We all know that inflation is tough right now. It’s the highest level of inflation in the United States since the late 70’s / early 80’s. And there are many people who have never experienced inflation at all, much less at these high levels.

So, I don’t want to minimize the impact and struggle that we’re experiencing at the moment. This inflation is very real to us. But, from an economic perspective, I believe this inflation was manufactured by transactional opportunists. It was not a natural economic outcome.

Here’s a common argument: our current bout of inflation is a natural outcome of printing money since the Financial Crisis of 2008. After all, inflation is often referred to as “more money chasing fewer goods.” According to this narrative, this has created inflated asset prices and it was only a matter of time before it created staggering inflation.

This is a logical – but very surface level – argument. The economy is a little more complicated and nuanced than this.

In my view, this inflationary period was caused almost exclusively by the economic shutdowns and recession from COVID. Yes, it has been amplified by the Russia-Ukraine conflict, but COVID is why we’re feeling it so badly.

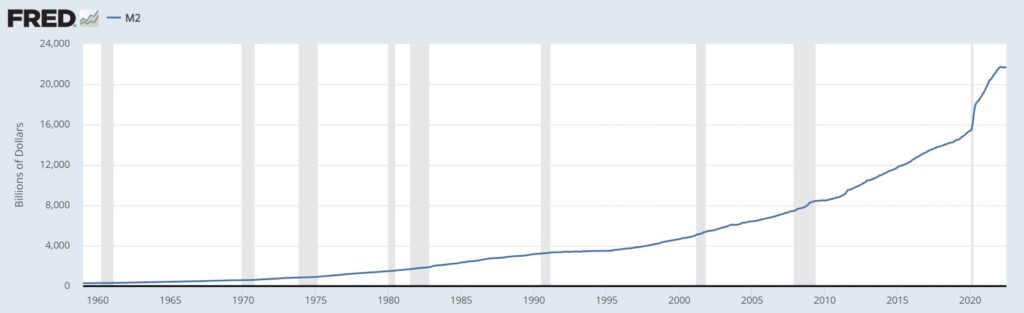

To illustrate this, we need to understand M2 money supply. M2 money supply is a good representation of money circulating through the economy. Therefore, it is a good indicator of inflationary pressures. Again, inflation happens when more money is chasing fewer goods. M2 represents things like cash, checking deposits, and “near money” such as savings deposits, money markets, and other assets that are highly liquid and easily converted to cash.

Take a look at the chart below, which illustrates the history of M2 money supply. Keep in mind, this is a linear chart, not a logarithmic chart, so the increases to the right look more significant than they actually are.

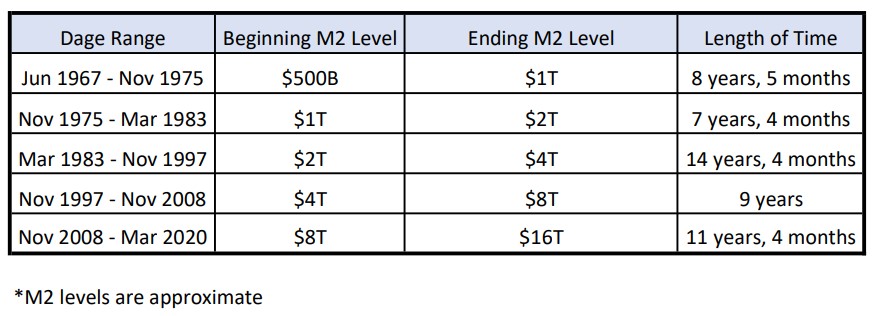

Now, let’s look at how long it typically takes M2 money supply to double:

Then, from the beginning of COVID shutdowns – March 2020 – M2 money supply grew all the way to nearly $22T in just two years. At this pace, it would have doubled in about five years.

Clearly, this is the fastest rate of increase we have ever seen, since we began recording it. And furthermore, the period of money “printing” since 2008 was pretty tame. It was the second longest doubling period on record. I don’t think this has anything to do with the inflation we are currently experiencing.

This is why I’ve said all along that this inflation is and was a temporary phenomenon. And I think it’s why Jerome Powell and the Federal Reserve called it “transitory” right from the start. Because once we worked through supply chain issues, supply levels should catch up to demand (which would inherently slow a bit after the initial “pent up covid demand” had been spent), bringing inflation back to a more normal level.

Unfortunately, corporations saw it as an excuse to increase their profit margins. After all, they had just suffered through shutdowns and a whole lot of lost revenue. So, instead of absorbing the hit, they used temporary inflation as an excuse to raise prices. It makes up for a little bit of the lost revenues, while also setting them up for fatter profit margins when this temporary inflation passes.

And that’s when it really started permeating throughout the economy. So now, it’s sticky. And we are all feeling it. This creates massive public support to fix it.

So now, the Fed changes their tune. Maybe they were thinking “well…raising interest rates is our tool to fight inflation…and everyone wants us to do that…cool, let’s start raising rates…it increases demand for US debt (reinforcing our borrowing ability), while also giving us ammunition to combat a future stock market collapse (in the form of cutting rates again).”

And the crazy thing is this: raising interest rates doesn’t do much to bring down the current type of inflation. Raising rates decreases demand, through higher borrowing costs. But this was never demand driven inflation. It was cost driven inflation. And people typically aren’t taking out loans to pay for their groceries, gas and electric bills.

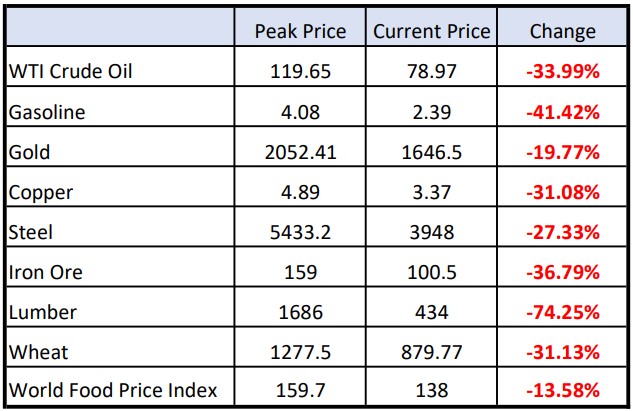

So here we are. Inflation sucks and we all hope it will go away soon. The good news is, I think it will. The commodities markets are telling us as much. And just like the stock market tends to be a leading indicator of the economy, the commodities markets tend to be a leading indicator of inflation. If the market expects the economy to improve from current levels, the stock market tends to go up. And if the market expects higher inflation, commodity prices tend to go up.

Here’s a look at some commodity prices over the last several months. It’s starting to look a lot like mean reversion after the unprecedented shocks from COVID shutdowns. If this continues, it shouldn’t be long before these falling prices are fully reflected in the inflation rate.

*data as of 1:00 PM EDT on 9/23/22 and sourced from the following links: HERE and HERE