If you followed news in the stock market this week, you probably heard about the Federal Reserve statement on Wednesday, followed by chairman Jerome Powell’s press conference. It resulted in – yet again – some wild swings in the stock market. The market is currently fixated on the Fed at the moment, so it’s worthwhile to dig a little deeper and understand what’s going on.

As a reminder, the Fed is currently raising interest rates to fight inflation. Higher interest rates are widely viewed as a negative to the economy. And recent stock market performance has been largely based on expectations of how long this will last and how high rates will ultimately end up.

When the Fed’s initial statement was released on Wednesday, it was taken as an indication that they could slow the pace of rate hikes in the near future. And the stock market immediately shot up in reaction to this. Then, after the statement was released, Fed chairman Powell held a press conference. He dampened those expectations and the market immediately took a dive. For the week, the S&P 500 finished down nearly 3%.

So how do we make sense of this? It seems like we are hearing two different stories from them.

To me, there seems to be a logical explanation. After the statement was released, Powell saw the reaction in the stock market. And he knew he needed to curb speculation. They are trying to carry out a delicate balancing act. And they don’t need speculation driving up stock prices to a point that would influence their decisions.

I still maintain that inflation is slowing and will continue falling. Therefore Fed rate hikes will slow. And that will be a positive surprise to the stock market – good news. As I’ve said before, the stock market doesn’t need things to be great in order to go up. It just needs things to be a bit better than expected.

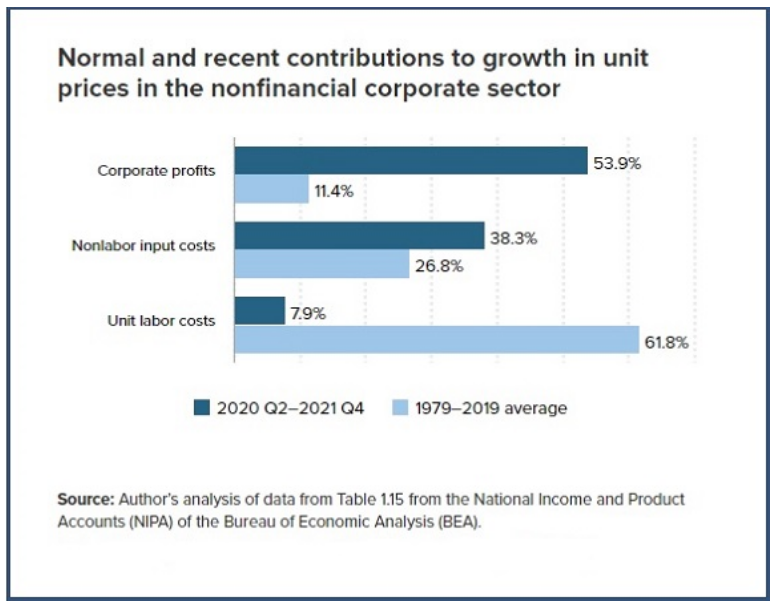

Why do I continue to think this? I came across a great chart this week that illustrates what’s been causing inflation.

As you can see, corporate profits have been driving growth in prices (in other words, the inflation that we feel as consumers). Think of it this way: there are three components to the prices we pay.

- How much the company profits (prices we pay, minus 2 and 3)

- How much it costs a company to make their products (nonlabor input costs)

- How much it costs a company to pay their employees (unit labor costs)

Recently, I talked about how component #2 – namely commodity prices – and #1 were driving this inflation. You can read that here: Get Ready to Welcome a New Bull Market. In this post, I talked about how #2 was falling and should ease the rate of inflation.

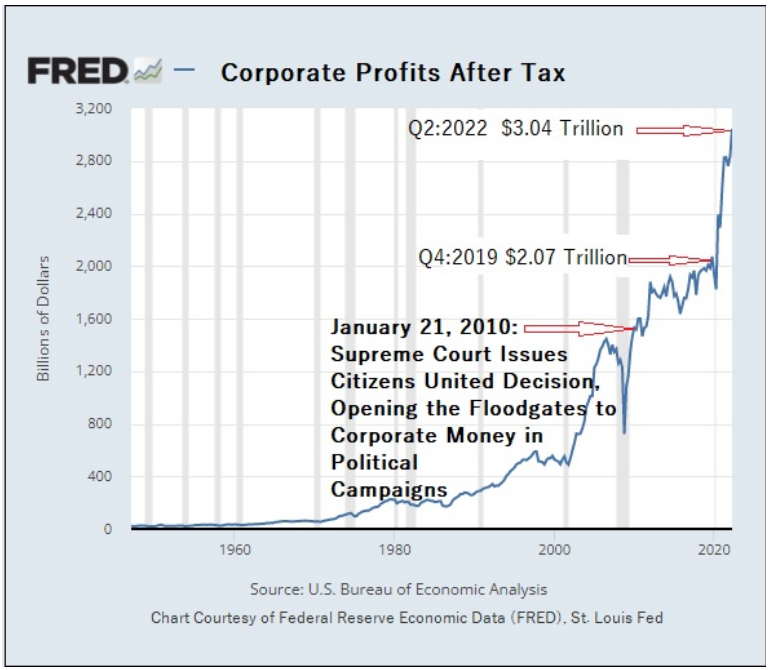

And if you look at the following chart, it certainly appears as though #1 doesn’t need to go higher – companies have already increased their prices and are swimming in profits right now.

*source of above chart: Wall Street on Parade

So the next question is what will happen with #3 – labor costs. This has been an area of significant debate recently. Many argue we will see a “wage price spiral,” which means continued higher inflation. Because this tight labor market (not enough workers) is causing companies to pay more to attract employees. But the wage price spiral assumes these companies will then have to increase prices in order to maintain their profit margins. Thereby, creating higher prices for us to pay as consumers.

But, as illustrated above, these price increases have already occurred. And corporate profit margins are looking very healthy. And if nonlabor input costs continue falling, there will be no need for companies to raise prices any further.

I think we can expect inflation to continue subsiding. Which means the Fed will slow their pace of rate hikes sooner than the market thinks. Better than expected means positive surprise. Positive surprise means good stock market performance.

Have questions or want to learn more? Schedule a Video Chat

If you’re new to RW Weekly, here is my disclaimer: Nobody can predict short-term stock market movements on a consistent basis, over multiple market cycles. Not even the most skilled investment managers, who spend most of their waking hours dedicated to trying. I never let my forecasts influence my longer-term investment portfolio. Rather than trying to be the unicorn that can “beat the market” all the time, I stick to a strategy that I believe puts long-term probabilities in my favor.

You can learn more about my full investment process here.