Volatility is Here to Stay

For the past 20+ years, we’ve had tremendous stock market volatility, thanks to shareholder capitalism. And for the next 20+ years, we should expect continued high volatility, thanks to a paradigm shift from the analog generation to the digital generation. Staying invested, while planning for the short-term risks has been a winning strategy. And I think it will continue to be in the future.

What Happened

Ever since the late 70’s, our economy has operated under shareholder capitalism. Shareholder capitalism was popularized by Milton Friedman at that time. Friedman served as an economic advisor to President Reagan and had significant influence over government policy throughout the 80’s and 90’s.

Shareholder capitalism simply means the only purpose of a business is to maximize profits for shareholders. Friedman famously said, “the social responsibility of business is to increase its profits.” Hard stop.

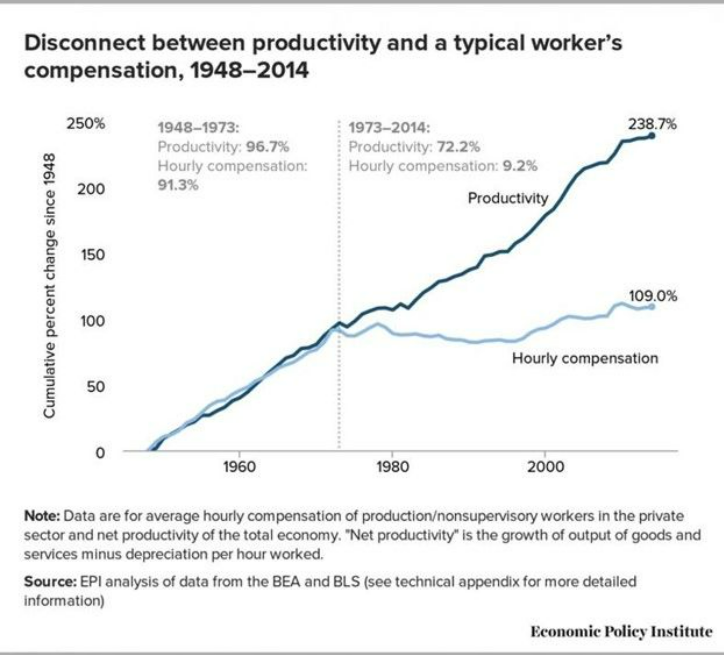

Given this context, the following chart should not surprise anyone. Business productivity (and profits) have gone up dramatically. However, hourly compensation has not. Companies have gotten really good at squeezing the maximum possible profit out of every expense. And workers are an expense to them.

While this chart is from 2014, the trend has mostly continued since then. And I believe this hyper-focus on profit maximization has essentially created the financial markets we’ve experienced over the past couple decades.

Since shareholder capitalism incentivizes nothing other than maximum short-term profits, it inevitably leads to massive short-term booms that are unsustainable. Which eventually leads to big busts. I believe this is why the past 22 years have included the two worst stock market crashes since the Great Depression (bursting of the 90’s dot com bubble + 2008 financial crisis.

What to Expect

Similar to how the rise of shareholder capitalism has led to an extreme transfer of wealth and power away from employees to shareholders, I think the next couple decades will see another major power struggle. But this time, it will be a transfer of power and wealth from the analog generation to the digital generation.

Much has been made about the transition from Baby Boomers to Millennials, in terms of the largest generation in the workforce. But it’s much bigger than any one generation. It’s a transition from a generation that did not grow up with technology to a generation that did. This is a profound shift.

As Christopher Lochhead points out, “…the definition of what a human is has changed. You see, if you’re 35 and up, you are the last of a dying breed called Native Analogs. If you’re 35 or younger, you are the first generation of Native Digitals. Native Digitals experience life in a digital first way, and an analog way, second. Native Digitals have come of age integrated with the machines. Your smartphone and technology overall is like part of who you are as a person.”

Said differently, there is a new generation of leaders that have a significant advantage in the digital age.

I doubt this will be a smooth process. Wealth transfers rarely are. But I do expect it to create a lot of longer-term growth for the economy and stock market.

Expect to see ebbs and flows as the old guard tries to hang on and delay the transition as much as possible. Additionally, a paradigm shift like this is likely to create a lot of uncertainty. And uncertainty usually leads to higher stock market volatility.

Not to Worry

The good news is that staying invested in a well-diversified stock portfolio has always been a good strategy and I think it will continue to be.

Despite how volatile the stock market has been over the last 20 years, investors still would have done really well. Here is the total return of the S&P 500 – which includes dividends – from the peak of the dot com bubble in 2000, until today:

- Cumulative Return (from start to finish) = +302.51%

- Annualized Return (average per year) = +6.29%

Your growth would have beaten inflation by around 132%. Not bad, considering you immediately went through the worst bear market since the Great Depression in 2000, which was followed up by the worst bear market since the Depression once again in 2008. In the history of the stock market, this is a historically bad stretch. One of the worst twenty-year periods in history. But even still, you could have taken 5% annual withdrawals and still grown your nest egg.

Personally, I think volatility will begin to slow gradually over time. As the new generation places less of an emphasis on short-term profits and more of an emphasis on long-term value creation. And I think there will be lots of great opportunities to get in early on some emerging industries.

But I could be wrong, so I take comfort in knowing that even in the “worst case” scenario described above, things still turned out ok.