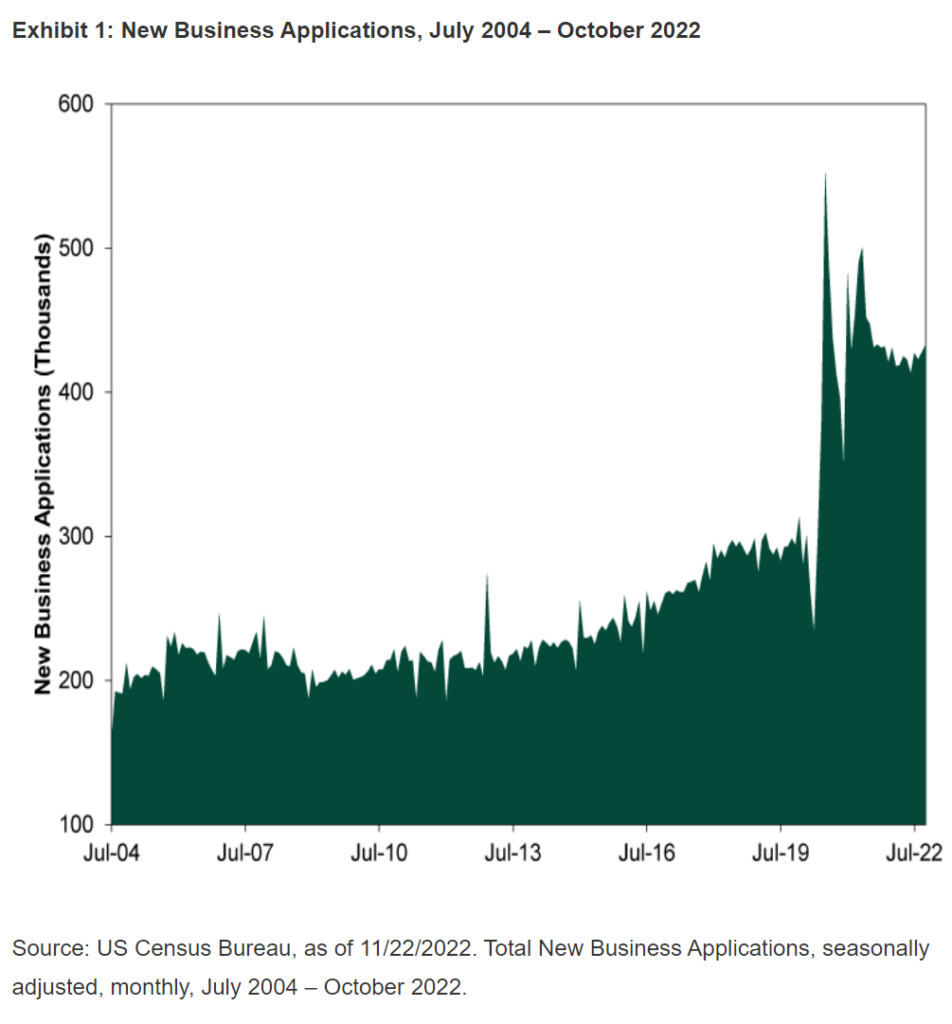

Take a look at the following chart I came across this week (courtesy of Fisher Investments). It shows new business applications according to data from the US Census Bureau.

As you can see, there was a giant spike in new business applications after the pandemic. While many of these new ventures will likely fail, the sheer volume should also lead to many successful ones as well.

Entrepreneurship doesn’t always lead to economic growth everywhere around the world. However, in developed economies like the US and Europe, there is a strong correlation between the two. And, according to the Kauffman Foundation, most job creation has historically come from companies that are 0-5 years old.

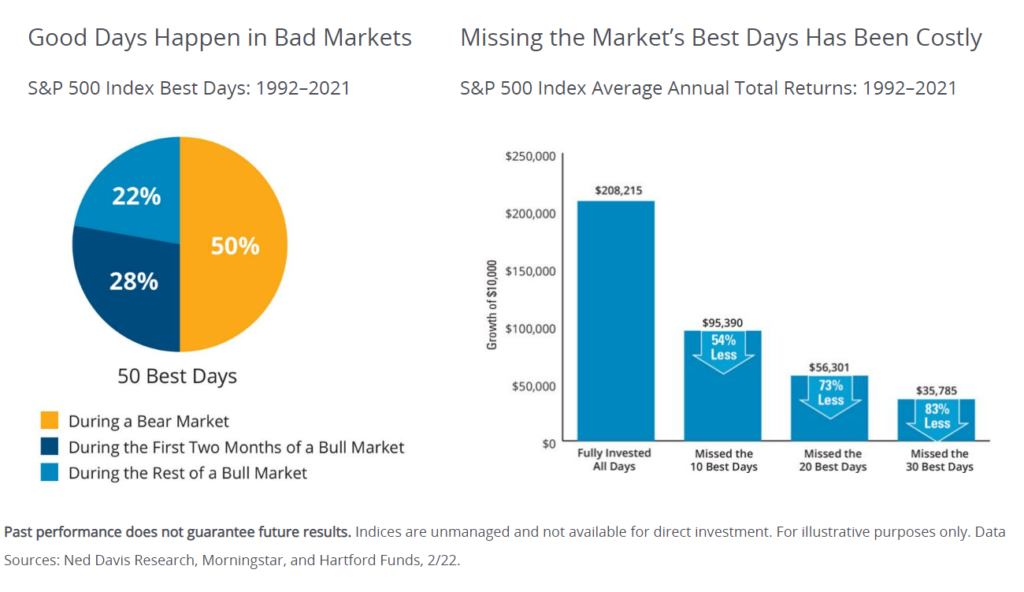

Time In the Market, Not Timing the Market

It can be difficult to stay invested during times like this. It is an emotional rollercoaster. But it’s important to remember that staying invested typically yields much better results. Here’s a great graphic courtesy of Hartford Funds. From 1992 – 2021, missing the 10 best “up days” in the stock market would have cut an investor’s returns by more than half. And 78% of those big days occur during a bear market or during the first two months of a bull market (when fear is usually still at very high levels). So, as usual, I stay the course and stick to my plan.