Two weeks ago, I wrote a newsletter about a hypothetical couple (The Smiths), who were able to retire early thanks to some creative planning. I received a lot of feedback on this one, so I thought I would expand on it, to show how a creative approach can open up even more opportunities than just “retiring” early. After all, is it really “retirement” that most of us are seeking? Or is it the financial freedom to live the life we choose?

Traditional retirement planning can often keep people from living a more fulfilling life. I’ve seen it many times throughout my career. People tend to contribute as much as they can to their 401(k), worrying they might not have enough money to retire. And with such a disproportionate amount of savings locked up until their 60’s, there ends up being little left over to plan a more fulfilling life now and in the near future.

A few years ago, I decided I was no longer going to subscribe to this traditional philosophy. And the more I share this perspective with others, the more I realize that many people are tired of being “held hostage” by a 401(k) or other traditional retirement account.

Current Savings Plan

- Married, both 40 years old

- $150,000 combined income

- Annual take-home pay = $102,780

- Annual expenses = $90,928

- Contribute 10% of salary to 401(k) = $15,000 annually

- Combined 401(k) balance = $250,000

A New Philosophy

The Smiths have decided they don’t want to spend another 20 years working a job they don’t like. They’ve often wished they could do more meaningful work. But they’ve been afraid to pursue it because it would probably mean a significant pay cut – at least initially.

And traditional retirement planning suggests they cannot afford a decrease in pay. In fact, based on everything they’ve read, they feel like they are probably behind on their retirement savings. In other words, they’ve been held hostage by their traditional retirement plan.

New Savings Plan

After meeting with their financial planner, they created a plan to quit their unfulfilling jobs in ten years, at age 50. To do this, they are eliminating their 401(k) contributions entirely. Instead, they will direct these contributions – as well as additional free cash flows – to a taxable non-retirement investment account.

Here is what their savings plan looks like now:

- Annual take-home pay = $114,480

- Annual expenses = $90,928

- 401(k) contributions = $0

- Combined 401(k) balance = $250,000

- Non-retirement contributions = $23,552 (take-home less expenses)

At 50 Years Old

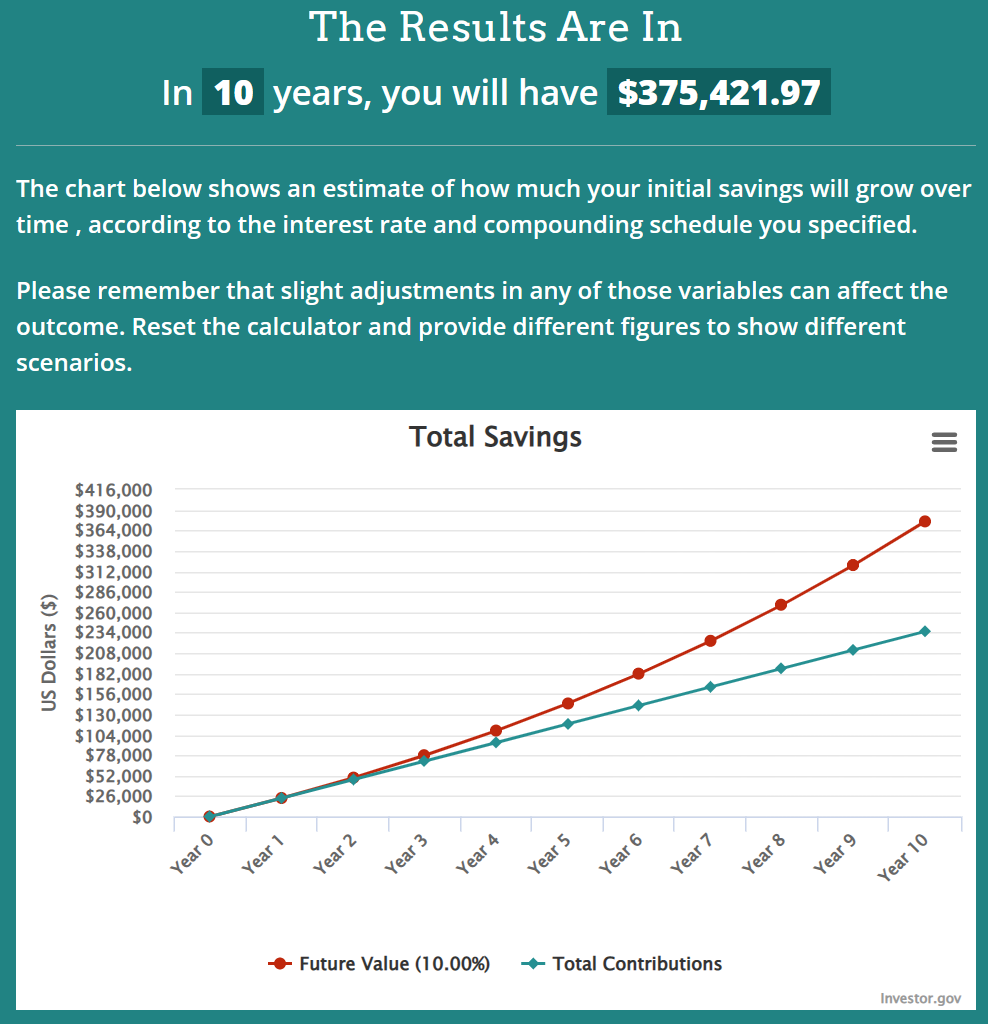

After ten years of $23,552 annual contributions into a taxable non-retirement investment account, the expected balance in this account at age 50 is $375,421.

At this point, they both will quit their unfulfilling jobs.

Mr. Smith is going to get a job at the local concert venue. He’s always been really passionate about music. And now he gets to work a fun job, taking in live music all the time.

Mrs. Smith is going to work for a non-profit organization that is very meaningful to her. She’s really excited to have a lot more purpose in her work life.

However, in order to make this transition, their total household income will be cut by 40%. So they will only be able to cover 60% of their expenses from these jobs.

Here is their plan to account for this:

- Annual Expenses (adjusted for 10-years of inflation) = $122,199

- Monthly Expenses = $10,182

- 60% covered by income = $6,109

- 40% covered by account withdrawals = $4,073

At 60 Years Old

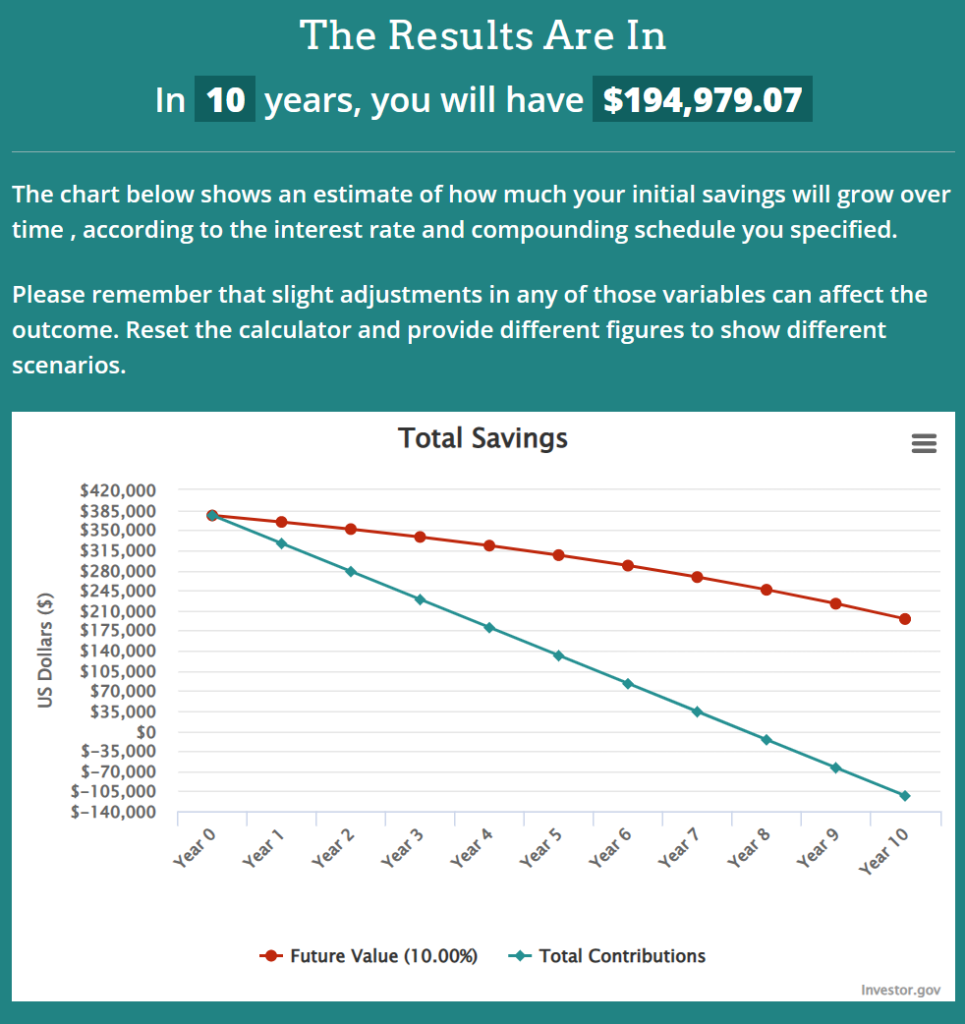

Given their starting balance of $375,421 at age 50 – and 10 years of withdrawing $4,073 per month – here is the expected balance in their taxable account at age 60.

But now – because they have reached age 59 ½ – they are able to make withdrawals from their traditional retirement assets (which have been compounding for the last 20 years). Remember, they had $250,000 at age 40. Assuming zero contributions since then, here is the expected balance in these accounts now:

However – since the income from their “fun jobs” has not kept up with the rate of inflation – they are only able to cover 50% of their expenses, instead of 60%. Which means they will now have to cover half of their expenses from account withdrawals, instead of only 40%.

Here’s the plan to account for this:

- Annual Expenses (adjusted for 10 more years of inflation) = $164,225

- Monthly Expenses = $13,685

- 50% covered by income = $6,842

- 50% covered by account withdrawals = $6,843

At 65 Years Old

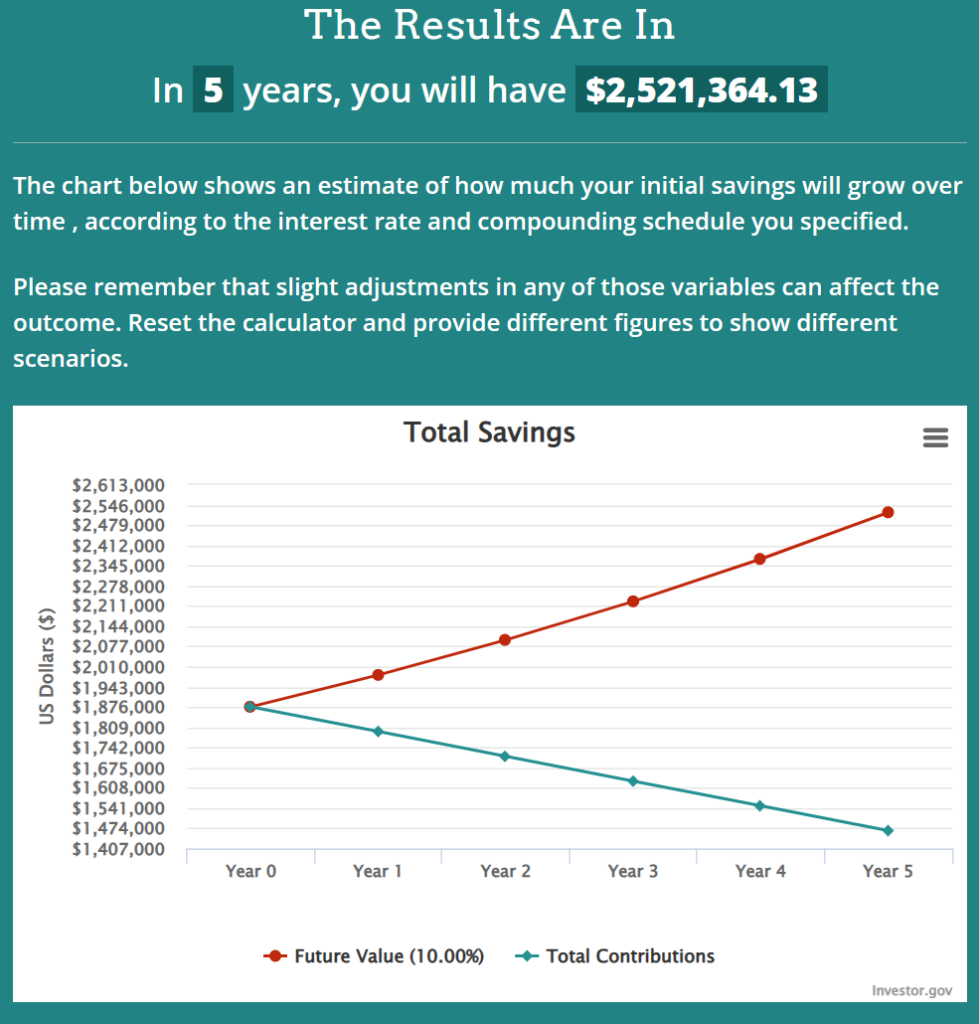

Given their starting balance of $1,876,853 at age 60 (retirement + non-retirement) – and 5 years of withdrawing $6,843 per month – here is their expected balance at age 65.

At this point, they plan to officially retire. Although, it’s always possible that they continue working. After all, if they love what they do and are able to control their time, why stop? But from a planning perspective, it’s better to be conservative and assume their income goes away at age 65.

So, now, they will plan on covering 100% of their living expenses by using account withdrawals.

Here’s the plan to account for this:

- Annual Expenses (adjusted for 5 years of inflation) = $190,381

- Monthly Expenses = $15,865

- 100% covered by account withdrawals = $15,865

At 70 Years Old

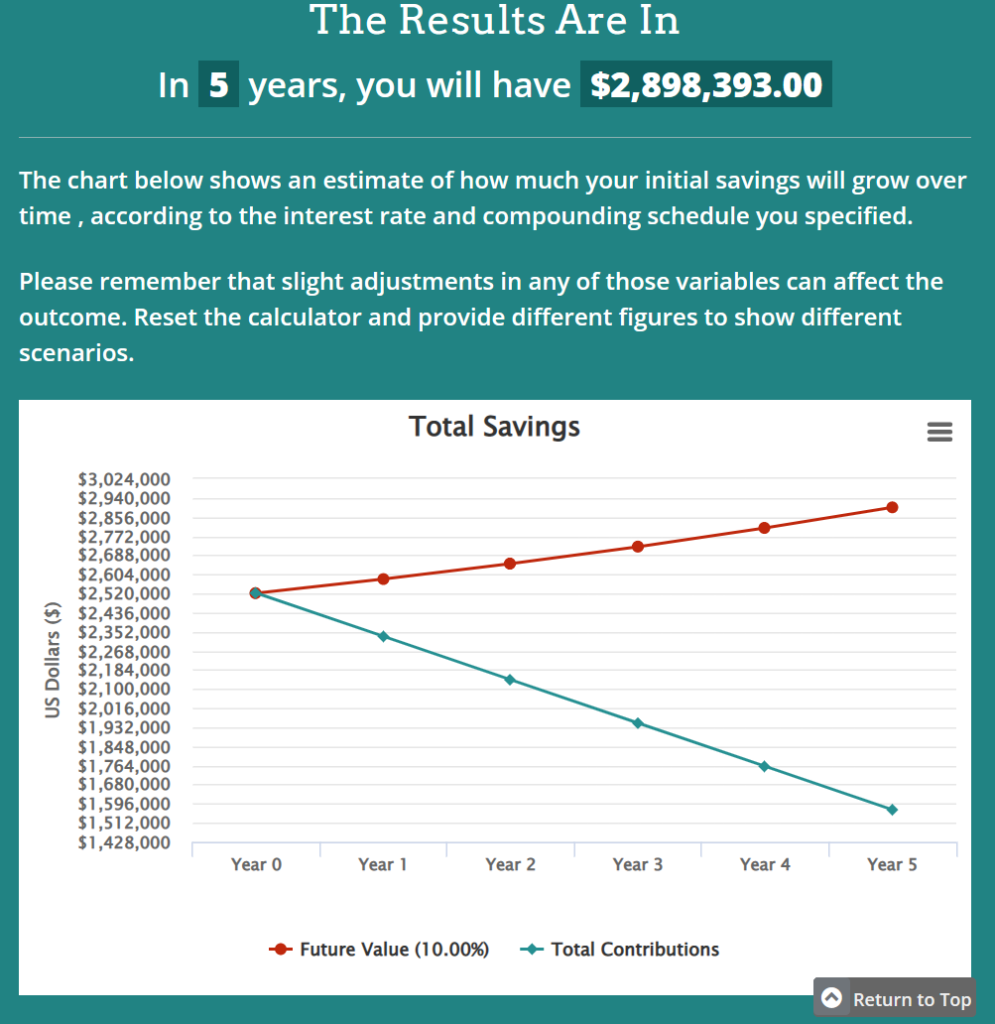

Given their starting balance of $2,521,364 at age 65 – and 5 years of withdrawing $15,865 per month – here is their expected balance at age 70.

Now that they have reached age 70, they will begin drawing social security. Their combined social security is expected to be around $12,000 per month at this point in time (estimate was generated by my professional financial planning software, built by Right Capital). So they will no longer have to rely on their accounts to cover 100% of their expenses.

Here’s the plan to account for this:

- Annual Expenses (adjusted for 5 more years of inflation) = $220,703

- Monthly Expenses = $18,391

- Social Security = $12,000

- Account Withdrawals = $6,391

At 90 Years Old

Given their starting balance of $2,898,393 at age 70 – and 5 years of withdrawing $6,391 per month – here is their expected balance at age 90.

This gives them a tremendous amount of financial cushion toward the end of their lives, which is great. They should be able to pay for any kind of unforeseen expenses, particularly big medical expenses, that could occur late in life. And they will probably have a decent amount to pass down to loved ones or causes they believe in.

Needless to say, the Smiths are pumped about their new plan. Knowing they can quit their unfulfilling jobs in ten years has completely changed their mindset. They’ve gone from anxious to really excited about their future.

Important to Note – This illustration assumes 3% annual inflation and 10% annual returns on investment. While both are reasonable annualized estimates over long periods of time, neither of these things will happen. Both will vary significantly from year to year. Also, selling investments when they are significantly down, can decimate long-term returns. It is very important to have a financial plan that allows for sufficient liquidity (meaning enough cash reserve to avoid selling investments when they are significantly down, so you can wait until they recover to begin taking withdrawals again).

This is an oversimplified illustration and should not be taken as advice. It is for informational purposes only, to illustrate a concept. Please consult with a trusted advisor or financial planner to see how this information could potentially apply to your situation.